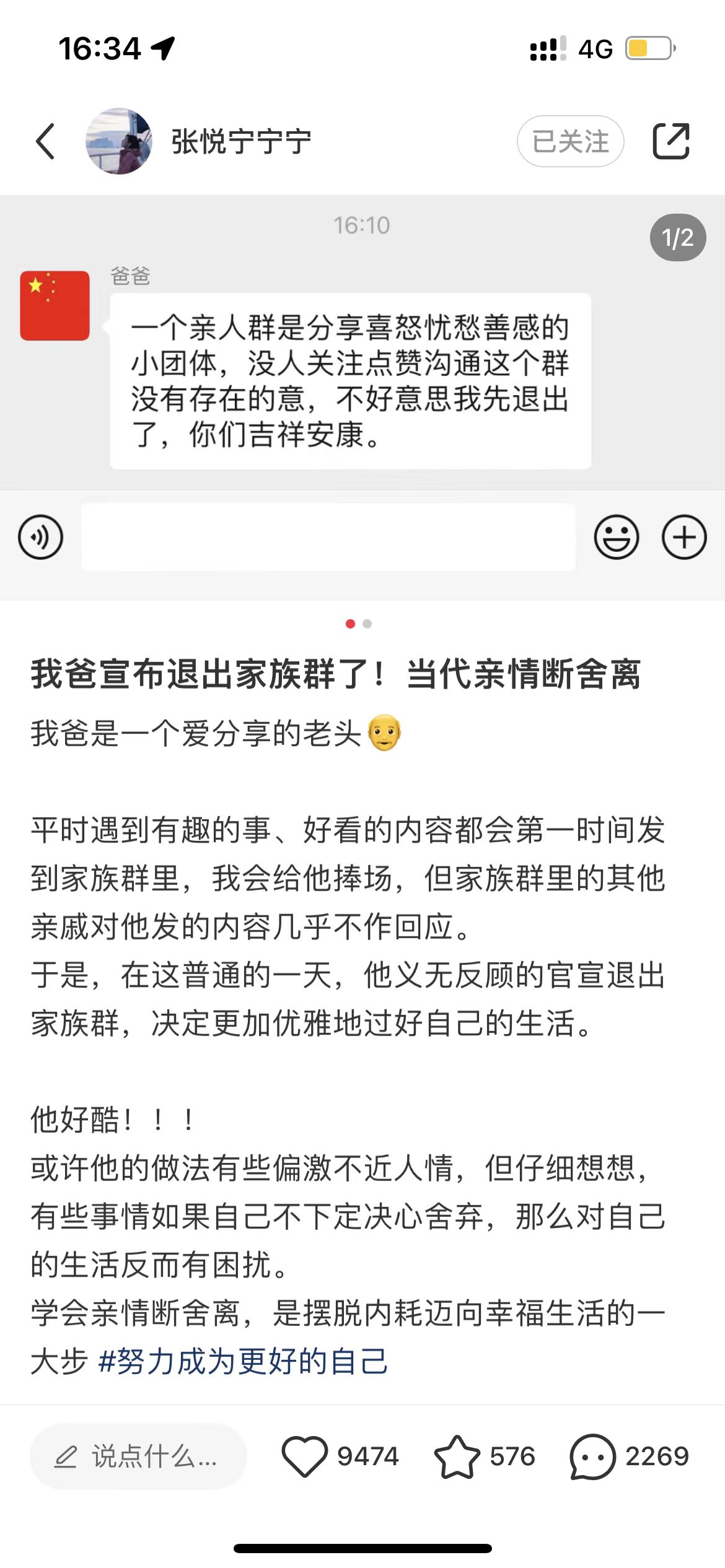

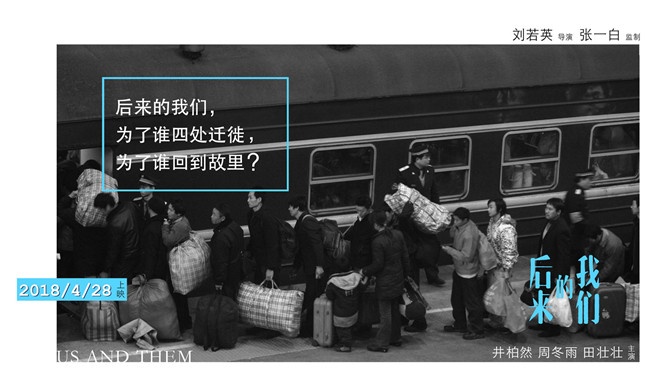

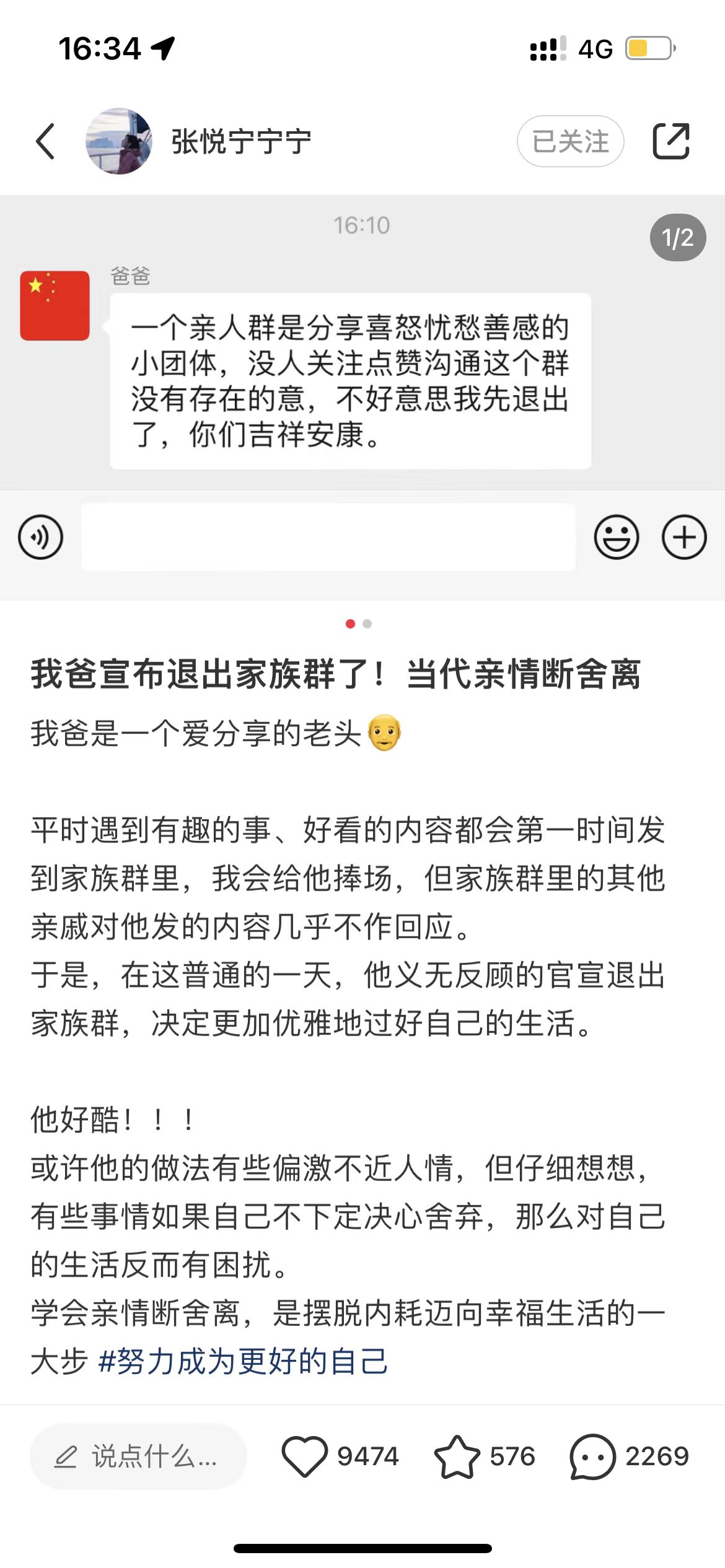

A few days ago, a topic of "My father retired from the family group because no one responded to sharing" attracted public attention and boarded a hot search.

In Weibo Middle School, the blogger "@ Zack Zhang Ningningning" shared his father’s story, "My father announced his withdrawal from the family group! Contemporary family ties are broken. " The screenshot of the chat shows that Zhang Dad shares his daily life in a family group of 8 people — — I’ve been drinking for 28 years. But after a day, only my daughter replied.

The next afternoon, Dad Zhang sent a message: A family member is a small group that shares emotions, sorrows and feelings. No one pays attention to praise communication. This group has no meaning. Subsequently, he withdrew from the group chat.

This Weibo has aroused the emotional resonance of many netizens, and many netizens said that they had similar situations and experiences. "Even if you don’t respond to the sharing link, it is normal to want to quit the group if you share your life seriously but have never responded." A netizen said.

On April 28, the Red Star journalist contacted this party, Zhang Dad. He told reporters, "This group was probably established around 2015. It was still very lively when it was first built. After 2019, it gradually cooled down. Sometimes I didn’t respond when I sent a message. I really felt a little lost."

▲ The blogger "@ Zack Zhang Ningningning" shared the story of his father quitting the family group.

-1-

"Dad left the family group."

Dialogue I: I feel a little lost after quitting the group, but I also feel unprecedented relaxation.

Dad Zhang is 53 years old and lives in Baotou, Inner Mongolia. He is engaged in management. The family group that appeared in Weibo was founded by his brother-in-law in about 2015. "There are three families in the group, my wife, my brother and sister. We have a very good relationship in real life and often make phone calls and voice calls. Later, family groups were established with the aim of strengthening their ties and facilitating communication. "

For him, the most lively time in the group was three years after the group was founded. "At that time, people would chat interactively every day, say good morning to each other in the morning, and share their work and life today, so I think it is a good way to build a family group." Dad Zhang said.

After the excitement, it was silent. I don’t know when, most of the relatives in the group are in a state of "diving".

Dad Zhang said: "In the past, my wife often sent some anti-fraud videos to recommend to everyone, but after 2019, the group suddenly became deserted, and few people sent messages. We shared interesting things and good-looking content, except for my daughter. Few people replied."

"I sent a message in the group, and I will definitely look forward to everyone’s response. In my opinion, this is the meaning of family groups. If I sincerely share it but no one replies, my heart will definitely be lost, not to mention the content we share is more meaningful. " Last Sunday, Dad Zhang shared a tweet in the group that "the public security department shot 17 anti-fraud videos in half a year to accurately expose fraud tricks" and expressed the hope that everyone would take the time to watch the videos to prevent fraud. However, after posting this tweet, no one replied. "I was really sad to open the group chat many times but found no reply." Until April 25, a similar situation appeared again, when he chose to quit the group in a rage.

▲ Last Sunday, Zhang Dad shared an anti-fraud tweet in the group but no one responded.

However, Dad Zhang also expressed his understanding of the "coldness" of the family group. "After quitting the group, some relatives talked to me privately to explain, saying that they were really busy, so they didn’t respond. Now everyone’s work pressure is relatively high, relatives and children of the same generation are very busy at work, and everyone is drifting away because of differences in life, work and experience. "

Dad Zhang said frankly: "After quitting the group, I feel more lost in my heart, and at the same time I feel more relaxed than ever, because I don’t have to stare at the group chat all the time and care about whether someone replies to me." In this regard, Dad Zhang said that after leaving the group, he will also use other ways to maintain his feelings with his family. "Our emotional foundation is still there, but in the future, it will be more point-to-point contact, such as talking privately with his brother-in-law, which will not affect the work and life of others."

-2-

Is your family group still lively?

Reporter’s investigation: "lively" is getting farther and farther, and "cold and cheerless" is more common

With the rapid development of the Internet and social platforms, a number of WeChat groups based on kinship have been established. In 2018, a survey of 2005 respondents conducted by China Youth Daily Social Survey Center showed that 93.8% of the respondents joined the family WeChat group.

Red Star journalists interviewed 10 Chengdu citizens randomly on the street, among which 8 citizens joined the family group and 2 did not, while 8 citizens who joined the family WeChat group all said that "there is little chat in the group except red envelopes" and "chatting only when something happens, and it is usually very deserted". Ms. Chen, a 27-year-old citizen, told reporters, "I have nothing in common with them (relatives in the family group). I have a young group, all of whom are little sisters. I like to chat with them."

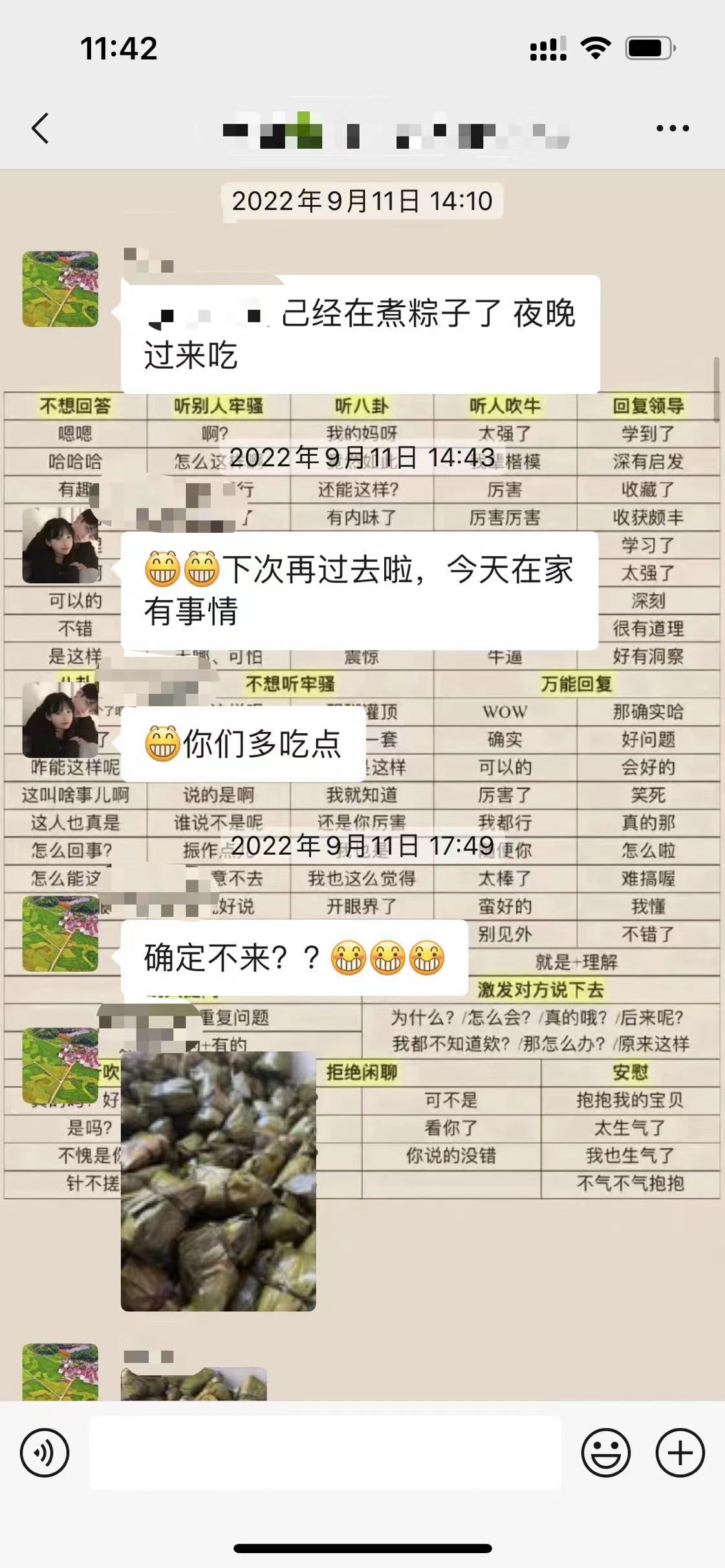

"Zhang Dad quit the group" caused emotional resonance among many netizens, while many netizens commented that they had similar situations and experiences. "The reporter browsed related topics and found that the family group chat shared by netizens includes but is not limited to these characteristics: the family group with one family as the unit has a high chat frequency, and the group with multiple families often has a low chat frequency; Older people chat more, younger people chat less, and younger people often play the role of echoing and cheering; The content of chatting in the family group is mainly rumors, anti-fraud videos and "chicken soup for the soul".

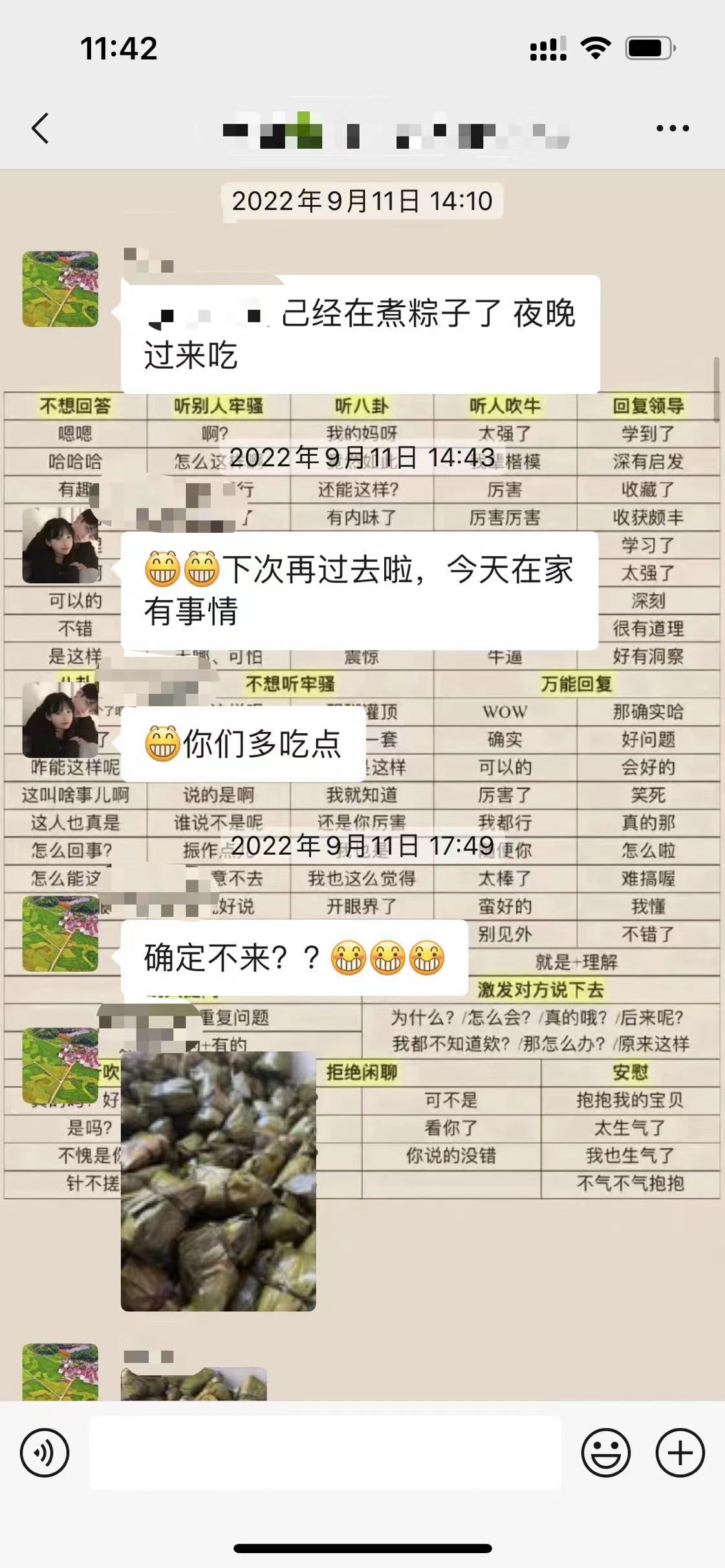

▲ Netizens said that the chat content in the family group is mainly based on rumors, anti-fraud videos and "chicken soup for the soul".

At the same time, netizens also commented on many reasons why they don’t chat in family groups. Some people say that dealing with work every day is already a headache, and I really don’t want to reply in the family group after work; Some people say that the title party’s health knowledge and international events shared by the elderly in the group make people have no desire to reply; Some people also say that they are simply not good at expressing themselves and don’t want to speak in family groups, but their relationship with relatives and friends in real life is still very good … …

▲ User comments

Wechat family group has built a family cultural space in social media, but in fact, more and more people find that family group is not as "lively" as expected, and it has not achieved the expected function of providing contact and interaction platform for relatives in different living spaces.

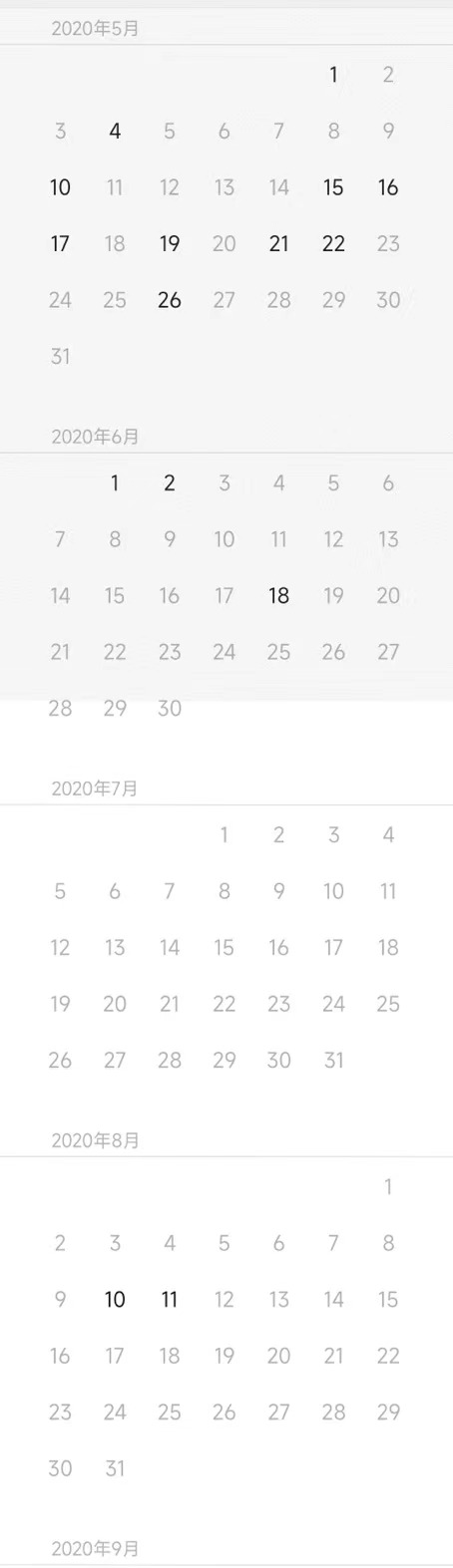

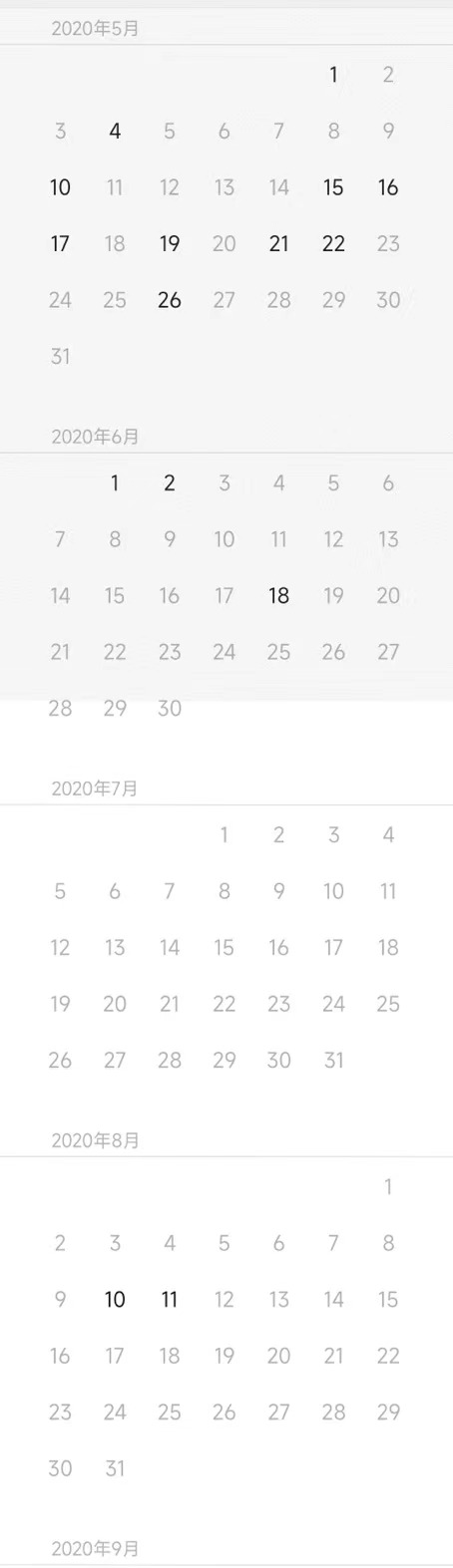

Similar to Zhang’s father’s experience, Zhang Chenchen, who was born in Shandong in 1996, showed reporters a screenshot of the date of a family group’s chat. Her family group only had people chatting for a few days every month, and the last chat was on February 26th, 2021, and the news record stayed on the content of her aunt @ her mother’s dinner.

▲ Family group chat shared by Zhang Chenchen.

"Before 2019, the link between us and my uncle’s family was weak and the relationship was not good. Later, I thought that there was still a place where we could talk together, so I built a family group." Zhang Chenchen said that at first, families would often share their lives, send out red envelopes and take photos in groups, and sometimes they would have dinner through family groups, but the excitement would only last until May 2020.

In Gao Cen’s thirties, family group is just a "cyber space" for Chinese New Year entertainment. "There are 25 people in the group (our family). The news is generally concentrated in the few days of the New Year, sending red envelopes and sending New Year videos. Sometimes there are dozens of messages a day, which is particularly lively." But usually, "cold and cheerless" is more of a state.

▲ The family group chat records shared by Gao Cen, the news is generally concentrated in the days of the New Year.

Gao Cen is also reluctant to send messages in the group at ordinary times. "I’m very busy at work, and I’m already very tired during the day. When I go home at night, I sometimes see messages from my uncles, all of which are about grabbing tickets and preventing fraud. I can only reply ‘ Roger that ’ I don’t know what else to talk about. Moreover, when I came out to work, to tell the truth, I rarely thought of my relatives in my hometown. It is impossible to chat on my own initiative, and there are few common topics. If we don’t reply, the elders will rarely send messages. "

For her, she doesn’t expect to gain emotional value in the family group, and her daily emotional sharing has another way. "I prefer to chat with friends and girlfriends. There are many topics. Every day in the group, the news is ‘ 99+’ . Many people in the family group are elders. They don’t use WeChat very much. If there is an urgent need to contact, they will call directly. "

Among the interviewees interviewed by Red Star journalists, the phenomenon of "cold and cheerless" of family groups is almost common. After the initial "hot period" of building groups, most groups will gradually cool down, and their speeches and discussions will gradually decrease, and even eventually become silent.

"This may have something to do with the harmony and personality of family members." Respondent Xiao Bai is a cheerful person. In her family, most of her relatives are lively people. "Everyone loves to express and communicate, and they usually walk close. As long as one person speaks in the group, everyone will come out soon. Of course, there are quite a lot of friends around me, and the family group is very weak. "

▲ User comments

-3-

"I feel that the relationship is getting farther away."

The Spread of "Weak Relationship" Offline in the Network

Watching the family group cool down, Zhang Chenchen felt that it was inevitable that the family group would become cold and cheerless. "The original intention of building a group is to enhance mutual affection. Later, we found that there are still many contradictions in life, and the family will be indifferent, so we can’t use WeChat group ‘ Repair ’ Even chatting is just superficial, so this group is gradually falling apart, and I completely forgot it. "

For Zhang Shu in Guilin, Guangxi, the "showing off" and "comparing" of relatives in the group from time to time has become an important reason for him to "shield" his family group. "Because the uncle’s family is superior, he often shows off what kind of good job his son has found in the group, more than money and children. Sometimes we don’t know how to reply to him, and occasionally mentioning our own affairs will be strongly taught by him, so junior students generally don’t speak in the group."

Zhang Shu said that if it weren’t for the dissuasion of his family, he might have retired from the group long ago. In their view, everyone is a relative. "Don’t be too embarrassed."

▲ Family group chat records shared by Zhang Shu.

The reporter found that in these two family groups, the WeChat family group was expected to "repair the relationship". However, in real life, the differences in values between families and trivial life contradictions led to the alienation of family relationships, and the family group, as an extension of family relationships, was gradually deserted.

Work group, classmate group, meal partner group … … Family group seems to be submerged in the waves of WeChat group chat, which has become the one that is ignored, but in fact, family group provides a convenient and fast communication platform for relatives far away from the ends of the earth and acts as a network link to contact family.

Duan Wenjie, vice president of Chengdu Association for the Promotion of Barrier-free Environment and professor of the Department of Social Work of East China University of Science and Technology, told the reporter that relatives rarely communicate in family groups. From the perspective of sociology, this phenomenon actually reflects the dispersion of the strong and weak relationship formed between people from the real society to the network society.

"Specifically, in the real society, due to the long distance between many family members and the lack of intersection in daily life, family feelings are relatively distant and intimacy is insufficient, which is the so-called ‘ A distant relative is better than a close neighbor ’ When encountering difficulties, family members who are far apart cannot provide timely help or provide opportunities for interaction. "

▲ Netizens said that family groups with their own families have a high frequency of chatting.

Duan Wenjie said that this has also become one of the reasons for the formation of weak relationships among family members. "Even if the spatial distance can be narrowed on the Internet, the emotional distance still exists, and it is often shared in the group but no one responds. In fact, it is the spread of weak relationships in the real society in the network."

"Although there are many family groups today, it is very deserted within the group. This phenomenon reflects that with the rapid development of modern society and the explosion of information in the Internet age, everyone’s cognitive level is highly diversified and stratified. Therefore, even in their own family circle, many people still feel ‘ We can’t talk together ’ 。” Analysis of Zhang Chengfeng, a senior family lawyer of Sichuan Mingju Law Firm.

In her view, the family is the epitome of society, and the "stratification" in the family is mainly manifested in the following aspects.

"The first is the diversification of wealth levels. For example, a family may include the middle class, high net worth people and ordinary people, and the span is very large. Due to the great gap between living habits and cognition caused by family economic conditions, it is also difficult to avoid misunderstandings. For example, ordinary life sharing may be considered as showing off. " Zhang Chengfeng said.

"At the same time, because everyone’s growth environment, educational background and professional background are different, they all live in their own circles and form different living habits, behavior patterns and language communication systems. These factors have cast a natural ‘ Barrier ’ 。” According to Zhang Chengfeng, the complexity of this gap on the cognitive level is far greater than others. For example, some people pay attention to the short and trivial parents, while others are more concerned about the international situation. "I don’t care about what you care about, and you don’t care about what I care about. The topics and hobbies between each other are very different, and slowly they become speechless."

-4-

How to warm up family relationships?

Expert: We can start with discussing common topics, family memory and providing emotional support.

So how to use the Internet as a "sharp weapon" to enhance the affection between relatives? Zhang Chengfeng said that improvements can be made in the following aspects.

"In the face of family affection, we can give full play to our subjective initiative and actively promote and discuss common family issues, such as providing for the elderly, the marriage of the younger generation, family dinners on holidays, etc., to improve the frequency of communication between relatives."

She took Zhang Shu, Guilin, Guangxi as an example to analyze. Uncle Zhang Shu’s superior family background and showing off and comparing in the group from time to time made him feel uncomfortable, so this family group was not lively. "But a family group is made up of many people. If the affection is indifferent, the reason is that the two sides have not managed a good relationship together. At this time, what we have to do is to understand, tolerate and accept, actively promote the emotional link between each other, and at the same time promote the development of family relations in a more benign direction. "

At the same time, she also stressed that we should not expect too much from family groups. "We need to uphold ‘ Seeking common ground while reserving differences ’ Attitude. Despite the natural link of blood relationship, it is actually very difficult for two people in the family to achieve a high degree of spiritual harmony and nourish each other. Therefore, it is necessary for relatives to talk more about common topics and reduce or avoid conflicts caused by different opinions and viewpoints. "

In Duan Wenjie’s view, the "weak relationship" between family members can be transformed into "strong relationship" by adopting different forms, enhancing the frequency of interaction with family members, strengthening emotional ties, increasing intimacy and increasing interest exchange.

"For example, sharing valuable content in a family group, discussing topics that can involve other group members, and participating in some interactive games or activities together can enhance the frequency of interaction with family members." Duan Wenjie emphasized that we can also discuss common memories, share the living conditions of the elderly at home, actively respond to others’ sharing, positively praise and comment on family members’ circle of friends, video chat, etc., which can strengthen emotional ties and intimacy.

On the other hand, we can also take the initiative to understand the daily life of family members, understand their troubles and difficulties and provide help as much as we can, which is helpful to establish mutually beneficial family relations.

"Of course, we can also learn some communication skills to promote communication with family members and provide good emotional and social support for each other." In conclusion, Duan Wenjie believes that under the joint management of family members, we can make full use of the channel of Internet and the platform of WeChat family group, and turn the "cold and distant weak relationship" into a "warm and loving strong relationship".

In the eyes of Fan Ping, a researcher at the Institute of Sociology of China Academy of Social Sciences, family groups are actually "blood groups", not necessarily "common life groups" or "interest groups", so the sense of link between them will be weak.

"If you want to promote the close connection between family groups, living together is the key. In addition to the ties of consanguinity, families can also establish corresponding social ties besides consanguinity, such as taking care of each other at work and generating economic ties, as the saying goes ‘ Eat in a pot ’ 。” At the same time, we need to pay attention to the scale boundary between family relationship and personal life. Too close family relationship may also bring some "sweet" burdens.

Red Star journalist Du Yuquan and Lu Jiayu