Xike Guanfa [2023] No.2

All relevant enterprises and institutions:

In order to better implement the Provisions of Beijing Xicheng District on Supporting the Independent Innovation of Zhongguancun Science Park Xicheng Park (No.1 of Westbound Regulation [2021]) and refine the relevant contents of the specific provisions, the Detailed Rules for the Implementation of the Provisions of Beijing Xicheng District on Supporting the Independent Innovation of Zhongguancun Science Park Xicheng Park (for Trial Implementation) (No.1 of Xike Guanfa [2023]) are hereby revised, please follow them.

Zhongguancun Science Park Xicheng Park Administrative Committee

April 10, 2023

Detailed Rules for the Implementation of Several Provisions of Xicheng District of Beijing on Supporting Independent Innovation of Zhongguancun Science Park Xicheng Park (for Trial Implementation) (2023 Revision)

In order to implement the Provisions of Beijing Xicheng District on Supporting the Independent Innovation of Zhongguancun Science Park Xicheng Park (No.1 [2021] of Westbound Regulation) (hereinafter referred to as the "Several Provisions"), these Detailed Rules are formulated.

Article 1 Scope of application

An enterprise that meets the following conditions may declare the corresponding provisions of Several Provisions:

1. Zhongguancun high-tech enterprises registered and tax registered in the administrative area of Xicheng District, which have been recognized by Beijing Science and Technology Commission and Zhongguancun Science Park Management Committee in the year of policy fulfillment, and have applied for inclusion in the statistics of Xicheng Park of Zhongguancun Science Park (hereinafter referred to as "Xicheng Park") in the year of policy declaration;

2. The science and technology enterprise incubator recognized by the Xicheng Park Management Committee of Zhongguancun Science Park (hereinafter referred to as "Xicheng Park Management Committee");

3. Enterprises registered in the administrative area of Xicheng District, settled in Beijing, China Publishing Creative Industry Park (hereinafter referred to as "Publishing Park") and jointly recognized by Beijing Press, Publication, Radio, Film and Television Bureau and Xicheng Park Management Committee.

Article 2 Support independent innovation of enterprises

I. Matching of major special funds for science and technology (Article 2 (1) of Several Provisions)

(1) Category of supporting projects

1. National projects

(1) National Natural Science Foundation projects of the Ministry of Science and Technology (hereinafter referred to as "the Ministry of Science and Technology"), major national science and technology projects, key national R&D plans, technical innovation guidance projects, technical innovation funds for small and medium-sized enterprises, key new products, "Torch" plans, and major new drug creation (including projects approved by the Ministry of Health);

(2) Industrial Internet innovation and development projects, electronic information industry development fund projects, Internet of Things, cloud computing and other emerging industries development projects of the Ministry of Industry and Information Technology (hereinafter referred to as "MIIT");

(3) The special project of the central government guiding local scientific and technological development jointly implemented by the Ministry of Science and Technology and the Ministry of Finance (the matching proportion shall be determined according to the actual contract and the level of the funding unit);

(4) Other projects that have been reviewed and identified by the leading group of Xicheng Park Management Committee.

2. Beijing municipal projects

(1) Small and medium-sized enterprises’ technological innovation funds, special projects for promoting small and medium-sized scientific and technological enterprises, scientific and technological plans, major scientific and technological projects, independent innovation projects of scientific and technological research and development institutions, high-tech achievements transformation projects, special projects for promoting scientific and technological services, and special projects for cultural and technological integration by Beijing Municipal Science and Technology Commission and Zhongguancun Science Park Management Committee (hereinafter referred to as "Municipal Science and Technology Commission"); Major high-tech achievement industrialization support fund projects, cutting-edge technology achievement transformation and industrialization projects, subversive technology research and development and achievement transformation projects, cutting-edge technology enterprise fund projects, industrial development fund projects, and young eagle talent enterprise support fund projects;

(2) Other projects that have been reviewed and identified by the leading group of Xicheng Park Management Committee.

(2) Supporting standards

State-level projects shall be matched according to the ratio of 1:1, and Beijing municipal projects shall be matched according to the ratio of 1:0.5. The total amount of supporting funds for a single project shall not exceed 1 million yuan; If the same enterprise applies for multiple projects, the total annual supporting funds shall not exceed 1.5 million yuan.

(3) Conditions for application

1. The enterprise is the subject of project declaration and implementation;

2. The declared project does not belong to fixed assets investment category, transformation category and commercial facilities supporting category;

3. If the same project is supported by multi-level project funds at the same time, it shall be supported according to the high amount of funds;

4. If the year of project establishment is inconsistent with the year of receipt of supporting funds, it shall be audited according to the year of receipt of funds;

5. If the enterprise undertakes the research and development of sub-projects, it shall provide the main task book of the project and the cooperation agreement signed with the lead unit;

6. The declared amount shall not exceed the self-raised funds of the enterprise; If the research and development expenses of the project are all supported by the national or municipal funds, they will no longer be matched.

(4) application materials

1 annual policy cash application and project matching funds summary table;

2. Obtain the relevant certification materials of national and Beijing municipal special projects and the proof that the funds are in place;

3 annual financial audit report of the enterprise;

4. Other materials related to the declaration.

II. Awards for R&D institutions established by enterprises (Article 2 (2) of Several Provisions)

(1) Award criteria

1. The State Key Laboratory and National Technology Innovation Center recognized by the Ministry of Science and Technology, the National Engineering Laboratory, the National Engineering Research Center and the National Industrial Innovation Center recognized by the National Development and Reform Commission (hereinafter referred to as the "National Development and Reform Commission"), and the National Manufacturing Innovation Center recognized by the Ministry of Industry and Information Technology will be awarded a one-time award of 1 million yuan;

2. The National Enterprise Technology Center recognized by the National Development and Reform Commission, the National Industrial Design Center recognized by the Ministry of Industry and Information Technology, the Beijing Key Laboratory recognized by the Municipal Science and Technology Commission and Zhongguancun Management Committee, the Beijing Engineering Laboratory recognized by beijing municipal commission of development and reform (hereinafter referred to as the Municipal Development and Reform Commission), the Beijing Engineering Research Center, and the Beijing Industrial Innovation Center recognized by the Beijing Economic and Information Bureau (hereinafter referred to as the Municipal Economic and Information Bureau) will be given a one-time award of 500,000 yuan;

3. Enterprise Technology Innovation Center, Beijing Design Innovation Center and Zhongguancun Frontier Technology Innovation Center recognized by the Municipal Science and Technology Commission and Zhongguancun Management Committee, and Beijing High-tech Industrial Design Center recognized by the Municipal Economic and Information Bureau will be given a one-time reward of 200,000 yuan;

4. Other qualifications that have been recognized by the leading group through the policy of Xicheng Park Management Committee.

(2) Application conditions

1. The enterprise is the subject of declaration and construction;

2. The declared qualification shall be newly acquired within the year when the policy is fulfilled;

3. If the same institution obtains multiple certifications or multi-level certifications, it will be given a one-time reward in accordance with the highest standards, without cumulative rewards.

(3) application materials

1. Application for annual policy fulfillment;

2. Summary of awards for self-built R&D institutions and introduction of R&D institutions;

3. The organization has obtained the relevant notices and announcements recognized by the State and Beijing Municipality, a copy of the project approval and a plaque photo.

Three, the enterprise award ("several provisions" second paragraph (two))

(1) Award criteria

1 won the first prize of the National Science and Technology Progress Award and above, the first prize of the National Technological Invention Award and above, and the China Patent Prize to give a one-time award of 1 million yuan;

2. Won the second prize of the National Science and Technology Progress Award, the second prize of the National Technological Invention Award and the silver prize of the China Patent Award, giving a one-time reward of 500,000 yuan;

3. Get a one-time reward of 300,000 yuan from the "Little Giant" enterprise and "Unicorn" enterprise specialized by the Ministry of Industry and Information Technology;

4. Won the China Patent Award for Excellence, the second prize of Beijing Science and Technology Award and above, the special prize of Beijing Invention Patent Award and the first prize to give a one-time reward of 200,000 yuan;

5. Received a one-time reward of 100,000 yuan from the new "Little Giant" enterprise specializing in Beijing by Beijing Economic and Information Bureau;

6. Other awards recognized by the leading group for consideration by the policy of Xicheng Park Management Committee.

(2) Application conditions

1 to declare the award should be newly obtained within the year when the policy is fulfilled. If the award year is inconsistent with the year when the certificate is issued, the time of the certificate shall prevail;

2 enterprises in the same year won multiple awards, in accordance with the highest standards to give a one-time award, not cumulative award.

(3) application materials

1 annual policy cash application and enterprise award summary table;

2. Award-winning certificates, notices and other relevant certification materials.

4. Subsidies for R&D expenses (Article 2 (3) of Several Provisions)

(1) Application conditions

1. The annual expenditure intensity of scientific and technological activities is higher than the average level of Xicheng Park;

2 enterprises in the first two years of the reporting year to continue to increase R&D expenses;

3. The amount of subsidy is calculated based on the amount of R&D expenses increased in the policy fulfillment year compared with the previous year, and is accounted for according to the proportion of 5%. If the amount is less than 100,000 yuan, no subsidy will be granted, and the maximum subsidy will be 500,000 yuan.

(2) application materials

1. Annual policy cash application form and summary table of R&D expense subsidy;

2. A special audit report on enterprise R&D investment in the first three years of the policy declaration year issued by a third-party professional organization;

3 other materials related to the declaration.

Article 3 Cultivate innovative leading enterprises

I incentives for key enterprises to settle in (Article 3 (1) of Several Provisions)

(1) Award criteria

"Unicorn", invisible champion, listed enterprise or other enterprises with significant influence or outstanding contribution after evaluation, as well as other key high-tech enterprises that meet the industrial positioning of Xicheng Park, can enjoy a one-time comprehensive contribution award in any natural year within three consecutive years since the industrial and commercial tax registration, and will be awarded a maximum of 10 million yuan after comprehensive evaluation according to the development of the enterprise in that year.

(2) application materials

1 annual policy cash application and key enterprise reward summary table;

2. "Unicorn" enterprises, invisible champion enterprises and listed enterprises must provide relevant qualification certificates;

3. Brief introduction of the enterprise;

4. Other materials related to the declaration.

Two, the national high-tech enterprise award ("several provisions" article third (two))

(1) Application conditions

1. If a national high-tech enterprise newly moved to Xicheng District in the policy fulfillment year and is within the validity period, and it is recognized as an enterprise in Xicheng District for the first time in the policy fulfillment year, and it is filed by Zhongguancun high-tech enterprise before the first quarter of the policy declaration year, it will be awarded 300,000 yuan, and the reward funds will be allocated in three years, with an annual allocation of 100,000 yuan;

2. Enterprises that have obtained the national high-tech enterprise qualification for the first time and then apply for the national high-tech enterprise certificate continuously after the expiration of the validity period can enjoy a one-time reward of 50,000 yuan if they fill in the Annual Report on the Development of High-tech Enterprises on time for three consecutive years within the validity period of the last round of qualification.

(2) application materials

1 annual policy cash application and national high-tech enterprise award summary table;

2. National High-tech Enterprise Certificate (provided by Xicheng Park Management Committee according to the high-tech enterprise identification management network of the Ministry of Science and Technology).

Three, invention patent subsidies ("several provisions" article third (three))

(1) Application conditions

1. The declared international and domestic invention patents shall be newly acquired within the year when the policy is fulfilled;

2. The reporting enterprise shall be the first applicant for the invention patent, and the invention patent obtained by the transferee shall not be subsidized;

3. Invention patents in Hong Kong and Macao are supported according to domestic invention patent standards.

(2) application materials

1 annual policy cash application and invention patent subsidy summary table;

2. The authorization certificate obtained.

Four, technical standards subsidies ("several provisions" article third (four))

(1) Application conditions

1. The declared technical standards shall be newly released within the year of policy fulfillment, and the official release time shall be subject to the standard release time announced by the standard announcement;

2 enterprises must rank in the top five in the drafting unit (except national ministries and universities);

3. Testing standards and revised standards are not supported; In principle, a series of standards are supported by one standard;

4. If the same technical standard is jointly formulated by many units (enterprises or institutions) in the park, the parties shall make a declaration after negotiating the allocation plan of the amount of support by themselves;

5. Industry standards shall be supported after being filed by the National Standards Committee;

6. The fulfillment of this clause shall be audited by Xicheng District Market Supervision Administration. (Accepting institution: Standardization Department of Xicheng District Market Supervision Administration 66503790)

(2) application materials

1 annual policy cash application and technical standard subsidy summary table;

2 "Zhongguancun Science Park Xicheng Park technical standard subsidy application form";

3. A copy of the business license of the enterprise and a copy of Zhongguancun high-tech enterprise;

4 standard official text (original), standard announcement, filing announcement (industry standard) and other relevant certification materials;

5. Other materials related to the declaration;

6. This clause shall be declared in a separate bound volume.

Article 4 Support the application of new scenarios of cutting-edge science and technology.

(1) Application conditions

1. The enterprise is the main body of project investment or research and development;

2. The original technology applied in the project should reach the international leading level or fill the gap in the domestic industry, which belongs to the global or national launch and is applied in the administrative area of Xicheng District;

3. The project construction is completed and put into use, and certain economic or social benefits are formed.

(2) application materials

1. Annual policy fulfillment application form and new scenario application project report form;

2. Brief introduction of the project (including technical originality description, intellectual property rights, talent team, technical equipment, software and hardware infrastructure, application scenarios, etc.);

3. Project investment final accounts report issued by a third-party professional organization;

4. Details of various expenditures of the project and copies of invoices;

5. Photographs of project application scenarios;

6. Description of the economic benefits or social benefits obtained by the project and relevant certification materials;

7. Other materials related to the declaration.

Fifth, promote the innovation of incubation carriers to improve quality and efficiency.

Science and technology enterprise incubation institutions (hereinafter referred to as "incubation institutions") recognized and assessed by the Xicheng Park Management Committee shall be given financial support according to the following standards.

(A) Support standards

1. According to the "Zhongguancun Science Park Xichengyuan Science and Technology Enterprise Incubator Identification and Assessment Method" and the annual assessment, the identified Xichengyuan Science and Technology Enterprise Incubator will be given financial support from the aspects of promoting regional economic development and cultivating enterprise effectiveness, and the total annual support for each incubator will not exceed 8 million yuan.

2. Support incubation institutions to guide enterprises to declare high-tech enterprises. The enterprises that were coached or introduced in that year were rewarded and supported according to the standard of 50,000 yuan for each newly added national high-tech enterprise and 20,000 yuan for each Zhongguancun high-tech enterprise.

3. Encourage incubators to settle in enterprises and increase R&D investment. More than 90% (inclusive) of high-tech enterprises have R&D investment, and the annual average R&D investment accounts for more than the average R&D investment intensity of the park, and 100,000 yuan will be awarded, and 50,000 yuan will be awarded for every 3% increase, and the total annual award will not exceed 500,000 yuan.

4. Encourage incubators to strengthen the promotion and protection of intellectual property rights of settled enterprises. For those who have obtained the authorization of domestic invention patents within the year when the enterprise policy is fulfilled, each item will be awarded to the incubator 1000 yuan; If an enterprise applies for an international invention patent through the Patent Cooperation Treaty (PCT for short) or the Paris Convention within the year when the enterprise policy is fulfilled, the incubator will be given a reward of 2,000 yuan for each item, and the application for a single patent in six countries will be rewarded at most. The total annual reward shall not exceed 500,000 yuan.

5. Encourage incubators to cultivate and introduce high-tech enterprises such as listed enterprises, unicorn enterprises and invisible champions, and reward each new one according to the standard of 500,000 yuan.

6. Support incubation institutions to strengthen their own construction. The state-level and Beijing-level science and technology business incubators newly recognized in the year of policy fulfillment will be given a one-time reward of 500,000 yuan and 200,000 yuan respectively.

(2) application materials

1. An application for the annual support fund of the incubator;

2. Annual work summary of incubation institutions;

3 incubator annual support fund application summary table and related certification materials;

4. A summary of the annual presence of incubation institutions in enterprises and relevant certification materials.

Article 6 Enhance the brand influence of characteristic industries

I. Matching of special funds for publishing design (Article 6 (1) of Several Provisions)

(1) Category of supporting projects

1. Publishing special projects

(1) National cultural industry development project, national cultural innovation project, national cultural science and technology promotion plan, national publishing fund, "Motive Force" China original animation publishing support plan, and China national original online game publishing project;

(2) Various special funds of Beijing Press, Publication, Radio, Film and Television Bureau;

(3) Other projects that have been considered by the leading group of Xicheng Park Management Committee.

2. Design projects

(1) Beijing Industrial Design Promotion Project and Capital Design Promotion Plan of the Municipal Science and Technology Commission and Zhongguancun Management Committee;

(2) Other projects that have been considered by the leading group of Xicheng Park Management Committee.

(2) Supporting standards

Give matching funds support according to the ratio of 1:0.5 of the funds obtained; If the same enterprise applies for multiple projects, the total annual supporting funds shall not exceed 1 million yuan.

(3) Conditions for application

1. The enterprise is the subject of project declaration and implementation;

2. Enterprises settled in the publishing park can declare special funds for publishing;

3. If the same project is supported by multi-level project funds at the same time, it shall be supported according to the high amount of funds;

4. If the year of project establishment is inconsistent with the year of receipt of supporting funds, it shall be audited according to the year of receipt of funds;

5. If the enterprise undertakes the research and development of sub-projects, it shall provide the main task book of the project and the cooperation agreement signed with the lead unit;

6. The declared amount shall not exceed the self-raised funds of the enterprise; If the expenses are all supported by national or municipal funds, they will not be matched.

(4) application materials

1. Annual policy cash application form and summary table of supporting funds for publishing and design projects;

2. Obtain the relevant certification materials of national and Beijing municipal special projects and the proof that the funds are in place;

3 annual financial audit report of the enterprise;

4. Other materials related to the declaration.

Two, publishing design awards ("several provisions" article sixth (two))

(1) Award criteria

1. Publishing awards

(1) Won the "Five One Projects" Award and the "World’s Most Beautiful Book Award" for spiritual civilization construction in Publicity Department of the Communist Party of China, giving a one-time award of 1 million yuan;

(2) Won the "China Publishing Government Award", "Three Hundred Original Publishing Projects" and "China Excellent Publications Award", giving a one-time reward of 500,000 yuan;

(3) Won the Tao Fen Publishing Award, Mao Dun Literature Award, Lu Xun Literature Award and Bing Xin Literature Award with a one-time reward of 200,000 yuan;

(4) Won the "50 Popular Books", "Wenjin Book Award", "National Excellent Children’s Literature Award" and "Animation Award of China Culture and Art Government Award", as well as being selected into the "Double Hundred Books Publishing Project of Socialist Core Value System Construction" and "National Animation Quality Project" and given a one-time award of 100,000 yuan;

(5) Other awards shall be implemented after being reviewed by the policy cash leading group of Xicheng Park Management Committee.

2. Design awards

(1) A one-time award of 200,000 yuan was given to the winner of the German Red Dot Award, the German IF Award and the American IDEA Award;

(2) A one-time award of 100,000 yuan was given to the Red Dot Award and Red Dot Star Award in Germany, IF Design Award in Germany, Silver Award in American IDEA Award, Outstanding Industrial Design Award in China, and Red Star Award (silver award and above) in China for innovative design;

(3) Other awards shall be implemented after being reviewed by the policy cash leading group of Xicheng Park Management Committee.

(2) Application conditions

1. The enterprise is the main body of planning, publishing and distributing works;

2. The above awards do not include individual awards and nomination awards;

3. Enterprises settled in the publishing park can declare publishing awards;

4. The declared awards should be newly obtained in the year when the policy is fulfilled;

5. If an enterprise has won multiple awards in the same year, it will be given a one-time award in accordance with the highest standards, and there will be no cumulative award.

(3) application materials

1. Annual policy cash application form and summary table of awards for publication and design;

2. Award-winning certificates, notices and other relevant certification materials.

III. Subsidies for copyright development (Article 6 (3) of Several Provisions)

(1) Application conditions

1. The enterprise is the main body of planning, publishing, distributing or investing in works, and the main body of submitting and examining film and television and game works;

2. Enterprises settled in the publishing park can declare this clause;

3. The declared works should be newly published within the year of policy fulfillment;

4. For the works for which the copyright fee is paid in the form of sales volume sharing, the payment time for the copyright signing fee of the works by the enterprise may be extended to June 30th of the policy declaration year, and the total time span of subsidy shall not exceed one full year;

5. Different works developed with the same copyright shall be rewarded according to the highest standards, and there shall be no cumulative rewards;

6. If an enterprise develops and produces high-quality audio books with its own copyright, it will be supported according to the total investment of product publishing and distribution (copyright signing fee+production fee): if the cost is 100,000 yuan (inclusive)-300,000 yuan, each work will be subsidized by 10,000 yuan; 300,000 yuan (inclusive)-500,000 yuan, each work will be subsidized by 20,000 yuan; More than 500,000 yuan (inclusive), each work will be subsidized by 30,000 yuan;

7. Enterprises applying for copyright signing fee subsidies need to be confirmed by the publishing platform of the publishing park.

(2) application materials

1 annual policy cash application and copyright development subsidy summary table;

2. Relevant certification materials such as publication, distribution and submission for trial;

3. Proof materials such as copyright signing contracts, agreements and payment invoices;

4. Other materials related to the declaration.

Four, special talent award ("several provisions" article sixth (four))

(1) Award criteria

1. A one-time reward of 500,000 yuan will be given to those who are selected as the leading talents in the national press and publication industry, national cultural masters and "four batches" of talents;

2. Those who are selected into the "Four Groups" talents of Beijing’s propaganda and cultural system and the "Hundred Talents Project" of Beijing’s publishing talents will be given a one-time reward of 200,000 yuan.

(2) Application conditions

1. The declared award should be newly obtained in the year when the policy is fulfilled;

2 enterprises settled in the publishing park can declare the title award of publishing talents;

3. Talents who have won the title shall, in principle, have worked in park enterprises (reporting enterprises) for three years; If it is less than three years, it will not cash the reward funds temporarily, and then apply for cash after three years;

4. If the same person has won multiple titles, he will be rewarded or make up the difference according to the highest single standard;

5. The reporting subject of this clause is the enterprise where the qualified personnel are located.

(3) application materials

1 annual policy cash application and special talent award summary table;

2. An application signed by the talent himself and stamped with the official seal of the enterprise;

3. A copy of the ID card signed by the talent himself;

4. Certification materials for obtaining the title of talent;

5. Personal tax records of Beijing in the first two years of talents;

6. The social security payment certificate of the enterprise where the talent is located in the first two years;

7. A copy of the labor contract signed by the talent and the enterprise for not less than three years;

8. Other materials related to the declaration.

V. Special Policy Support for Digital Economy (Paragraph (5) of Article 6 of Several Provisions)

In accordance with the "Several Provisions on Accelerating the Development of Digital Economy in Xicheng District of Beijing (Trial)" (Westbound Regulation [2020] No.1).

(Accepting institution: Beijing Xicheng District Bureau of Science, Technology and Information Technology 83976217)

Article 7 Optimize services in technology and finance.

I. Loan discount (Article 7 (1) of Several Provisions)

(1) Application conditions

1. Enterprises are the main body of loans, and personal loans are not supported;

2. The actual term of the loan is not less than three months and not more than twenty-four months;

3. The principal and interest of the loan should be completed before December 31st of the policy fulfillment year. Loans that have not completed the repayment of principal and interest will be included in the next year to give support;

4. If the loan is overdue due to the enterprise’s own reasons, no discount will be given; If the enterprise loan is compensated, it will no longer enjoy the support of loan discount within three years.

(2) application materials

1 annual policy cash application and loan discount subsidy summary table;

2. A copy of the loan contract signed between the enterprise and the bank and the loan certificate; It is the first time for an enterprise to obtain a loan, and it is also necessary to provide relevant certificates for the first loan;

3. Copies of relevant bills for repayment of principal and interest of enterprise loans;

4. Other materials related to the declaration.

II. Special Policy Support for Listing (Article 7 (3) of Several Provisions)

It is implemented in accordance with the Measures of Beijing Xicheng District for Encouraging and Supporting Enterprises to Go Public (Westbound Regulation [2018] No.4).

(Accepting institution: Beijing Financial Street Service Bureau 66025302)

Article 8 Encourage innovative and entrepreneurial talents.

I. Title Award for Innovative and Entrepreneurial Talents (Article 8 (1) of Several Provisions)

(1) Award criteria

1 selected "national special support plan for high-level talents" (hereinafter referred to as "national special support plan") outstanding talents with the same category of national talents, giving a one-time reward of 1 million yuan;

2 selected "national special support plan" leading talents, "Zhongguancun high-end leading talents" equivalent category of municipal talents, giving a one-time reward of 500 thousand yuan;

3. A one-time reward of 300,000 yuan will be given to those who are selected as top-notch young talents in the National "Hundred Million Talents Project" and "National Special Support Program", outstanding talents or leading talents in the Beijing High-level Talents Innovation and Entrepreneurship Support Program (hereinafter referred to as the "Hi-Tech Plan"), "Science and Technology Beijing Top 100 Talents Training Project" and "Capital Outstanding Talents Award";

4. Those who are selected as Beijing scholars, young Beijing scholars, "outstanding scientific, technical and management talents in Beijing", outstanding young talents in Beijing, and top-notch young talents in Beijing’s "Hundred Million Talents Project" and "Innovation Plan" will be given a one-time reward of 100,000 yuan.

(2) Application conditions

1. The title of talent should be newly acquired in the year of policy fulfillment;

2. Talents who have won the title shall, in principle, have worked in park enterprises (reporting enterprises) for three years; If it is less than three years, it will not cash the reward funds temporarily, and then apply for cash after three years;

3. If the same person has won multiple titles, he will be rewarded or make up the difference according to the highest single standard;

4. The reporting subject of this clause is the enterprise where the qualified personnel are located.

(3) application materials

1 annual policy cash application and innovation and entrepreneurship talent reward summary table;

2. An application signed by the talent himself and stamped with the official seal of the enterprise;

3. A copy of the ID card signed by the talent himself;

4. Certification materials for obtaining the title of talent;

5. Personal tax records of Beijing in the first two years of talents;

6. The social security payment certificate of the enterprise where the talent is located in the first two years;

7. A copy of the labor contract signed by the talent and the enterprise for not less than three years;

8. Other materials related to the declaration.

Two, talent housing subsidies ("several provisions" article eighth (two))

(1) Application conditions

1. If the annual comprehensive contribution of the enterprise policy reaches 2 million yuan (inclusive), this clause can be declared;

2. Enterprises must rent housing for talents and pay the rent within the year when the policy is fulfilled; Subsidies will be given according to 50% of the actual payment amount, with a maximum subsidy of 300,000 yuan for each enterprise;

3. The rental housing object should be the senior management personnel and core technical backbone personnel of the enterprise;

4. Talent apartments provided by Xicheng District Government do not enjoy the support of this clause.

(2) application materials

1 annual policy cash application and talent housing subsidy summary table;

2. The rental contract, a copy of the rental invoice and the proof of the actual payment of the rent transfer (the complete internal examination and approval procedures must be provided for the rental in the form of enterprise reimbursement after individual leasing);

3. Brief introduction of the actual residents of the enterprise talent housing, a copy of the ID card signed by me, the labor contract, the annual social security payment certificate and the personal tax payment record of Beijing;

4. Other materials related to the declaration.

Article 9 Promote international exchanges and cooperation.

I. Supporting international exchange and cooperation projects (Article 9 (1) of Several Provisions)

(1) Category of supporting projects

Various international exchange and cooperation projects, international development projects and "going out" projects initiated by the Ministry of Science and Technology, the Ministry of Industry and Information Technology, the Municipal Science and Technology Commission, the Zhongguancun Management Committee, the Municipal Bureau of Economic and Information, and the Municipal Bureau of Press, Publication, Radio, Film and Television and supported by special funds; Zhongguancun International Innovation Resources Support Fund Project.

(2) Application conditions

1. The enterprise is the subject of project declaration and implementation;

2. The declared project does not belong to fixed assets investment category, transformation category and commercial facilities supporting category;

3. If the same project is supported by multi-level project funds at the same time, it shall be supported according to the high amount of funds;

4. If the year of project establishment is inconsistent with the year of receipt of supporting funds, it shall be audited according to the year of receipt of funds;

5. If the enterprise undertakes the research and development of sub-projects, it shall provide the main task book of the project and the cooperation agreement signed with the lead unit;

6. The declared amount shall not exceed the self-raised funds of the enterprise; If the expenses are all supported by the national or municipal funds, they will no longer be supported.

(3) application materials

1. Annual policy fulfillment application form and summary table of matching funds for international exchange and cooperation projects;

2. Obtain the relevant certification materials of national and Beijing municipal special projects and the proof that the funds are in place;

3 annual financial audit report of the enterprise;

4. Other materials related to the declaration.

Two, multinational institutions to support special policies ("several provisions" article ninth (two))

In accordance with the relevant special policies issued by Xicheng District Government.

Article 10 Supplementary Provisions

I. Work flow

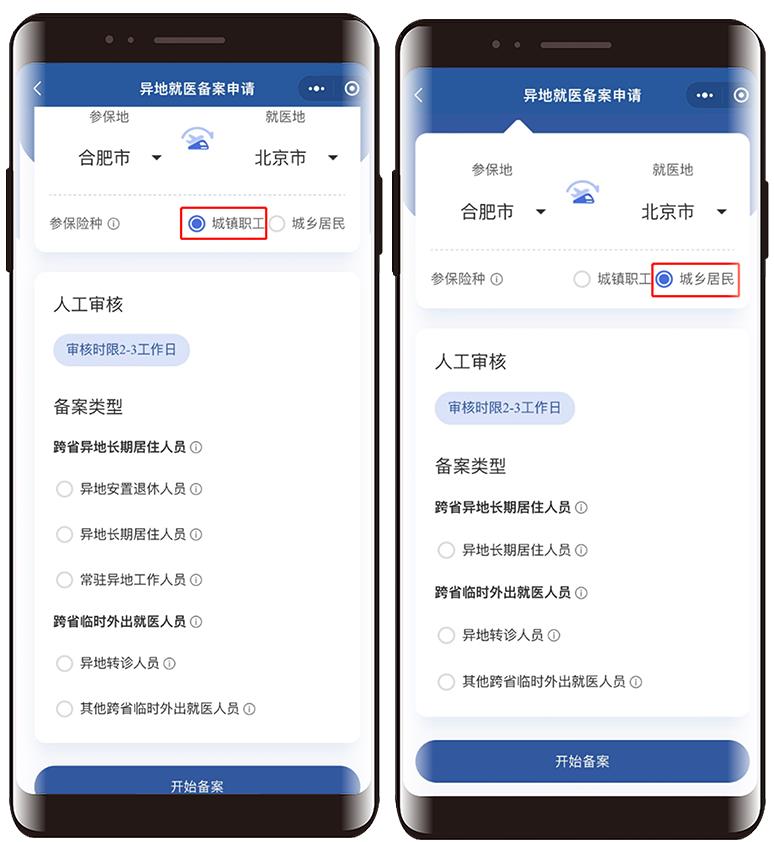

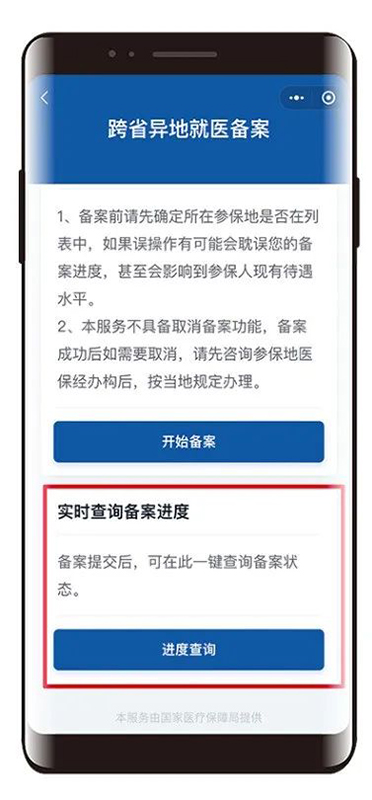

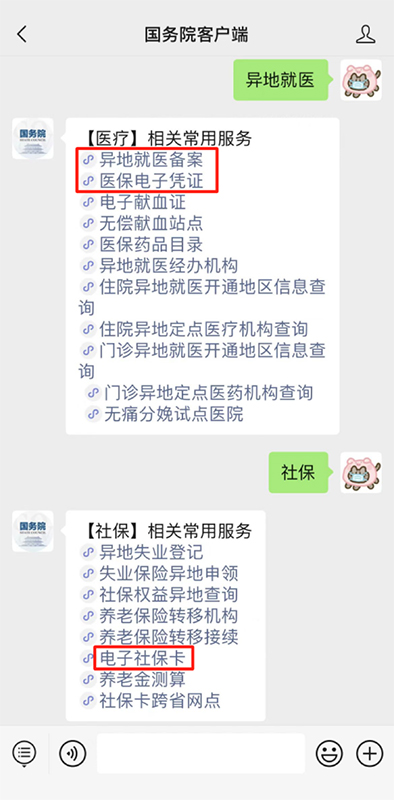

(1) The Xicheng Park Management Committee issues an annual policy declaration notice on the website of Xicheng District Government and WeChat WeChat official account, and enterprises declare various support clauses on Zhongguancun Xicheng Park’s independent innovation declaration system and upload various policy application materials;

(two) after the first trial, the enterprise shall submit the annual policy paper application materials to the Xicheng Park Management Committee within the prescribed time limit for acceptance, and it will not be accepted within the time limit;

(3) The declared projects with complete materials shall be considered step by step by organizing the joint deliberation of relevant departments, the deliberation of directors and working committees of Xicheng Park Management Committee, the special meeting of Xicheng District People’s Government, and the deliberation of the Standing Committee of the District Committee;

(four) the results of the examination and approval shall be publicized on the website of Xicheng District Government for 5 working days, and those that fail to pass the examination will not be notified separately;

(5) Allocating funds according to the results of deliberation and publicity;

Second, the relevant requirements

(1) Enterprises that have obtained the support of policy funds shall conduct accounting treatment according to the relevant national accounting system, separately account for the special funds, use them for special purposes, accept the supervision, inspection and audit of relevant district departments, and actively cooperate with the Xicheng Park Management Committee to carry out relevant work.

(2) If an enterprise applies for other policies of Xicheng District Government for the same project and the same matter at the same time, it shall be supported according to the principle of preferential treatment; If you have obtained other policy funds of the same type in Xicheng District when applying for this provision, you will not repeat the support.

(three) to cancel the policy qualification of enterprises that provide untrue materials, and the undistributed support funds will no longer be allocated, and the allocated support funds will be recovered, and they may not apply again within two years; If the circumstances are particularly serious, they shall be handed over to judicial organs for handling.

(four) before the actual disbursement of support funds, if it is found that the enterprise has illegal operations and is included in the list of untrustworthy people, it will no longer be supported.

(five) the total amount of funds obtained from all the terms of the enterprise’s annual application (except Article 3 (1) (2) and Article 5) shall not exceed 50% of the comprehensive contribution of the enterprise’s annual policy.

Iii. Requirements for application materials

1. The application for annual policy fulfillment and the summary table of various terms in paper materials (automatically generated by the online declaration system) shall be stamped with the official seal;

2. Paper materials are in duplicate, formally bound into a book, and the cover and riding seam are stamped with official seals. The summary table and certification materials required for each clause are separated in the order listed in the application. Among them, the application materials for technical standard subsidies in Article 3 (4) are bound separately.

These Rules shall be implemented as of the date of promulgation. The Detailed Rules for the Implementation of Several Provisions of Xicheng District of Beijing on Supporting the Independent Innovation of Zhongguancun Science Park Xicheng Park (for Trial Implementation) (Xike Guanfa [2023] No.1) shall be abolished at the same time. Support standards from 2022 onwards shall be implemented in accordance with these detailed rules.

Note: 1. Year of policy fulfillment: the year when enterprises get support to carry out scientific and technological innovation.

2. Policy declaration year: the year when the organization conducts policy declaration.