() The business review of the Board of Directors in 2022 is as follows:

I. The industry in which the company is located during the reporting period.

(A) Analysis of industrial environment

1. Industry enterprise information market

(1) Industrial Internet

Industrial Internet has become an effective means to promote the high-end development of manufacturing industry, bringing new opportunities for industrial integration and development on a global scale. As a product of the deep integration of the new generation of information technology and industrial economy, the industrial Internet has been attached great importance by the CPC Central Committee and the State Council, and has been written into the government work report for four consecutive years. It has been mentioned three times in the national "Tenth Five-Year Plan", demanding the active and steady development of the industrial Internet and promoting the industrial ecological construction of "Intelligent Manufacturing in Industrial internet plus". Since 2015, China has successively issued Made in China 2025, Guiding Opinions on Actively Promoting internet plus Action, Guiding Opinions on Deepening the Integration and Development of Manufacturing Industry and Internet, and Guiding Opinions on Deepening the Development of Industrial Internet in internet plus’s Advanced Manufacturing Industry, thus forming a strategic policy system for manufacturing a strong country. At the end of 2020, the Industrial Internet Task Force issued the Industrial Internet Innovation and Development Project (2021-2023), proposing to deepen the "5G+ Industrial Internet". The Ministry of Industry and Information Technology and relevant departments have issued a large number of landing policies and measures, established an industrial Internet logo analysis system, and promoted the construction of a national-level basic platform. Local and provincial governments also responded to the call for active follow-up, established industrial Internet pilot parks, introduced fiscal policies, and promoted the digital transformation of large enterprises and the development of small and medium-sized enterprises on the cloud, and the relevant markets flourished.

In recent years, the development of China’s industrial Internet platform has made remarkable progress, the application level of the platform has been significantly improved, and a multi-level systematic platform system has taken shape. There are more than 50 platforms with regional and industry influence in China. There are traditional industrial technology solution enterprises such as Aerospace Cloud Network, Haier, Baoxin and Petrochemical Pacific Century to build platforms for the needs of transformation and development; There are also large-scale manufacturing enterprises such as Shugen Internet, Xugong, TCL, (), Foxconn and other independent operating companies that focus on platform operation; There are also various innovative enterprises such as Youya, Kunlun Data and Black Lake Technology to build platforms based on their own characteristics. There are also many excellent companies in innovative solutions and application models. For example, in R&D and design, companies such as Digital Generosity, Suowei and Anshi Asia Pacific have emerged. In terms of enterprise management, platforms such as UFIDA and Kingdee provide services such as cloud ERP, cloud MES and cloud CRM. In terms of application mode innovation, companies such as Shugen Internet, Tianzheng and Businessman have explored new modes and formats such as "platform+insurance", "platform+finance" and "platform+order".

Report to the 20th CPC National Congress of the Communist Party of China pointed out that the next five years will be a crucial period for building a socialist modern country in an all-round way. We should adhere to the theme of promoting high-quality development, promote new industrialization, promote the high-end, intelligent and green development of manufacturing industry, and promote the deep integration of digital economy and real economy. Promoting the development of industrial Internet and intelligent manufacturing is an inevitable requirement and an important way to implement the spirit of the 20th National Congress of the Communist Party of China and the objectives of the national "14th Five-Year Plan", promote the deep integration of digital technology and the real economy, and promote the high-end, intelligent and green development of manufacturing industry.

According to the information released at the press conference of the State Council Office in July 2022, the development of China’s industrial Internet system has achieved some remarkable results, which has supported the digital development and transformation of the country’s economy and society. At present, the industrial Internet has been widely integrated into 45 national economic categories, and the industrial scale of the industrial Internet is expected to reach 1.2 trillion yuan in 2022. At present, the industrial Internet is facing an important period of rapid development, with an annual added value exceeding one trillion yuan during the Tenth Five-Year Plan period.

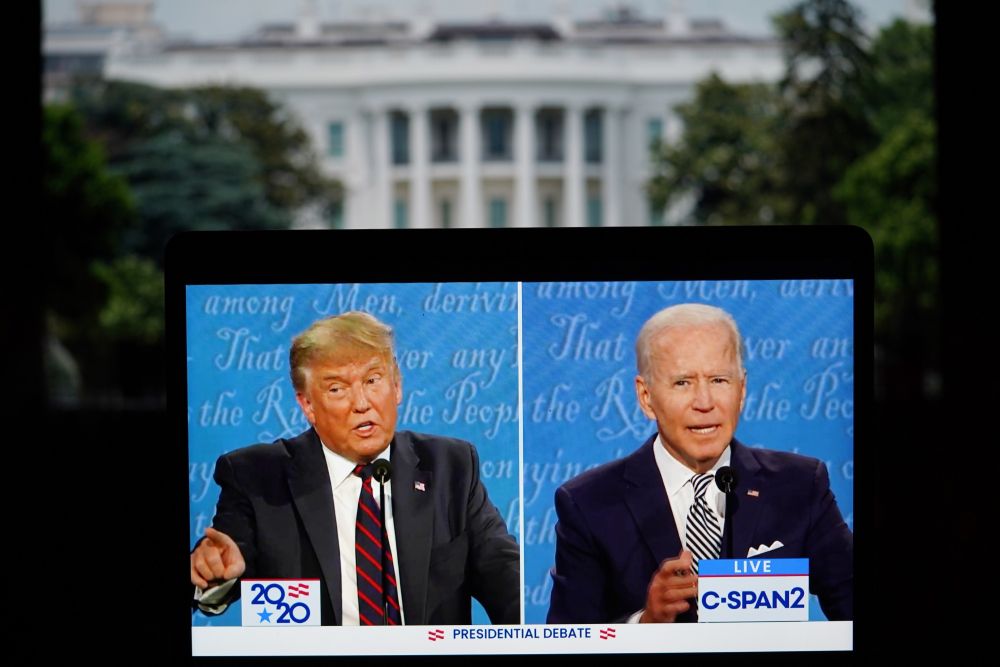

(2) car networking

In terms of vehicle networking, China proposed in the 14th Five-year Plan and the Outline of Long-term Goals in 2035 to actively and steadily develop vehicle networking. At present, relying on the new infrastructure development strategy, China is actively practicing the vehicle-road-cloud collaborative development model of "smart car+smart road+collaborative cloud" based on 5G and C-V2X vehicle networking, and promoting the collaborative deployment of C-V2X vehicle networking technology and bicycle intelligence with China characteristics.

At present, China’s C-V2X vehicle networking is on the resonance of policy, technology and industry. The related standard system of C-V2X is becoming more and more perfect, the key technologies are constantly breaking through, and the process of industrial landing is accelerating.

At the policy level, the Central Committee of the Communist Party of China and the State Council’s "National Comprehensive Three-dimensional Transportation Network Planning Outline" strengthen the overall layout and coordinated construction of transportation infrastructure construction and information infrastructure, promote the deployment and application of vehicle networking, strengthen the overall planning of new infrastructure construction, and strengthen the coordination of standards related to vehicles, communications, intelligent transportation and traffic management. Eleven ministries and commissions jointly issued the Strategy for Innovative Development of Smart Cars, proposing that by 2025, the vehicle wireless communication network (LTE-V2X, etc.) will achieve regional coverage, and the new generation vehicle wireless communication network (5G-V2X) will be gradually applied in some cities and highways. The Ministry of Industry and Information Technology issued the Notice on Accelerating the Development of 5G, proposing to promote the coordinated development of "5G+ car networking". Promote the integration of the Internet of Vehicles into the national new information infrastructure construction project, and promote the large-scale deployment of LTE-V2X. The Ministry of Transport issued the "Guiding Opinions on Promoting the Construction of New Infrastructure in the Field of Transportation" to promote collaborative applications such as 5G. Collaborative construction of vehicle networking, supporting vehicle-road coordination, automatic driving, etc. At the level of industrial promotion, China’s C-V2X is entering the stage of scale deployment. Based on C-V2X technology, China has formed a complete industrial ecology including communication chips, modules, terminal equipment, roadside equipment, testing and certification, security services and so on. China held "Three Spans", "Four Spans" and "New Four Spans", "2021 C-V2X Four Spans (Shanghai, Suzhou and Wuxi)" and "2022′ Zhixing Cup ‘C-V2X Application Demonstration".And other large-scale car networking interconnection test activities prove that China has the foundation to realize the commercialization of C-V2X related technologies; Seventeen national-level test and demonstration zones, four national-level vehicle networking pilot zones and 16 "double-intelligence" pilot cities have been built nationwide, and the landing process of the vehicle networking industry has been accelerating. In addition, C-V2X has also been recognized by the automobile industry, and more than a dozen automobile companies have released mass production models. C-V2X technology has also been included in the C-NCAP Roadmap (2022 ~ 2028), which applies C-V2X technology to active safety scenes to improve driving safety.

As for the specific application link, there have been a large number of demonstration projects in China’s C-V2X, and some projects are really applied to users. The application of C-V2X technology has gone through different stages of development, and is gradually evolving from focusing on improving road safety and traffic efficiency to automatic driving application. C-V2X technology has been gradually integrated with ADAS technology at the level of assisted driving, which helps to improve the safety of assisted driving, improve the traffic environment and improve road traffic efficiency. At the level of autonomous driving support, in limited scenes such as mining area, port, park distribution, trunk logistics, Robotaxi and other scenes, C-V2X technology has been gradually applied to promote the full commercial landing of autonomous driving.

According to Garnter’s forecast and the actual development of car networking, by the end of 2025, it is estimated that the global new car loading capacity of C-V2X will reach about 162.5 million, and the market size of C-V2X module will reach 50 billion yuan. Referring to the report of Essence Securities Research Center and the national highway grade and mileage shown in the Statistical Bulletin of Transportation Industry Development in 2018 by the Ministry of Transport, by the end of 2025, the cumulative deployment of RSU is expected to be 665,000 units, and the market size of RSU equipment is expected to be 30 billion yuan, and the corresponding integration construction cost is about 30 billion yuan.

(3) Trusted (cloud) computing

With the gradual implementation of equal security 2.0 and customs security, the application scenarios of trusted (cloud) computing market are broad. At the same time, the landing rhythm of Xinchuang industry presents a development trend of "2+8+N". Under the guidance of the party and government departments, eight key industries, such as finance, telecommunications, electric power and transportation, have also begun to accelerate their independent and controllable pace. Besides the "2+8" system, n industries, such as automobiles, logistics, tobacco and electronics, are expected to start to exert their strength around 2023.

On July 30th, 2021, the State Council issued the Regulations on Security Protection of Critical Information Infrastructure, which pointed out that "operators should give priority to purchasing safe and reliable network products and services". On November 7, 2022, the national standard "Information Security Technology Key Information Infrastructure Security Protection Requirements" (GB/T39204- 2022) was released. As the foundation of the key information infrastructure security protection standard system, the standard will be formally implemented on May 1, 2023. In March, 2022, "Network Security Management Requirements for Industrial Control System of Nuclear Power Plant" was officially released, and the standard clearly stipulated that "trusted computing technology with password as the core can be popularized and applied to realize the security and credibility of computing environment and network environment, immune to unknown malicious code attacks and respond to high-level malicious attacks." The requirement was implemented on October 1, 2022. In April 2022, the National Development and Reform Commission issued the Measures for the Administration of Electric Power Reliability (Provisional), which will come into effect on June 1, 2022, and clearly pointed out that "structural safety, ontology safety and infrastructure safety should be improved, and safety immunization should be gradually promoted". In November 2022, the National Energy Administration issued the Measures for the Administration of Network Security in the Power Industry, which clearly stated that "operators of key information infrastructure in the power industry should give priority to purchasing safe and credible network products and services and compliance".

According to CCID Consulting’s calculation, Waiting for Insurance 2.0 will bring more than 25 billion new security market space. According to the forecast of Forward-looking Industry Research Institute, the CAGR of information security, servers and other markets will remain above 8%-10% in the next few years, and the annual market scale will reach over 100 billion. Under conservative estimation, the market size of China Xinchuang industry will exceed 2 trillion in 2026, with a compound annual growth rate of 39.19% from 2021 to 2026. According to general estimation, the market size of China Xinchuang industry will exceed 2.1 trillion in 2026, with a compound annual growth rate of 39.34%. Trusted computing technology has relevant requirements in insurance, customs protection and credit creation, and can be applied to the above product markets. It is conservatively estimated that the direct market has hundreds of millions of market space every year.

2. Information service market

(1)IDC services

Although the IDC service market in China has been impacted to some extent in the early stage, the IDC industry in China has maintained a rapid development momentum under the joint action of the new infrastructure policy and the national digital transformation and development strategy. From the demand side, the demand of Internet industry, including public cloud, is the core driving force for China IDC business to maintain sustained and rapid growth; During this period, the rise of distance education, telecommuting, and epidemic prevention through science and technology has brought about an explosion of traffic, a substantial increase in data traffic, and promoted the digital transformation of traditional industries, as well as the pilot application of next-generation information technologies such as 5G, AI, and industrial Internet, and the demand for industrial Internet has gradually entered an explosive period. In 2021, the overall size of China’s overall IDC business market exceeded 300 billion yuan, reaching 301.27 billion yuan, up 34.6% year-on-year. Compared with 2020, the growth rate slowed down. The future market scale will further climb, and it is estimated that by 2024, the scale will reach 612.25 billion yuan, and the growth rate may continue to slow down.

At this stage and for some time to come, the Internet industry is still the main demander of the data center market in China, and the demand from video, e-commerce and games accounts for nearly 70%. Internet head enterprises are seeking the integration and development of their own advantageous businesses and other sub-sectors, which will bring a new wave of IDC demand growth in the Internet industry. According to the forecast of China Information and Communication Research Institute, in the next few years, the IDC market in China will still maintain an industry growth rate of more than 20%.

Under the guidance of the national policy of "calculating from the east to the west", large enterprises turned their attention to the western region with better natural environment and lower deployment cost, and IDC resources began to tilt to the mainland. With the demand for Internet services in core cities becoming saturated and the public cloud services placing more emphasis on regionalization and localization, head Internet companies are sinking into the market and are gradually deploying data center applications in second-tier cities. The data center industry in second-and third-tier cities is welcoming a period of development opportunities. Under the background of the national double carbon policy, Internet companies actively explore innovative technologies, use renewable energy, build green data centers, and practice the social responsibility of sustainable development.

(2) Digital marketing

The communication industry has shifted from user expansion to stock management, and operators have actively responded to the national 5G construction plan and increased their investment in basic network construction. User competition has entered the stage of user maintenance, and the direction of cooperation has also changed accordingly, and the attention of stock business has increased. The anti-monopoly in 2021 brought about two major changes in business development, and built an operational position to drive user traffic with high-quality content; The wall demolition action broke the barrier between Internet apps and achieved multi-position alliance. At the same time, policy supervision on user privacy and user rights has been strengthened.

In terms of mobile information, SMS is irreplaceable compared with instant messaging tools such as WeChat because of its strong timeliness, high legal effect, good stability and determinable identity. SMS is still one of the mainstream ways of mobile information service for enterprises, and the market capacity of the industry is still in the stage of steady growth.

The old and new advertising channels continue to divide, and the market scale of traditional advertising formats shrinks, while Internet advertising maintains rapid growth. The change of brand advertising market demand has driven the rapid growth of the effect advertising market, and the content marketing with video as the main carrier has ushered in rapid development.

3.IT sales

IDC predicts that the compound growth rate of PC market will be 4.0% from 2022 to 2026. At the same time, in terms of market division, the five-year compound growth rate of the commercial market will reach 3.7%, in which the continuous increase in mobile office demand will lead the growth of the commercial market; The five-year compound growth rate of the consumer market will reach 4.4%. With the gradual recovery of economic and commercial activities in various places, the commercial sector is expected to rebound in 2023.

(B) Industry status analysis

1. Industry enterprise plate

(1) Industrial Internet

The company focuses on building a leading intelligent manufacturing industry platform, independently develops intelligent MES and other projects, and publishes MES production execution control system, WMS warehouse management system, data acquisition software, energy management system, production process monitoring and control system and other products. By cooperating with international industrial software giants, the company conducts business layout by first acting as an agent, and then providing solutions and own products and services. At present, it is in the stage of vigorously expanding its own products and national business layout industrial Internet.

-DTiiP, the industrial internet platform launched by the company, accelerates the vertical flow and interaction of data in all links by opening up the whole industrial chain, and realizes the intelligent operation and remote control of machinery and equipment through in-depth analysis of data, thus innovating production methods and optimizing production processes for enterprises; By building a platform for seamless connection between enterprises, users and stakeholders, the distance between manufacturing end and service end is narrowed, which provides support for enterprises to design production based on user needs and seamlessly deliver services, and promotes the rapid development of service-oriented manufacturing. By building an information sharing and integration platform, it can quickly find and dynamically adjust cooperation partners around the world, integrate superior resources among enterprises, and realize the transformation of enterprises from individual production to collaborative innovation in different links of the industrial chain.

According to its own development and exploration, the company has formulated the mode of 2G2B. First, through the government’s demand for enterprises to access the cloud, it will establish an industrial internet platform for local governments, serve local small and medium-sized enterprises, accumulate industry experience and customers, and establish industry influence; The second is to directly provide industrial internet platform for medium and large enterprises, help enterprises complete digital transformation, and then realize the ultimate goal of intelligence and intelligent manufacturing.

(2) car networking

During the "Thirteenth Five-Year Plan" period, relying on the Group, the company was at the forefront of the industry from the concept of LTE-V for car networking, the construction of international and domestic standard systems, the launch of prototypes, and the small-scale deployment of pre-commercial products. The former company is an important promoter of the C-V2X standard for the Internet of Vehicles. As a core member of many standardization organizations such as 3GPP, CCSA, CSAE, C-ITS, TIAA, 5GAA, etc., it has iteratively developed the core product series of C-V2X such as pre-commercial C-V2X module, on-board equipment (OBU), roadside equipment (RSU) and vehicle regulation C-V2X module, and has slave modules. Fully participated in the construction of the four pilot areas and the deployment of the 8+2 demonstration area of the Ministry of Industry and Information Technology, deployed Intelligent Vehicle Infrastructure Cooperative Systems in more than 30 cities and several expressways, led and participated in the deployment and construction of the national 50+ vehicle-road collaborative project, and the total amount of C-V2X equipment ranked first in the country. In 2022, it participated in the construction of the first intelligent high-speed demonstration project "No.1 Expressway", Hefei Intelligent Networking Public Transport Project, Liuzhou Vehicle Networking Pilot Area, Xiangyang Vehicle Networking Pilot Area, which realized inter-provincial interconnection, the longest mileage and was actually in use. Around the core products, the company has formed an overall solution for C-V2X, such as smart high-speed and smart parks. Based on the standard 17 application scenarios, it has expanded to more than 100 application scenarios, covering the relevant needs of C-V2X for automobile, transportation and other industries.

(3) Trusted (cloud) computing

The company is an internationally renowned leading provider of trusted (cloud) computing products, solutions and services in China. Trusted Cloud Computing has participated in the formulation of many national and industry standards such as TC260, CCSA, Ministry of Public Security, etc. It is a member of the international TCG organization and a founding member of the Power Infrastructure Network Security Innovation Consortium in the power generation field, which has unique advantages in technology, products and applications. The company provides self-developed software products and end-to-cloud trusted system solutions based on trusted (cloud) computing/confidential computing/operating system security technologies, and supports X86/ARM architecture and domestic CPU platform. Trusted server is the only product that has passed the test of National Virus Prevention and Control Product Testing Center and obtained the sales license of anti-spyware Trojan products issued by the Ministry of Public Security.

The company is an active and continuous participant, contributor and practitioner of the open source community, and actively contributes to many projects of cloud computing and network security. Trusted cloud system (including trusted server, operating system trusted enhancement system, trusted cloud management suite, etc.) has passed the third-level technical requirements of equal assurance 2.0.

2. Information service section

IDC service business, the company has a deep background in the telecommunications industry, has been engaged in value-added telecommunications business for a long time, has a cross-regional value-added telecommunications business license, CDN license, cloud license, and is familiar with and has long followed the value-added telecommunications business supervision policy.

The digital marketing business has established strategic cooperation with head enterprises such as (), (), China Unicom, Alipay and CCTV Finance. The mobile information service is transformed from the traditional telecom value-added service to the enterprise communication service, and the access points of several local operators’ channels are connected to the ground, thus realizing the coverage of the three major operators’ channels, laying the foundation for the all-round development of the enterprise communication service, and providing enterprise communication services to users in education, games, e-commerce and finance industries through the self-developed platform.

3.IT sales section

The company is a leading IT sales enterprise in East China, selling IT products such as Asustek and Lenovo as agents, and forming a strategic cooperative relationship with JD.COM and Suning. As one of the largest IT distributors in Jiangsu, it has formed an obvious scale advantage and has a large number of high-quality customer resources.

II. Main businesses of the Company during the reporting period

During the reporting period, the company took stability and quality improvement as the general tone, insisted on making breakthroughs in its main business, focused on integrating resources for development, comprehensively promoted various businesses in the three business sectors of enterprise informatization, information service and IT sales, intensified efforts to optimize its business structure, and made important achievements in technological innovation, product optimization and market expansion, and continued to consolidate the company’s industrial base.

(A) Industry enterprise information plate

Based on the company’s independent innovation ability, the industry enterprise information sector will carry out the following two types of business for target market segments: First, focus on the layout of industrial Internet, car networking, trusted computing and other fields to provide products and solutions for upstream and downstream partners and users in the industrial chain. Development, sales and services; The second is to provide application software system development, information system solutions and system integration services for government, Internet, telecommunications, education, radio and television industries and corporate customers.

Industrial Internet: The company focuses on regional industrial Internet business, and deploys DTiiP, an industrial Internet platform with its own products as the core, in key manufacturing areas across the country, to form a trinity of industrial governance platform, industry collaboration platform and enterprise innovation platform covering macro, meso and micro comprehensive services and operation systems to provide services for the government, industries and enterprises; Based on the industrial Internet platform, vigorously expand innovative applications such as intelligent manufacturing, smart broadcasting, smart logistics, smart emergency, and smart environmental protection; Focusing on independent research and development of industrial software products MES (manufacturing enterprise production process execution system), SRM (supplier management system), TMS (transportation management system), PHM (equipment diagnosis and prediction system), EMS (energy management system), WMS (warehouse management system) and WCS (warehouse control system), focusing on automobile, electronic information, logistics and other sub-fields, we will provide intelligent manufacturing solutions for enterprises. We will continue to strengthen cooperation with leading international enterprises such as Siemens, PTC and SAS, and cultivate self-owned services such as the implementation and delivery of high-end industrial software projects with the support of innovative service platforms.

Internet of Vehicles: In order to support the persistence of high-intensity R&D investment before the outbreak of the Internet of Vehicles market, promote the overall rapid development of the Internet of Vehicles industry, and ensure the company’s stable operation, the company conducts iterative R&D, sales and delivery of modules and complete machine terminals through investment cooperation. At the same time, the company conducts communication chip customization, research and development of industrial application platforms and security solutions, production and marketing service system construction, and provides professional intelligent networking solutions for smart high-speed, urban roads, parks, ports, mines and other application scenarios.

Trusted (cloud) computing: provide software products and end-to-cloud trusted system solutions independently developed based on trusted (cloud) computing/confidential computing/operating system security technologies, support X86/ARM architecture and domestic CPU platform, provide support for the trustworthiness and compliance of products such as computing/communication/border equipment manufacturers, cloud computing manufacturers and industry ISVs (independent software developers), and provide security solutions for industrial applications such as car networking and industrial Internet.

Industry/enterprise information service: The company provides comprehensive digital capabilities, builds a complete system flow of system design, software development, system integration, operation and maintenance, and strengthens the service quality assurance capability of the whole project life cycle, which has been widely used in government, military, transportation, energy, politics and law, education, operators and other industries.

(2) Information service sector

The information service sector mainly includes IDC (data center) and digital marketing, and actively carries out business transformation and business model innovation based on strategic cooperation with head enterprises.

IDC (Data Center): Deepen cooperation with Equinix, the world’s leading data center operator, actively supplement market resources and operation and maintenance capabilities, innovate and develop new models such as CDN services and cloud services on the basis of the original business guarantee, and expand customer types to EC, MC, cloud and other fields. IDC extends domain connection and IP connection services.

Data marketing: In line with the development trend of new consumption and industrial Internet, actively seize market opportunities in Internet marketing, artificial intelligence application products, mobile information, mobile media and other business fields, optimize business models, build agile R&D capabilities, and enhance the core capabilities of users and data operations. Collect the resources of Alipay and communication operators to realize the in-depth operation of operators and their customers from communication services to life services; Provide mobile Internet-based telecom value-added services, enterprise cloud short message services and 5G message services; Provide customers with one-stop services such as information flow advertising, brand advertising, search marketing and short video marketing.

(3) IT sales section

The IT sales business mainly includes the sales of IT products (notebooks, desktops, digital products), the product sales of global first-line small household appliances brands and the overall supporting service business. With Lenovo, ASUS and other core brand products, the company faces big customers such as JD.COM and distribution customers in the industry, and provides long-term and stable supply to customers with the most competitive supporting service capabilities; Expand new business, enrich product structure, realize product diversification, increase the sales scale and proportion of small household appliances, and provide customers with high-quality products and services through the advantages of efficient supply chain integration.

Third, the core competitiveness analysis

Building the core competitiveness of the business is the long-term strategic goal pursued by all business sectors of the company and the driving force for the company’s sustainable development. Through continuous efforts, in some segments, the company has formed a strong technical leading edge and business competitiveness.

(a) industry enterprise information plate:

The company has a number of qualifications, such as classified information system integration (Grade A) qualification, information system construction and service capability evaluation CS4 qualification, security engineering (Grade I) qualification, China AAA quality and integrity enterprise, CMMI5 software capability maturity model integration, and Grade II electronic and intelligent engineering professional contracting, which makes the company form a strong competitive advantage in the fields of building intelligent weak current integration and computer system integration business, and ranks in the first echelon of domestic system integration service providers.

In terms of scientific and technological innovation, the company actively participates in standardization organizations such as 3GPP, 5GAA, CCSA, C-ITS, IMT-2020 C-V2X, National Information Security Standardization Technical Committee (TC260), CSA (Global Cloud Security Alliance), and continuously enhances its influence. The company is an important promoter of international and domestic vehicle networking technical standards, and actively carries out patent layout in strategic businesses such as industrial internet, vehicle networking and trusted (cloud) computing.

The company has rich experience in enterprise informatization and digitalization. Since 2013, it has laid out the direction of intelligent manufacturing and Internet of Things, and gradually focused on the industrial Internet industry. The company’s industrial internet platform adopts the micro-service architecture, integrates and shares the experience, knowledge and technical achievements of industrial big data services through the industrial PAAS platform, data terminal and industrial scene APP, builds a brand-new industrial manufacturing and service system, and promotes the construction of basic industrial internet platforms and industrial-level (highlighting the common support of industries), regional-level (highlighting the characteristic industrial clusters) and enterprise-level (highlighting the coordination of industrial chains and the intelligentization of enterprises) industrial internet platforms. In many years of industrial Internet practice, the company has established a good reputation among governments, industries and enterprises, and won many national, provincial and municipal honors. The company signed a strategic cooperation with the Federation of Industry and Commerce and Tianjin Unicom to jointly build a 5G+ industrial Internet joint laboratory, and the joint laboratory will focus on the related research of industrial Internet. Datang’s DTiiP industrial Internet platform was selected as "Top 50 Special Industrial Internet in 2022". The three-dimensional visualization solution of Datang’s industrial digital twin was awarded as "100 excellent cases of enterprise digital transformation in 2022". The company was selected as a member of the two working groups of the Key Laboratory of the Ministry of Industry and Information Technology, "Cloud on Equipment" and "Digital Twin", which marked the technical capability based on Datang’s integrated industrial Internet platform.The achievements in the fields of "equipment on the cloud" and "digital twins" have been highly recognized by the industry. At present, the access equipment covers Northeast China, North China, East China and Central China, with a total access number of 10,000+,involving manufacturing, logistics and transportation, energy and environmental protection and other industries. Hangzhou subsidiary, a subsidiary of Datang Fusion, participated in the robot industry brain project led by Xiaoshan District People’s Government and was shortlisted for the second batch of industrial brain construction in Zhejiang Province.

The company’s car networking business has the advantage of first-Mover technology. It has launched the world’s first commercial C-V2X module, and released the world’s first commercial C-V2X vehicle-mounted terminal (OBU) and roadside equipment (RSU). At present, it has achieved mass production of C-V2X vehicle-mounted module, iteratively developed core product series such as vehicle-mounted terminal (OBU) and roadside equipment (RSU), and has an industrial chain from module, terminal to overall solution. The company is the core supporting unit for the interconnection and application display of the "Three Spans", "Four Spans", "New Four Spans" and "New X Spans" of the Internet of Vehicles. It has fully participated in the construction of the four pilot areas and the deployment of the 8+2 demonstration area of the Ministry of Industry and Information Technology, deployed Intelligent Vehicle Infrastructure Cooperative Systems in more than 30 cities and several expressways, and built the Shi-Yu Expressway collaborative model project with the longest mileage in the world at present, which has been written into Chongqing’s "14th Five-Year Plan of Traffic Power".

The company’s vehicle-road-cloud collaboration platform has the capabilities of V2X map making, high-precision map processing, event intelligent processing early warning engine, 3D visualization, traffic simulation, big data analysis and prediction, etc. It has been verified in many projects, and the vehicle trajectory fusion algorithm across MEC is leading the industry. Since 2019, the company’s Cheluyun collaborative platform has accumulated a number of high-speed and urban road projects, which have been well received by customers. In the future, we will continue to explore vehicle-road collaborative application scenarios and operation modes based on vehicle-road cloud collaborative platform. On the one hand, we will improve the level of traffic governance through digital intelligent construction at the traffic management end, and on the other hand, we will support autonomous driving in different scenarios through vehicle-road collaborative support, which will promote industrial development. In-depth promotion of applications in various industries.

Trusted Cloud Computing has participated in the formulation of many national and industry standards such as TC260, CCSA, Ministry of Public Security, etc. It is a member of the international TCG organization and a founding member of the "Power Infrastructure Network Security Innovation Consortium", which has unique advantages in technology, products and applications. The company has built an end-to-end cloud trusted system solution, which supports X86/ARM architecture and domestic CPU platform, and supports TCM/TPM specification. Trusted server is the only product that has passed the national virus prevention product testing center and obtained the sales license of anti-spyware Trojan products issued by the Ministry of Public Security, and the trusted cloud platform system has passed the third-level security requirements assessment of equal protection 2.0.

In terms of long-term product R&D capacity building, the R&D system is optimized around the brand-new positioning of "digital intelligent empowerment experts", and the all-round ability of "digital intelligent empowerment experts" is continuously enhanced from three dimensions: product structure, horizontal expansion and vertical depth.

(2) Information service sector

The company has cross-regional IDC business licenses in Beijing and Shanghai, and has multiple data centers, which can provide comprehensive data center basic business and value-added service business for corporate customers.

In the field of digital marketing business, based on the insight into consumption orientation and industrial trends, the company has strong market sensitivity, is good at grasping market opportunities, actively integrates industry resources, and has established strategic cooperation with head enterprises such as China Mobile, China Telecom, Alipay, CCTV Finance and China Football Association. Strong business model innovation ability, agile research and development ability and data operation core ability.

(3) IT sales section

Since its establishment, its subsidiary, Gaohong Dingheng Company, has been committed to building a professional supply platform for hypermarkets. IT has channel advantages in 3C stores, high-quality and numerous customer resources, and has cooperated with domestic high-quality terminal vendors such as JD.COM, Suning Appliance, Gome and Tmall all the year round, and formed a strategic partnership. The company’s management team has rich resources and experience in IT supply chain services. In recent years, the company has continued to exert its efforts online, especially in small household appliances business, enriching and improving the company’s product structure and enhancing and improving market competitiveness.

Fourth, the main business analysis

1. Overview

(1) Industry enterprise plate

During the reporting period, the business development of the company’s industry and enterprise sector:

Industrial internet service

According to its own development and exploration, the company has formulated two business models. One is the 2G2B model, which establishes a regional industrial Internet platform for local governments, serves local small and medium-sized enterprises, improves the local manufacturing level, and accumulates industry experience and customers, and establishes industry influence. The second mode is 2B, which directly provides industrial Internet platform for large and medium-sized enterprises, helps enterprises to complete digital transformation, and then realizes the ultimate goal of intelligence and intelligent manufacturing.

The company established the "Datang Industrial Internet Innovation Service Platform" in Wuxi, and set up Datang-Siemens Intelligent Manufacturing R&D Center and public service platform in Wuhan and Hangzhou. Supported by the innovative service platform, the company provided services such as overall solutions for intelligent manufacturing, localized development and implementation delivery of industrial software and Siemens software, consultation and diagnosis, training, laboratory sharing, etc., and accurately connected the products and solutions gathered in the intelligent manufacturing ecosystem with the target market, focused on the Yangtze River Delta, empowered the whole country, and realized the scale of intelligent manufacturing business.

During the reporting period, the company vigorously expanded innovative applications such as smart manufacturing, smart logistics, smart environmental protection, smart radio and television based on the self-developed industrial Internet platform DTiiP; Focusing on self-developed basic MES suite, MES suite for automobile and electronics industry, supplier management system (SRM), transportation management system (TMS), equipment diagnosis and prediction system (PHM), energy management system (EMS), BI visualization system, and other SaaS applications on ToB side, we will focus on automobile, electronic information, logistics and other sub-sectors to promote intelligent manufacturing business. In the direction of industrial internet, the company undertakes the construction of Zhejiang robot industry brain, JD.COM Yuhuan industry brain and Hubei Ezhou industry brain project, and the centralized control and distributed rural domestic sewage treatment system of "internet plus Digital Intelligence" in the three northeastern provinces; SaaS application on ToB side has undertaken projects such as the integrated platform of scientific research and production (PMS+MES), (), Dongfeng Honda and BAIC Group of a design institute group in China. Smart Radio and Television has successfully landed in the customer service system supported by the 5G business of provincial branches of China Radio and Television.

Car networking service

In order to support the persistence of high-intensity R&D investment before the outbreak of the car networking market, promote the overall rapid development of the car networking industry and ensure the company’s stable operation, the company conducts iterative R&D, sales and delivery of modules and complete machine terminals through investment cooperation, and at the same time, the company conducts communication chip customization, research and development of industry application platforms and security solutions, production and marketing service system construction, and provides professional intelligent networking solutions for smart high-speed, urban roads, parks, ports, mines and other application scenarios.

Trusted (cloud) computing service

Provide customers with trusted (cloud) computing software products, trusted consulting, adaptation and integration services, and realize commercial value realization through consulting, adaptation, integration services and software authorization. The main business drivers come from the comprehensive implementation of Isoprotec 2.0, Guanbao and Xinchuang. As a key supporting technology of related standards, trusted computing involves the security of computing/network/boundary and industrial control equipment, and has broad application prospects.

The company can provide trusted computing software products, multi-platform equipment adaptation and system solutions, and integrated research and development of domestic trusted industrial control systems that meet the requirements of Class 2.0. The products have good compatibility and strong customization ability.

During the reporting period, firstly, we improved the adaptation of the trusted industrial chain, completed the adaptation with Ningsi, Zhongke Fangde operating system and Xinhua Sanxinchuang server, and became a certified enterprise and a certified partner of Loongson Eco-Partnership Program. Second, actively participate in the formulation of standards: GB/T 29829-2022 "Information Security Technology Trusted Computing Password Support Platform Function and Interface Specification", CCSA TC8 "Internet of Things Operating System Security White Paper" have been released, and the information security standards Committee TC260 "Information Security Technology Terminal Computer General Security Technical Specification" and "Information Security Technology Government Computer Terminal Core Configuration Specification" have been prepared; The third is to deepen the application of financial innovation, join the financial information technology application innovation laboratory of the National Engineering Research Center for Electronic Commerce and Electronic Payment, complete the pre-research work of domestic trusted financial instruments, and form a domestic trusted privacy computing all-in-one program.

Industry/enterprise information service business

During the reporting period, the company adhered to the business policy of "expanding quantity, stabilizing stock and improving quality", and established a complete service system process of system design, software development, system integration, operation and maintenance in the fields of government and enterprise, communication, education and integration of defense and civilian technologies by focusing on superior industries and key customers. It is unique in rapid response to localization and sustainable services, and can provide full-service software customization services and full-project life-cycle services for industry users, and achieve first-class quality assurance. Among them, the company focuses on smart cities, digital justice, operator ecology, smart energy, education informationization, special information services and other business sectors, and has created a series of key benchmark projects.

In the field of smart city business, the company helped to promote the construction of new smart cities, and successively won the bid for the smart city project of a prefecture-level city, the intelligent networked parking lot construction project of Changde City, the urban governance modernization project of Hulunbeier City, the video conference project of Northeast Civil Aviation Administration, and the expansion project of smart emergency command and dispatch system in Haidian District. Among them, the construction, investment, development and operation project of intelligent networked parking lot in Changde City will transform the intelligent parking lot for 54 parking lots in Changde City. Through the intelligent construction of the front end of the parking lot and the construction of the parking data platform, it will promote the integration and development of parking information and the Internet, adapt to the development trend of intelligent networked automobile industry, continuously expand parking applications, provide rich operational management means, and build an urban parking system with convenient parking, efficient operation, proper supervision and scientific planning, serving all social groups.

In the field of digital justice business, the company mainly undertakes the information construction of the public security industry, relies on the in-depth mining and analysis of video big data to improve the office efficiency of the public security system, and responds to various social security incidents more efficiently and accurately. It has won the bid for the operation and maintenance service project of urban video surveillance system in Wuchang District, Wuhan, with a total amount exceeding 150 million yuan, making it a pioneer in the regional comprehensive operation and maintenance project of the public security industry. In addition, the project of comprehensive management sub-center (comprehensive management sub-platform), a networking application project of public security video surveillance construction in Haixi Prefecture of Qinghai Province, which our company won the bid, has become a model project in Qinghai Province, laying a foundation for the municipal governance of Qinghai Province.

In the field of operator ecology, the company has further improved its service quality by strengthening market sales management and channel system construction management. By actively cooperating with the account managers of relevant operators, giving full play to the advantages of abundant qualifications and flexible operation, and optimizing the cooperation mode and business mode, we have successfully expanded the Unicom customers in Hebei, Shandong and other provinces on the basis of Beijing Unicom’s business. At the same time, we have actively carried out exploratory business layout in China Mobile and China Telecom, successfully completed the tens of millions of contracts, and achieved business docking with China Tower Group, realizing the Internet of Things, 5G, video networking, cloud computing services and so on in the entire operator’s ecological field.

In the field of educational informatization, the company launched a series of educational training solutions represented by the intelligent networking training room and the Xinchuang training room, and successfully placed the equipment procurement project of the intelligent networking automobile demonstration line of Wuhan University of Science and Technology, the intelligent networking transportation system of Chongqing Vocational College of Industry and Commerce and the intelligent networking pilot demonstration area project; At the same time, based on the technical advantages and industry influence in the field of information security, the company cooperated with the Teaching and Examination Center of the Ministry of Industry and Information Technology to carry out the training and examination of Xinchuang Integrated project management division (Advanced), and has issued qualification certificates for candidates who passed many batches of examinations.

In the field of special information services, the company focused on the integration of classified systems, emergency management of production safety, and integrated systems of military and political enterprises. Through cooperation with the State Secrecy Bureau, China Institute of Electronic Technology Standardization and other units, it made a breakthrough in the business field of classified system integration projects, and successively won the bid for a security upgrade project of the State Secrecy Bureau, an information project of Guangxi Prison Bureau and a relocation and reconstruction project of Hulunbeier Public Security Bureau. The company takes "intelligence" as its service feature, and through the on-demand upgrading and transformation of the information system of special industries, it empowers customers to realize digital and information-based internal management, and has achieved a high level of information construction in special industries such as secret-related and military-related industries.

(2) Information service sector

During the reporting period, the company’s information service business development.

internet data center

During the reporting period, IDC’s basic operation business continued to develop steadily. Shanghai has a national leading network environment, which provides good hardware support for the quality service of local data centers. The company’s IDC business, customer category expansion needs to EC, MC, cloud and other fields, IDC extended domain connection, IP connection business has been officially launched.

Digital marketing business

In the field of Internet marketing, the renewal of "Double V" and China Mobile’s agency operation agreement has been completed, and all the projects of China Unicom’s top-up payment center have completed the final inspection process. In the field of mobile information, the company focused on expanding the access points of operators’ high-quality channels. The three major operators each received multiple 5G message channels, and successfully landed a number of different service code resources, and launched the IPTV cloud game platform of China Unicom. In the field of mobile media, it has reached an annual cooperation plan for new projects with CCTV Finance, and the new media platform of China Football Association is under operation planning.

(3)IT sales section

In view of the unfavorable factors such as the early influence of IT distribution market and the shortage of supply chain funds, the company adopted the strategy of seeking a breakthrough in stability. On the basis of ensuring the stability of the supply chain, we will determine the normal cooperation mode of sales channels and actively expand new marketing models to maximize profits.

During the reporting period, the company stabilized ASUS business, increased the sales scale of Philips, and expanded small household appliances businesses such as Beswin, Samsung Smart Door Lock and Panasonic. Open up Lenovo’s commercial industry applications and enhance Lenovo’s commercial sales scale. Make every effort to increase the sales scale and proportion of JD.COM platform, and expand high-margin products to realize product diversification. Strengthen brand strategic cooperation and expand the sales scale of traditional channels.

V. Prospect of the Company’s Future Development

(1) Industry pattern and trend (macro-economy, industry environment)

During the 14th Five-Year Plan, China’s economy is moving from high-speed growth to high-quality development, and the digital economy and the real economy are merging and showing a trend of rapid development. The state will increase investment in emerging infrastructure, focusing on 5G, artificial intelligence, industrial Internet, Internet of Things, smart cities, etc., to empower and serve the development of various industries, increase investment in intercity transportation, logistics, municipal infrastructure, etc., and fill the shortcomings in rural infrastructure and public service facilities, providing China with new kinetic energy for economic development.

2022 is the year when the "14th Five-Year Plan" is fully implemented, and some key areas will usher in a golden period of development. New engines such as "two new and one heavy", "private and inclusive", "specialization and innovation", "digital technology" and "green and low carbon" will strongly stimulate economic growth, and rural revitalization will further broaden the depth of China’s economy.

1. Industrial Internet

Industrial Internet is a revolution in the field of production. It integrates a new generation of information technology with the industrial field in an all-round way, gives full play to the advantages of China’s manufacturing power and network power, and becomes an important supporting force for promoting economic development.

China’s intelligent manufacturing has moved from local pilot to full popularization, from basic interconnection to deep optimization, forming a series of breakthroughs in network, platform, security and logo analysis, and gradually establishing an industrial Internet ecosystem that is suitable for China’s economic development. In the platform direction, a good situation has been formed, a multi-level systematic platform system has taken shape initially, and many well-known industrial Internet platform products have emerged. Compared with foreign established enterprises such as Siemens, GE, Bosch, ABB and Hitachi, there are more than 50 platforms with industry influence in China. Traditional industrial technology solution enterprises, including Aerospace Cloud Network and Haier, build platforms for the needs of transformation and development. Large manufacturing enterprises such as Shugen Internet, Xugong, TCL, Zoomlion and Foxconn incubate independent operating companies to focus on platform operation, and some innovative enterprises rely on their own characteristics to build platforms. The development prospect of domestic intelligent manufacturing is improving, but there is still a big gap compared with developed countries. First, key technologies, core components/equipment and high-end industrial software are controlled by people. Second, the system integration ability is relatively insufficient. Third, the informationization foundation of small and medium-sized manufacturing enterprises is weak, making it difficult to integrate into the intelligent wave. In the future, intelligent manufacturing will present three major trends: flexible production driven by data, industrial interconnection supported by platform, and intelligent manufacturing service centered on users.

2. Car networking

On a global scale, the ecology of the car networking industry has been continuously enriched and improved. Advanced driver assistance system (ADAS) has become the standard for a large number of new cars, and the intelligent level of cars has been gradually improved. The integration of ADAS and networking has become a development trend, and the function of LTE-V2X is being highly concerned by automobile manufacturers. The application scenarios and service capabilities of the Internet of Vehicles are constantly evolving and improving; Application scenarios such as networked automatic driving taxis and remote control driving are constantly emerging; The Internet of Vehicles empowers the coordinated development of intelligent networked vehicles and smart cities, and promotes the transformation of new models. According to the statistics and forecast of HISMarkit, a global research consultancy, the penetration rate of new cars equipped with intelligent networking function in the global market will be about 45% in 2020, and it is estimated that the market scale will reach nearly 60% by 2025.

As a cross-border integration field, the Internet of Vehicles plays a more abundant role, including traditional telecom equipment vendors and traditional smart transportation vendors, such as ZTE, Huawei, (), () and (), as well as new smart transportation vendors and automotive electronics vendors that have infiltrated from the automotive electronics field to the vehicle-road collaboration field. Different types of vendors have their own advantages. At present, it is still in the initial stage of the vehicle-road collaborative market. Although various manufacturers are competitive in the market, to some extent, participants with different roles are needed to prove the social value and commercial value of vehicle-road collaborative technology from various angles through practice, thus promoting the benign development of the industry.

3. Trusted (cloud) computing

Trusted computing technology is an active immune endogenous security technology, which is highly valued by the industry. In recent years, it has developed rapidly all over the world. The International Trusted Computing Alliance has issued TPM2.0 standard including China encryption algorithm. Microsoft, INTEL, Google, etc. have widely applied this technology to software and hardware platforms such as PC, server, mobile phone and Internet of Things terminal. Trusted computing is an important recommendation technology in the equal security 2.0 standard, and it is also one of the key technologies of national network security determined by the Ministry of Industry and Information Technology. At present, the application scenarios of trusted computing are relatively limited, mainly limited to a few industries such as power, broadcasting and media, etc. with the implementation of the equal protection regulations, trusted computing technology will be widely used in PC, server, mobile phone, IoT terminal, cloud computing, Internet of Things, industrial Internet and other aspects of the national general equal protection industries in the future, with broad market prospects. At present, trusted computing, artificial intelligence, blockchain and other technologies are developing together, and it is combined with zero trust network system to promote trusted computing to enter a new development stage.

(II) Company development strategy

1. Strategic guidelines

In the next five years, the company will take "enhancing value" as its strategic goal, "improving quality steadily (overall tone), strengthening industry (core task) and integrating resources (resource guarantee)" as its development principle, and "stabilizing the team reform mechanism, stabilizing the scale and adjusting the structure, striving for quality through steady growth, concentrating on industry and strengthening innovation, and allocating resources to prevent risks" as its strategic development thinking, so as to further focus on industrial operation and enhance the competitiveness of core industry sectors. Integrate and allocate all kinds of resources to prevent major business risks and maintain the company’s healthy and sustainable development.

2. Development goals

The company’s strategic goal is to become a leading enterprise with "higher investment value and social value", become a new force in the construction of a new smart city, empower the "three major applications" of government and enterprise, people’s livelihood and social governance, and focus on the layout of new infrastructure (car networking, industrial internet and big data center). The business goal is to strive to make the main business segments become competitive enterprises in business segmentation, and the management goal is to continuously improve strategic management, human resources and finance that meet the management characteristics of high-tech enterprises.

3. Development strategy of specific business segments

(1) Industry enterprise plate:

Business goal: to become a leading enterprise in the field of domestic enterprise information segmentation.

Business orientation: to become "an industry integrated service provider with core technologies, products and operational capabilities".

Business development ideas: seize the new kinetic energy of digitalization, networking and intelligent development of the global digital economy industry, combine the strategic opportunities of industrial development such as national intelligent manufacturing, 5G, self-controllable, and new infrastructure construction, and take the promotion of customer value as the guide to empower the advantageous businesses in the segmentation field with ABCIE technology, and continuously optimize the business model and organizational structure. Strengthen the innovation ability of technical products, vigorously develop strategic businesses such as intelligent manufacturing/industrial Internet, vehicle networking and trusted (cloud) computing, continue to consolidate and optimize mature businesses such as industry informatization and system integration, improve the organizational ability of products and industry solutions, deepen the cultivation of value industries such as government, transportation, radio and television, telecommunications, manufacturing and electric power, and continuously improve the core competitiveness and profitability of industries, and become an application service expert of industry enterprises.

(2) Information service sector

Business goal: to become a leading enterprise in the field of mobile internet segmentation in China.

Business orientation: mobile internet intelligent life service expert.

Business development ideas: conform to the development trend of new consumption and industrial Internet, actively occupy industrial positions, seize market opportunities, optimize business models, build agile R&D capabilities, enhance the core capabilities of users and data operations, and become a leading enterprise in digital marketing segmentation.

(3)IT sales section

Business goal: to become a leading enterprise in domestic IT distribution regional market.

Business orientation: "multi-level supply chain service expert for IT electronic products".

Business development ideas: through the advantages of efficient supply chain integration, we will provide customers with high-quality products and services, enrich product categories, increase the proportion of online sales, optimize sales structure, explore new retail with brand alliance manufacturers, seek model breakthroughs, and achieve steady profit growth.

(III) Business Plan for 2023

In 2023, the company will take stability and quality, focus on the main business and integrate resources as its business policy, further promote the adjustment of business structure and organizational structure, pool resources in strategic business areas, persist in investing in continuous innovation, enhance the company’s profitability, and solidly promote the implementation of the 14 th Five-Year Plan.

Key work arrangements for 2023:

1. Industry enterprise information plate

(1) Industrial Internet, intensify the research and development of industrial Internet base platform, enrich the application of the platform, ensure the sustainable upgrade of products, and conduct research and development and exploration on industrial Internet terminals and side products. Further carry out iterative research and development of big data basic platform, multi-dimensional data visualization analysis platform, centralized control and distributed sewage treatment cloud platform, etc., and cooperate with the Internet of Things platform to carry out research and development of rule engine and factory-level digital twin scheme. Promote the intelligent control, management, fault predictive maintenance and energy consumption management of IOT equipment, optimize centralized control and distributed sewage treatment platform through emerging interconnection technologies, and realize fully intelligent operation of key businesses such as rural sewage operation management, process operation and equipment fault early warning and prediction. Comprehensively promote the regional industrial internet platform and carry out various forms of cooperation; Maintain the agency business of Siemens and PTC, and further increase the market share of self-owned services such as implementation and delivery of high-end industrial software projects.

(2) Internet of Vehicles, the company will focus on the core basic capacity building of the Internet of Vehicles industrial chain, further develop the research and development of the car-Lu Yun collaborative platform, and improve the functions such as big data analysis. At the same time, relying on the company’s system integration ability and customer market resources, we will focus on the market segmentation of vehicle-road collaborative scenarios with great potential and easy landing, and unite ecological partners to create and deliver industry-leading smart transportation overall solutions for customers.

(3) Trusted (cloud) computing, continuously promoting compatibility and mutual recognition with domestic mainstream CPU, firmware and operating system. Focus on strengthening the research and development work of such projects as equal-guarantee trusted certification, trusted cloud of southern power grid, and national trusted power generation DCS, and on this basis, promote the industry technology market.

2. Information service section

IDC service, building a national industrial Internet data bearing platform.

Mobile media services, actively deploy effect marketing, short video marketing and e-commerce operation services, and build a service system from brand communication to sales realization. We will build innovative service capabilities that are driven by creative content and technical data and characterized by efficient transformation of e-commerce drainage. Relying on the KA agent status of today’s headlines, Tencent and other traffic platforms, we will improve the click, registration and purchase transformation of advertising for customers, improve the input-output ratio, and bring delivery value to customers. Apply native content, creativity, crowd insight, market analysis, optimization technology, etc. to help efficient transformation, and truly achieve the integration of product and effect.

3.IT sales section

Stabilize the sales scale of FA business of IT products, increase the sales scale and proportion of small household appliances, expand emerging businesses, get rid of relatively single products, enrich product structure and realize product diversification. Stabilize the distribution business in JD.COM, expand the sales scale in JD.COM and increase the proportion of sales. Expand new channels and products of Philips, stabilize the sales scale of new business (small household appliances brands such as BiSheng and Panasonic), continue to expand new brands and increase the sales scale and proportion of small household appliances business.

(4) Possible risks

1. Macroeconomic risks: China’s potential economic growth rate is facing certain downward pressure, and economic recovery will take some time.

Measures: Based on the country’s increased investment in new infrastructure such as 5G infrastructure, industrial Internet and data center, the company will seize the opportunity to actively expand relevant markets and customers and hedge development risks with the help of policy engines such as specialization and innovation and rural revitalization.

2. Market risk: There are market uncertainty risks in the fields of car networking and trusted (cloud) computing. Although the national industrial policy strongly supports the Internet of Vehicles, because the industry is in the initial development period and the business model is still immature, there is a risk of uncertainty in the market development. Trusted computing, as a security technology of active defense, has been recommended in equal protection 2.0, but domestic customers are not familiar with it and accept it, so it needs to be publicized and popularized patiently. The implementation of equal insurance is lower than expected, the evaluation standard is not clear, the market is in the wait-and-see stage, and there are uncertain risks in market development.

Measures: In order to avoid the above business strategic risks, the company will closely follow the industry development trend and market changes, and adjust the business strategy and corresponding strategies in a timely manner; The Internet of Vehicles will actively expand the pilot projects in domestic demonstration areas and pilot areas, actively carry out brand promotion, deepen the application of industry segmentation, expand the application fields in smart high-speed and dual-intelligence applications, and expand the industrial applications based on the Internet of Vehicles while developing the products of the Internet of Vehicles. Trusted (cloud) computing will expand its technology and products. The technology development route will be extended from X86 platform to ARM and other platforms, and its application fields will be extended from servers and switches to mobile terminals, Internet of Things terminals and gateways, and autonomous and controllable computing platforms.

3. Financial risk: The expanding business scale of the company and the industrial mergers and acquisitions carried out according to the business strategy have led to the expansion of the demand for funds, facing the risk of capital security and investment recovery.

Measures: further optimize cash flow management, further revitalize assets, and further improve the management of two funds to optimize asset structure and ensure the support of capital flow to business; Further adjust the cost of pressure reduction through organizational structure to improve the efficiency of unit expenditure; Further optimize the debt financing structure, carry out multi-channel financing and reduce the debt risk; Further strengthen the prevention of capital risks, reduce capital risks, optimize the resource allocation structure among companies in various businesses, and improve the company’s operating efficiency.

4. Management risk: The company has diversified business portfolios, different business models, rapid development and changes in technology and market, and there is a risk of mistakes in management decisions of headquarters and business units.

Measures: The company continuously optimizes the management decision-making process, improves the industrial planning and layout ability, improves the business management level of the management team, introduces professional management talents, completes the authorization management, and reduces management risks.