Deeply Grasp the New Era, New Ideas and New Journey —— Theoretical circles study the spirit of the 19th Party Congress

Editors’ new ideas lead a new era, and new missions start a new journey. General Secretary of the Supreme Leader pointed out in the report of the 19th National Congress of the Communist Party of China that after long-term efforts, Socialism with Chinese characteristics has entered a new era, which is a new historical orientation for China’s development. Focusing on what kind of Socialism with Chinese characteristics and how to adhere to and develop Socialism with Chinese characteristics in the new era, our party has formed the Supreme Leader’s Socialism with Chinese characteristics Thought in the new era through arduous theoretical exploration. In order to seriously study and understand, profoundly grasp the new era, new ideas and new journey, and effectively unify thoughts and actions into the spirit of the 19 th National Congress of the Communist Party of China, this newspaper invited experts and scholars to interpret it — —

Welcome a new era in Socialism with Chinese characteristics.

General Secretary of the Supreme Leader solemnly declared in the report of the 19th National Congress of the Communist Party of China: "After long-term efforts, Socialism with Chinese characteristics has entered a new era, which is a new historical orientation for China’s development." The new era means opening a new chapter and stepping into a new journey.

This is a new era that ushered in a great leap from standing up, getting rich and getting strong. Socialism with Chinese characteristics’s entry into a new era means that the Chinese nation, which has suffered a lot in modern times, has ushered in a great leap from standing up, becoming rich and becoming strong, and has ushered in a bright prospect of realizing the great rejuvenation of the Chinese nation, which is a new historical orientation for China’s development. China is gradually moving towards the center of the world stage, starting the journey from an economic power to an economic power.

This is a new era when we embark on a new journey of pursuing a better life after welcoming the changes in the main contradictions in our society. With the improvement of productivity and living standards, people’s demand for non-material things is increasing day by day, and the demand for higher levels such as democracy, rule of law, fairness, justice, security and environment is growing. According to the report of the 19th National Congress of the Communist Party of China, "the principal contradiction in our society has been transformed into the contradiction between the people’s growing need for a better life and the unbalanced development". The transformation of principal contradiction, a historic change in the overall situation, is a profound summary of the historical achievements and changes in China’s development in the past five years, a historical response to the achievements of reform and development in the past 40 years, and an accurate positioning of the future development direction and goals of China. In the future, on the basis of continuing to promote development, we should focus on solving the problem of insufficient development imbalance, vigorously improve the quality and efficiency of development, better meet the growing needs of the people in economic, political, cultural, social and ecological aspects, and better promote the all-round development of people and social progress.

This is a new era for China to contribute wisdom and strength to world peace and development. In the process of realizing the Chinese nation’s great rejuvenation of the Chinese dream, China has played the role of a responsible big country, actively participated in the reform and construction of the global governance system, put forward ideas and views on global security governance, global economic governance and global development governance, and put them into practice, playing an increasingly important role in the international arena and contributing China’s wisdom and strength to global governance. China’s international status, influence and discourse power have been continuously improved, which has comprehensively opened a new era of contributing China’s wisdom and strength to world peace and development.

This is a new era that pays more attention to balanced development under the guidance of new development concepts. China’s economic development has entered a new stage. According to the report of the 19th National Congress of the Communist Party of China, there are still many shortcomings in our work, and we are also facing many difficulties and challenges. For example, some outstanding problems of insufficient development imbalance have not been solved. Solving these problems is also an important foothold for China’s economic work in the future. In the future, under the guidance of the new development concept, China will enter a new era of paying more attention to structural balance, urban-rural regional development balance and the balance between man and nature. (The author is the director and professor of the Department of Economics, National School of Administration)

Important Follow-up of Doing Economic Work Well in the New Era

On the basis of making a major judgment that "Socialism with Chinese characteristics has entered a new era" and accurately pointing out that "the main contradiction in our society has been transformed into the contradiction between the people’s growing need for a better life and the unbalanced development", General Secretary of the Supreme Leader devoted a lot of space to expounding economic work in the report of the 19th National Congress of the Communist Party of China, which not only systematically summarized the economic and social development achievements since the 18th National Congress of the Communist Party of China, profoundly analyzed the current economic situation in our country, but also made comprehensive arrangements for the future economic work led by the Party.

Since the 18th National Congress of the Communist Party of China, the CPC Central Committee with the Supreme Leader as the core has judged the situation from the long period of economic development and the global political and economic background, and put forward a series of new ideas, new ideas and new strategies around economic construction, forming a development idea centered on improving the quality and efficiency of development. From a comprehensive analysis of the trend change of China’s economic development to a highly generalized new normal of economic development, from a comprehensive understanding and grasping of the new normal to putting forward innovative, coordinated, green, open and shared development concepts, from defining the main line of supply-side structural reform to adhering to the general tone of steady progress. It can be said that it is precisely by relying on these new ideas, new ideas, new strategies and the closely linked and continuous economic policy framework that we can achieve the brilliant achievements of stable, healthy and sustainable economic and social development under the background of difficult global economic recovery. It is also based on these new ideas, new ideas, new strategies and the closely linked and continuous economic policy framework formed by them. The report of the 19th National Congress of the Communist Party of China made a major judgment that "China’s economy has shifted from a high-speed growth stage to a high-quality development stage, and it is in the key period of transforming the development mode, optimizing the economic structure and transforming the growth momentum", and accordingly put forward that "building a modern economic system is an urgent requirement for crossing the barrier and a strategic goal for China’s development". It can also be considered that these new ideas, new ideas, new strategies and the closely linked and continuous economic policy framework formed from them,It can’t come from textbooks of western economics, nor can it be copied from classical Marxist writers, but it can only come from China’s practice and can only be produced on the basis of China’s national conditions.

In short, the economic policy framework put forward by the CPC Central Committee with the Supreme Leader as the core in the past five years around economic work not only comes from practice, but also effectively guides practice, and is constantly enriched and improved in practice. It is useful, usable and effective, and it is an important follow-up for us to do a good job in economic work in the new era. As long as we follow this direction, we will be able to successfully achieve the grand goal of "building a well-off society with more developed economy, more sound democracy, more advanced science and education, more prosperous culture, more harmonious society and more affluent people’s lives by the centenary of the founding of the Party, and then struggling for another 30 years, basically realizing modernization and building China into a socialist modern country by the centenary of the founding of New China". (The author is a member of the Chinese Academy of Social Sciences and director of the Economic Research Institute)

Correctly understand the distinctive features and rich connotations of the new era.

In the report of the 19th National Congress of the Communist Party of China, General Secretary of the Supreme Leader clearly stated that "Socialism with Chinese characteristics has entered a new era", which is a new historical orientation for China’s development. It is of great significance for us to deeply understand and scientifically grasp the distinctive features and rich connotations of the new era and start a new journey.

It is a fine tradition of revolutionary leaders and communist party people to make a scientific judgment on the historical position of the cause led by the party in time, determine the goal of struggle, put forward the ideological program and formulate the action guide according to the changes of the characteristics of the times and the main contradictions.

A correct understanding of Socialism with Chinese characteristics’s entry into a new era has three dimensions and three signs: the first is the dimension of the Chinese nation’s own development, which is marked by the unremitting efforts of the people of China who have been United and led by the Communist Party of China (CPC) for more than 90 years, and the Chinese nation, which has suffered a lot in modern times, has ushered in a historic leap from standing up, becoming rich and becoming strong; The second is the dimension of the development of world socialism, which is marked by the unremitting efforts of New China in the past 60 years, especially in the past 40 years of reform and opening up. Scientific socialism has given off great vitality in China and held high the banner of Socialism with Chinese characteristics in the world. The third dimension is the modernization of human beings, which is marked by the continuous pioneering and forging ahead after nearly 40 years of reform and opening up, especially since the 18th National Congress of the Communist Party of China. Socialism with Chinese characteristics not only led China to the correct path of modernization, but also expanded the broad ways for developing countries to modernize, providing new choices for those countries and nations that want to speed up their development and maintain their independence.

One hundred years ago, the October Revolution brought us Marxism–Leninism. No matter whether it is China’s revolution or construction, what we initially learned is "Russian experience" and "Soviet plan". There are experiences and lessons, successes and failures. Since the reform and opening up, we have embarked on a Socialism with Chinese characteristics road, which not only blazed a "China road" for the development of world socialism, but also provided "China wisdom" and "China plan" for human beings to solve development problems.

After several generations of communist party people led the people of China in their relay struggle, today’s China has ushered in a new era of Socialism with Chinese characteristics. This is an extremely important judgment with rich connotation of the times: judging from the development process of Socialism with Chinese characteristics, this is an era in which the great cause we are engaged in is constantly enriched and developed and continues to win great victories under the new historical conditions; From the perspective of China’s modernization, this is an era of winning the battle to build a well-off society in an all-round way and then building a socialist modern power in an all-round way; From the perspective of people’s happiness, this is an era in which people of all ethnic groups in the country unite and struggle, constantly create a better life and gradually realize common prosperity; From the perspective of national rejuvenation, this is an era when all Chinese sons and daughters work together to realize the great rejuvenation of the Chinese dream; From the perspective of national prosperity, this is an era when China is approaching the center of the world stage and making greater contributions to mankind. Undoubtedly, this era is of great significance not only in the development history of People’s Republic of China (PRC) and the Chinese nation, but also in the development history of world socialism and human society.

Empty talk about wrong country, hard work and prosperity. We can’t live up to this great era. We must roll up our sleeves and work hard. In the spirit of waiting for time and seizing every minute, we should take the long March of the new era and strive for a bright future for the great rejuvenation of the Chinese nation. (The author is Party Secretary and Researcher of Shandong Academy of Social Sciences)

Chinese cultural genes with a new theoretical leap

Combining the basic principles of Marxism with China’s concrete reality is an important magic weapon for the Communist Party of China (CPC) people to realize Marxism in China. The "concrete reality of China" here includes history and culture. In a certain sense, history and culture actually determine the style and style of the ideological and theoretical system.

The Supreme Leader’s Socialism with Chinese characteristics Thought in the new era has a solid cultural foundation and civilization support. From putting forward the Chinese dream of realizing the great rejuvenation of the Chinese nation, to emphasizing that the road of Socialism with Chinese characteristics "came from the inheritance of the Chinese nation’s 5,000-year-old civilization, which has a profound historical origin and a broad realistic foundation", and then emphasizing that "China’s current national governance system is the result of long-term development, gradual improvement and endogenous evolution on the basis of China’s historical inheritance, cultural tradition and economic and social development", As well as "deeply excavating and expounding the times value of Chinese excellent traditional culture in stressing benevolence, attaching importance to the people, keeping honesty, upholding justice, respecting harmony and seeking common ground", it fully shows that the rich philosophical thoughts and humanistic spirit of Chinese excellent traditional culture have been creatively transformed and developed, and have given off lasting spiritual charm and cultural brilliance.

The historical logic of the development of Marxism in China tells us that it is the cultural spirit that has lasted for 5,000 years that makes China-oriented Marxism more popular among the people and more moist and silent.

The theoretical logic of the development of Marxism in China tells us that civilization, especially ideology and culture, is the soul of a country and a nation. No matter which country or nation, it can’t stand if it doesn’t cherish its own ideology and culture and loses its soul. Cultural self-confidence is a more basic, deeper and more lasting force in the development of a country and a nation. Only by persisting in moving from history to the future and forging ahead from the continuation of national culture can we do a good job in today’s cause.

"Standing on the vast land of more than 9.6 million square kilometers, sucking the cultural nutrients accumulated by the long struggle of the Chinese nation for more than 5,000 years, we have the majestic power of more than 1.3 billion people in China. We take the road of Socialism with Chinese characteristics and have an incomparably broad stage of the times. It has an incomparably profound historical heritage and an incomparably strong determination to move forward." General Secretary of the Supreme Leader has repeatedly emphasized this understanding, expressing the profound historical and cultural feelings of the Communist Party of China (CPC) people, and also conveying a firm historical and cultural consciousness. This feeling and consciousness are embodied in the supreme leader’s Socialism with Chinese characteristics Thought in the new era and in the historical journey of realizing the Chinese nation’s great rejuvenation of the Chinese dream. (The author is a professor at the Party School of the Central Committee of the Communist Party of China)

Grasping the Three Nodes and Advancing the Great Cause

Based on the new era conditions and starting from a new historical starting point, General Secretary of the Supreme Leader put forward in the report of the 19th National Congress of the Communist Party of China that "the overall task of upholding and developing Socialism with Chinese characteristics Thought in the new era is to realize socialist modernization and the great rejuvenation of the Chinese nation, and to build a prosperous, strong, democratic, civilized, harmonious and beautiful socialist modernization power in the middle of this century in two steps on the basis of building a well-off society in an all-round way". This clear-cut strategic arrangement is inspiring, and the grand blueprint of ambition is inspiring. In this process, there are three important time nodes that need to be grasped:

First, by 2020, we will achieve the goal of the first century of struggle and build a well-off society with more developed economy, more sound democracy, more advanced science and education, more prosperous culture, more harmonious society and more affluent people’s lives. This requires us to advance all the work in an orderly and smooth way according to the plan on the basis of promoting the overall layout of "five in one" and coordinating the promotion of "four comprehensive" strategic layouts.

Second, from 2020 to 2035, we will struggle for 15 years and basically realize socialist modernization. There are several aspects that need to be focused on: first, we should be among the forefront of innovative countries, narrow the gap in regional innovation investment capacity, and improve the national innovation system. Second, basically realize the modernization of the national governance system and governance capacity. Third, significantly enhance the soft power of the country’s culture. Fourth, promote common prosperity. Fifth, make the society full of vitality, harmony and order, and make great efforts to solve problems such as insufficient development imbalance. Sixth, build a beautiful China.

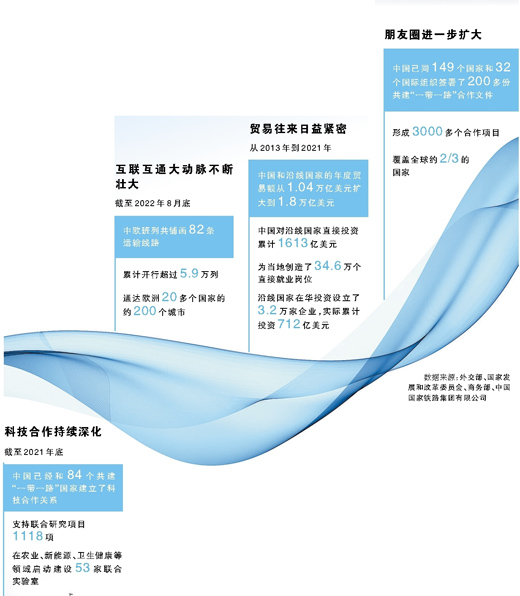

Third, from 2035 to the middle of this century, we will strive for another 15 years to build China into a prosperous, strong, democratic, civilized, harmonious and beautiful socialist modernization power. By then, our people will enjoy a happier and healthier life, and the Chinese nation will stand in the world’s national forest with a more high-spirited attitude. First, become a responsible big country that plays an important role in the world. Actively participate in the reform and construction of the global governance system, and constantly contribute to the wisdom and strength of China. Second, become an open economic power that affects the world. Promote the opening of global trade and investment, promote the development of economic globalization and promote the construction of an open world economy. It is necessary to focus on the construction of the "Belt and Road", form an open pattern of land and sea linkage and two-way mutual assistance between the East and the West, and form a global trade, investment and financing, production and service network. Third, become an innovative power. It plays an important role in promoting global knowledge accumulation, technological progress and personnel training, and promotes major technological innovation through all-round international cooperation, thus effectively promoting the strong, sustainable, balanced and inclusive growth of China’s economy and the world economy. Fourth, become a big country to promote global inclusive development. Further expand the way for developing countries to modernize and contribute China wisdom and China’s plan to solve human problems. Fifth, it has become an irreplaceable and important force for maintaining a "peaceful international environment and a stable international order." (The author is the chief researcher of China International Economic Exchange Center)