How much is housework worth-is 30,000 won a day reasonable?

During this period, the divorce war between South Korean stars Hye-seon Ku and Ahn Jae hyun was raging. In the tug-of-war of divorce, the man broke the news that the woman asked for 30 thousand won a day for housework, which was converted into RMB 176 yuan a day and more than 5,200 yuan a month. The broad masses of people who eat melons have said, please give me a dozen domestic workers of Hye-seon Ku’s standard.

If we change our perspective from gossip discussion to academic discussion, there are actually two interesting questions:

1. Does housework have monetary value?

2. If there is monetary value, how to price it? Let’s discuss it separately below.

No.1 does housework have monetary value?

Housework refers to a kind of work that family members do in their daily family life.Unpaid labor. It usually is.Serve family members.Including but not limited to washing and cooking, looking after children, buying daily necessities, cleaning and hygiene, caring for the elderly or patients, etc. Generally speaking,It is both a production activity and a consumption activity..

Whether housework has price or monetary value has always been controversial in economics and sociology. The traditional view is that the products of housework are not born for sale, so they do not produce production value, and it is even more impossible to constitute the source of surplus value.

On the other hand, according to Marx’s theory of labor value, the value of commodities is determined by the socially necessary labor time condensed in commodities.

Housework itselfCondensed labor, paid labor time and formed labor products., so it should be valuable. Although housework has become a private labor because of the emergence of private ownership and family, this private labor is still an important part of the socialized division of labor system.Its existence ensures the smooth progress of other social production activities.. In other words, if there is no housework, individuals may need to use money to buy corresponding services instead of its existence, thus proving its monetary value in reverse.

From a broader perspective, some studies have found that if housework is not considered,It is impossible to correctly calculate the market productivity and the real consumption of society. Becker, a well-known economist, proposed to bring housework into the national GDP system in 1985. Since then, many developed countries have also calculated the proportion of housework in GDP, ranging from more than 20% in Japan to more than 50% in Australia and other countries.

No.2 how to price housework?

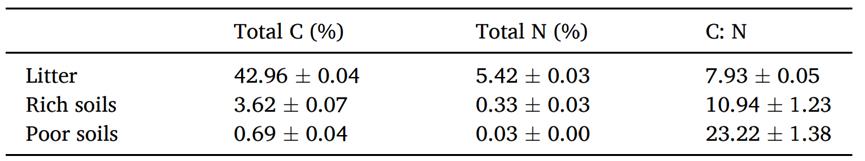

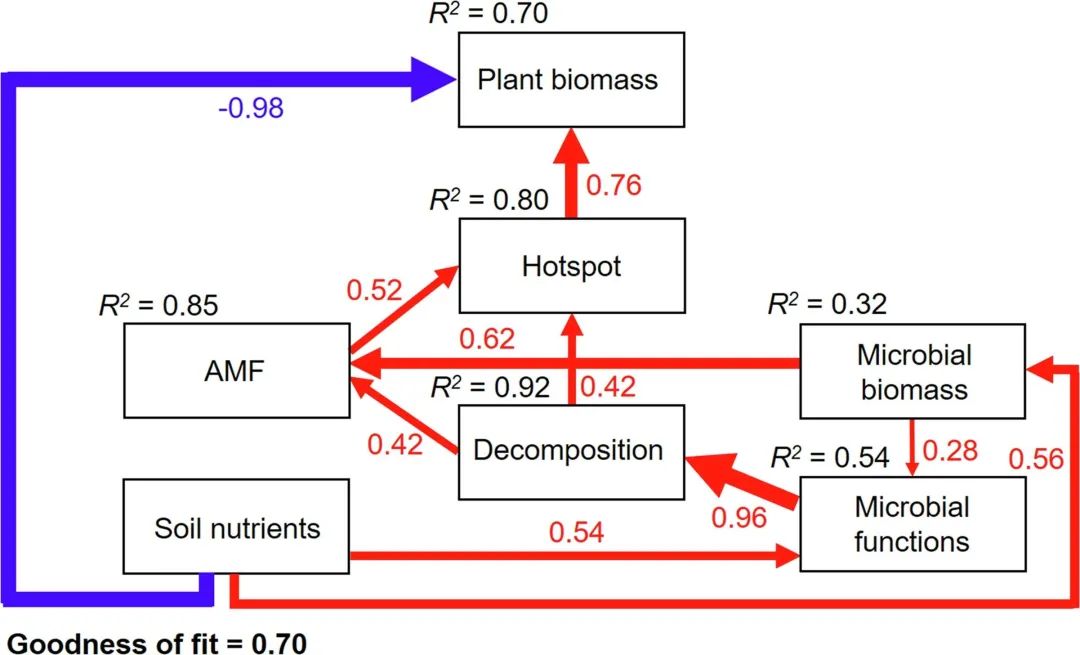

If we think that housework has monetary value, a more important problem is how to price it. At present, there are four mainstream methods in academic circles.

One is the comprehensive substitution methodThat is, the value of housework is replaced by the income level of full-time domestic service workers. The advantage of this method is that the calculation is very simple, and the remuneration of domestic workers in various regions can be directly regarded as the market price of housework. However, this method is easy to underestimate its value, because not all housework can be replaced by domestic servants.

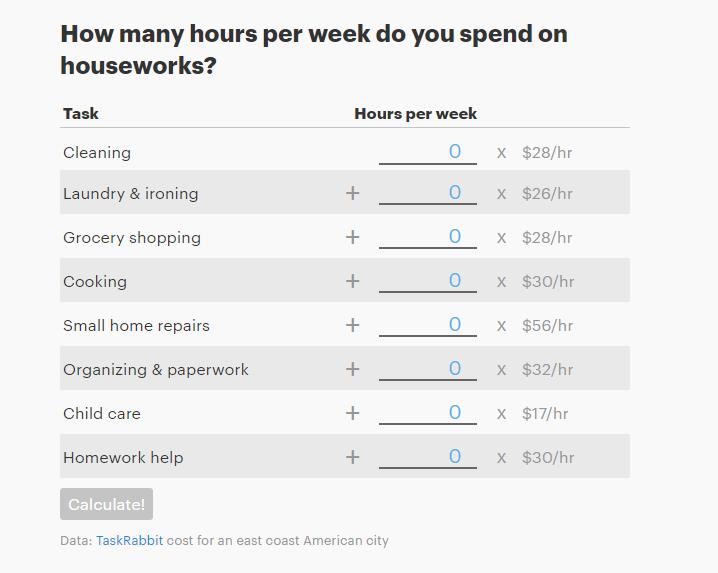

The second is the professional substitution method.That is, each activity of housework is separated, replaced by similar professional income level in market labor, and then merged into the total housework value. This method is also easy to underestimate the value of housework, because the labor efficiency of market specialization is generally high.

One person is better than six.

The following figure shows a calculation table for the value of housework in the eastern coastal cities of the United States, and the method used is the professional substitution method.

The third is the opportunity cost method.That is, the value of housework is estimated by the salary return (shadow price) that domestic workers may get in the labor market when they go out to work at the same time. This method assumes that domestic workers can be fully employed in the market and get the maximum value return, which obviously overestimates the value of domestic work. Take Hye-seon Ku as an example. If all the value of her housework is converted into the reward of spending the same time as an actress, the compensation for housework will be astronomical.

Balala energy! Compensation for housework!

The fourth is the family food law., that is, the consumption cost, which is produced by the family not cooking, is regarded as the value of housework. Obviously, this method greatly simplifies housework, which may cause great deviation.

It can be seen that there is no widely accepted perfect scheme for measuring housework, but these methods can still show us the upper and lower limits of the value of housework. It is worth noting that,Due to the great difference in the wage level between the domestic service market and the employment market in different regions, the value of housework in different regions is also quite different..

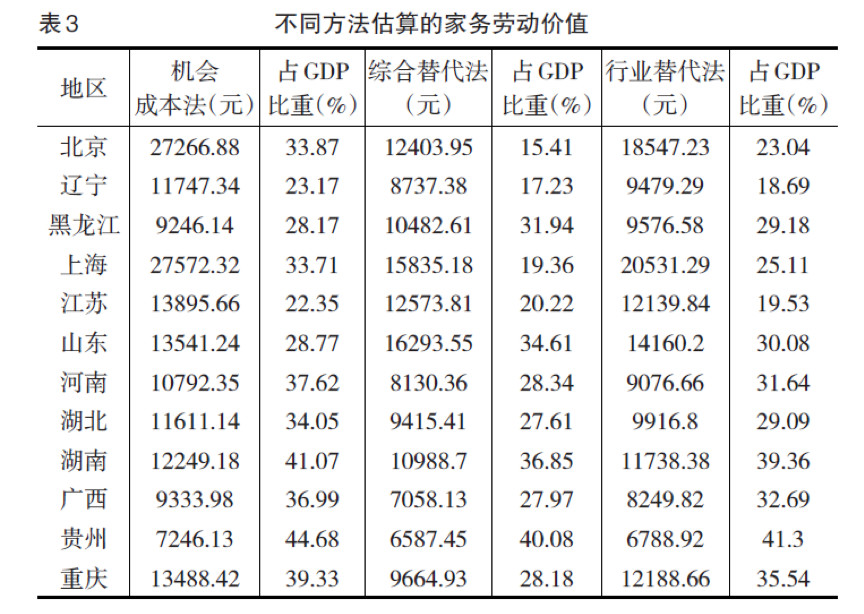

A research paper in 2018 used the first three methods mentioned above and the survey data of nutrition and health in China to calculate the monetary value of housework in different regions of China in 2011 (Liao Yuhang, 2018). The data shows that every family in China needs about 6 hours of housework every day, and the average daily working time of the wife is 4 hours, while that of the husband is about 2 hours. In contrast, American women spend 2.24 hours doing housework every day, while men spend 1.38 hours participating in it.

The figure below shows the value of housework in different regions and its proportion in local GDP. in general; generally speaking; on the wholeThe value of housework in the south is greater than that in the north..The more developed areas, the higher the overall value of housework.However, this does not mean that its proportion in GDP is higher. "The proportion of housework to GDP is also related to the wage level and economic growth, but it is inversely related. The more developed the economy, the higher the shadow price of unit housework time, and residents will take efficient ways to replace or reduce housework, thus making the relative ratio of housework to GDP lower (Liao Yuhang, 2018)". Simply put, if you can get a higher return by going out to work, individuals will choose to buy services instead of housework, which will reduce the contribution of housework to GDP in this area.

Source: Liao Yuhang. Estimation of housework value [J]. statistics and decision, 2018(8):38-42.

Q&A anonymous netizen

Since housework is valuable and can be monetized, should a couple ask for a supplementary fee for housework when they divorce?

Article 40 of China’s new marriage law stipulates: "Husband and wife agree in writing that the property acquired during the marriage relationship belongs to each other. If one party pays more obligations for raising children, caring for the elderly and assisting the other party in work, he has the right to ask the other party for compensation when divorcing, and the other party shall make compensation. This article provides that the party who undertakes more housework under the separate property system enjoys the right of economic compensation in divorce. The provisions of this article are essentially the recognition of the value of housework, so that the party (mostly women) who has a weaker economic status and undertakes more housework can enjoy financial compensation when divorced. "

From this point of view, at the legal level, this is completely feasible. But what we want to express more is,Everyone in marriage should pay more attention to the value of housework and be considerate of others’ efforts in the family, which is a necessary attitude to maintain a good marriage.

Let’s go back to the gossip at the beginning. Is it reasonable for Hye-seon Ku to ask for 30,000 won a day for housework? If we set the value of housework as 30% of GDP, it is probably the average level of East Asian countries. In 2018, the per capita GDP of South Korea is 32,000 US dollars (1 US dollar = 1,208.3 won), which is equivalent to the housework value of 31,000 won in the next day. Is this just a coincidence? Or did Hye-seon Ku show us that knowledge is power and knowledge is wealth in an extremely professional and secret way?

references

1. Liao Yuhang. Estimation of the value of housework [J]. statistics and decision, 2018(8):38-42.

2. Shen Youjia. How to measure the price of women’s housework? -the development of time allocation theory for single-family residents in Gary S. Becker [J]. Productivity Research, 2010(11):24-26.

3. Dai Qiuliang, Zhan Guohua. Analysis on the output accounting of housework [J]. statistics and decision, 2010(20):7-10.

4.Becker G. A Treatise on the Family[M].Cambridge:Harvard University Press, 1985.

Chadeau A. What Is Households’Non-Market Production Worth? [J].OECD Economics Studies, 1992,(18).

Author: Li Ting, Associate Professor, School of Social and Population Studies, Renmin University of China.

This issue is compiled by Li Zhiqi, an undergraduate student at the School of Social and Population Studies, Renmin University of China.

The manuscript was first published in WeChat official account, the WeChat of "Serious Demography Gossip". Please indicate the source, author’s name and "from The Paper Paike Channel" for reprinting. Please contact yansurenkou8gua@163.com for reprinting and cooperation.