On-site inspection! Yanziji will start shooting this homestead next month, and there is no rough price limit.

On Monday, Nanjing Land Market Network released the third batch of centralized land supply this year. 46 plots are distributed in various popular plates in Nanjing, and one plot in Yanziji New Town in the north of the city will be sold.

This earth auction is somewhat different from the previous one, and the setting of blank price limit has been cancelled. This earth auction will also start shooting on the 19th of next month.

Before the shooting, we also went to Yanziji New Town, a plot, and made a real exploration of the location and surrounding environment of the plot.

Shooting starts next month, and there is no price limit for blanks.

Hang another pure homestead in Yanziji New Town.

NO.2022G83 Plot

Name of plot: west of Jixiang Road and south of Lianzhu cun Road in Yanziji New Town, Qixia District.

Plot 4: Auspicious Road in the east, Fugui Road in the south, Zhidu Road in the west and Lianzhu cun Road in the north.

Land transfer area: 41,763.89 (including only 1,677.50 underground space) ㎡.

Nature of land use: Class II residential land.

Floor area ratio: comprehensive floor area ratio 2.0

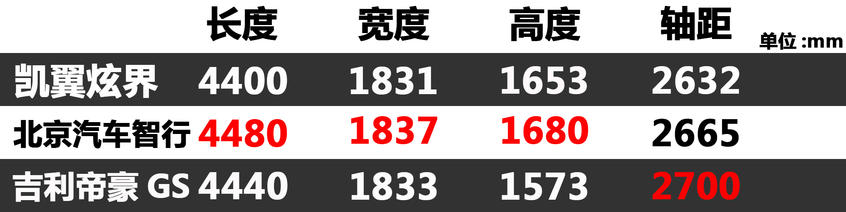

Total starting price: 1,530 million yuan

Starting floor price: 18,317 yuan/m 2

Maximum price: 1,740 million yuan

The location of the plot is the urban renewal area of Xinlian Machinery Factory, which is also famous in history. Founded in 1959, Xinlian Machinery Factory is a large-scale military and subordinate enterprise, and later transferred to the people, where the first household air conditioner and the first two-door refrigerator were born in China.

Now, according to the public notice, while protecting the industrial historical and cultural heritage, it will combine the internal landscape resources and industrial sites to create a livable community with mountains and water.

This is also the old urban area to be updated in Yanziji New Town. The first phase of Xinlian Machinery Factory to be sold this time is mainly residential, and it is also the first project to start updating and construction in the area.

Current situation of plots

From the location point of view, it is closer to the Shogun Mountain, surrounded by old residential areas, and has a certain distance from the Yihe Four Seasons Mansion, Huafa Four Seasons Yazhu and Baoneng Riverside Mansion currently on sale.

The relatively new second-hand housing communities around the project include Dafa Yanlan Bay and Sanjin Yanyuting. Among them, the highest transaction price of second-hand houses in Dafa Yanlan Bay was 36,607 yuan/m 2, but this house was sold in 2021. Since the beginning of this year, only one house has been sold in this community, with a unit price of 30,728 yuan/m 2.

Tuyuan Nanjing Home Link Network

The highest transaction unit price of Sanjinyan Courtyard is only 33,000 yuan/m 2. The suite originated from the transaction in 2019, and there is no housing transaction in this community this year.

Practical exploration: There are many old communities around.

The subway is expected to open to traffic at the end of the year.

Recently, we also came to the site of the plot to conduct a practical exploration.

Judging from the surrounding environment, the G83 plot of Yanziji New Town is surrounded by old communities such as Xinlian Ercun, Jixiang Garden, Lianzhu cun, auspicious village and Shengli Village. Although these communities have been built for a long time, after the renovation of the old communities, the environment in the communities is relatively good.

There is an access control system in the community. Although there is no separation of people and vehicles in the old community, there is no underground parking space. However, vehicles need to be identified when entering the community, and the management is fairly strict. There are also parking spaces for battery cars in the community, and the overall environment is relatively clean.

Judging from the surrounding living facilities, there are food markets, community centers, supermarkets, health service centers and some small shops along the street, which can basically meet the needs of life. However, there is also a lack of large-scale commercial facilities. If you want to meet the entertainment needs such as shopping, you have to go to Yanziji Business Circle and Maigaoqiao Business Circle.

However, there are four residential community centers and three grass-roots community centers around the plot, which will make life more convenient in the future.

There are still a large number of schools and educational planning land around the plot. At present, there are Qixia Experimental Kindergarten, Yanziji Central Primary School and Nanjing Xiaozhuang College Affiliated Primary School. In addition, 39 classes of middle schools, 12 classes of kindergartens and 9 classes of kindergartens are planned.

It is worth mentioning that the linear distance from this plot to Jixiang ‘an Station on the north extension line of Line 1 under construction is only about 400 meters. At present, the North Extension Line of Line 1 is undergoing a trial operation without passengers, which will be opened to traffic as planned during the year, and public transportation in Yanziji New Town will be much more convenient in the future.

Yanziji New Town currently has three properties for sale.

Three pure new sites are expected to enter the market next year.

There are currently three properties for sale in Yanziji New Town, namely Yihe Four Seasons Mansion, Huafa Four Seasons Yazhu and Baoneng Riverside Mansion.

Among them, Yihe Four Seasons Mansion and Huafa Four Seasons Yazhu are located near Yancheng Avenue, and the two projects are surrounded by Sunac Yulan Mansion, Jinpu Ziyu Dongfang, Hongyang Yanjiang Mansion, Merchants Evian Hefu, Jinke Bocui Garden, Zhonghaiyanji Tingchao and Yanxitai.

According to the on-site investigation, at present, both projects are under construction, and many surrounding communities have been delivered for use. Shops along the street can also meet the needs of life, and life is relatively convenient. However, there are still many roads under construction in this area, so you need to pay attention to it when traveling.

Project status quo

Yihe Sijifu is currently selling buildings 3, 9, 7 and 12, with a floor area of about 89, 108 and 128㎡, the average selling price is about 33,484-34,283 yuan/㎡, and an upgrade package of 2,650 yuan/㎡ is optional. Huafa Four Seasons Yazhu has a building area of about 99,120 and 140 m2, with an average selling price of about 33,783-34,067 yuan/m2, and an upgrade package of 2,500 yuan/m2 is optional.

Baoneng Riverside House is closer to the riverside, surrounded by projects such as Renheng Park Century, Kaisa Yanranju and Poly International Community. The building area of the main units in sale in Baoneng Binjiang House is about 93,108,122,128 and 140㎡, and the average selling price is about 36,011 yuan/㎡. Hardcover is not included.

At present, the average selling price of new houses in Yanziji New Town, including the upgrade package, is about 36,000-37,000 yuan/m2. The residential area with the highest unit price of second-hand houses in this range is Sunac Yulan Mansion, which has exceeded 45,000 yuan/m2.

Tuyuan Nanjing Home Link Network

In addition, in July this year, Yanziji New Town successfully sold three plots, and it is expected that it may enter the market next year. Among them, the Poly G32 plot is close to the upcoming G83 plot, but the G83 plot is on the west side of Jixiang ‘an subway station, and the Poly G32 plot is on the east side. According to the plan, 15 22-26F residential buildings will be built in Poly G32 plot, with a price limit of 32,640 yuan/m2.

Qixia construction G33 plot is located in the east of Huafa Four Seasons Elegant Building. According to the plan, 10 28-29F houses will be built in this plot, and the future blank price limit is 32,320 yuan/m2, which is slightly lower than that of Poly G32 blank.

The rough price limit of the above two plots is higher than the previous highest rough price limit of 32,000 yuan/m2 in the region. However, the G34 plot of Hi-Tech directly cancelled the setting of blank price limit.

The G34 plot of Hi-Tech is closer to Renheng Park Century and Baoneng Riverside House, and the planning of this plot has not yet been released. However, according to the transfer announcement issued by Nanjing Land Market Network before, we can see that in addition to residential buildings, there are some commercial facilities, and there are no hotel-style apartments. At the same time, the plot is located in the important node area of Yanziji New Town Riverside, which needs to maintain the style of the ancient town and historical block.

At the end of this year, the north extension of Metro Line 1 is about to open to traffic, and all the benefits of Yanziji New Town are being realized step by step. In addition, three properties are for sale, three new sites are waiting to enter the market, and one homestead is waiting to be photographed. If buyers want to start Yanziji this year and next, there are still many choices.

At the same time, how will G34 and G83 plots be priced in the future? It has also become a concern of many property buyers.