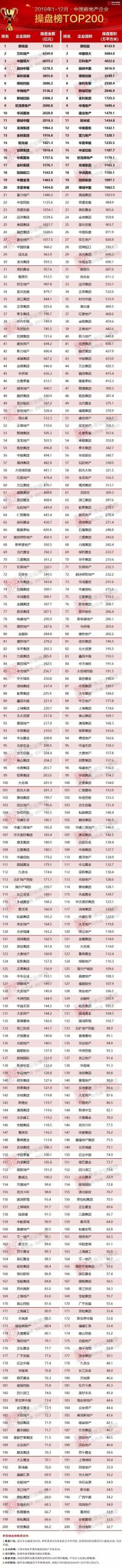

TOP200 list of sales of real estate enterprises in China in 2019

Source: real estate people’s words

☉ Wen/Kerui Research Center

List revision instructions

This year is the 11th year that Kerui compiled the sales list of China real estate enterprises, from the initial TOP20 to TOP50, TOP100 and TOP200;; From the single sales list to the launch of the trading list representing trading ability and the equity list of investment ability, we have been truly, rigorously and fairly recording the industry changes, pattern evolution and model innovation in the past 10 years.

Since January 2019, on the basis of the original sales flow list and equity list, we have added a sales full-caliber list. Full-scale sales refers to the statistical method that all projects of enterprise groups and joint ventures and associated companies are included in the performance, regardless of the proportion of equity and whether they are trading. Because the agent construction belongs to the export management behavior, the sales performance generated by the agent construction is not included in the full-caliber list data. The full-caliber list reflects the enterprise’s urban layout and project expansion ability.

The trading list is based on enterprise trading, that is, if a project is jointly developed by a number of housing enterprises, the performance of the project is only classified as trading enterprises. It reflects the marketing and trading ability of the enterprise, and the sales performance generated by the enterprise’s agent construction is included in the statistics of trading caliber.

The equity list is based on the proportion of corporate equity, that is, if a project cooperates with a number of housing enterprises, the performance of the project will be included in the corresponding enterprises according to the proportion of equity. It reflects the financial strength and investment ability of the enterprise. (Note: The data of equity caliber does not include the equity of the parent company and related parties, and the employee’s follow-up investment)

In view of the fact that most listed real estate enterprises have changed the caliber of performance announcement from consolidated statement to full caliber, readers who need to compare with the data released by listed companies can refer to the full caliber list.

List interpretation

In 2019, the cumulative equity sales amount of TOP100 real estate enterprises increased by 6.5% year-on-year, far less than 40.5% in 2017 and 35.1% in 2018. By the end of December, most large-scale housing enterprises have achieved their annual performance targets, but the overall overfulfilled rate is not as good as that in 2016 and 2017.

On the whole, the market environment for the industry to maintain long-term and stable development has become clear. It is expected that the overall scale growth of enterprises will continue to rise steadily in 2020, and the differentiation pattern within the top 100 housing enterprises will also be continued. While the sales threshold of real estate enterprises in each echelon is further improved and the competition is intensified, TOP30 will become an important watershed for scale development.

01

Overall performance: the growth rate of the industry slowed down significantly.

Better performance in the second and fourth quarters

In 2019, with the central government’s clear goal of "stabilizing land prices, stabilizing housing prices and stabilizing expectations", market regulation tends to be normalized, the credit level gradually tightens, and the real estate market develops steadily and healthily. As of the end of December, the cumulative equity sales amount of TOP100 real estate enterprises increased by 6.5% year-on-year, which was less than 40.5% in 2017 and 35.1% in 2018. The growth rate of the overall scale of the industry has slowed down significantly compared with the previous two years, and the growth of the top 100 housing enterprises has "stalled".

Judging from the annual performance trend, the overall sales performance of the top 100 real estate enterprises in the second and fourth quarters of this year was better, and the scale of equity sales increased by 7.5% and 11.7% respectively compared with the same period of last year. Among them, the "Xiaoyangchun" market in the first and second quarters, especially in March and April, increased the market enthusiasm, and the monthly year-on-year growth rate rebounded significantly from the beginning of the year. After the second half of the year, enterprises increased their supply, and the year-on-year growth rate of performance also showed a rebound trend. Especially since September, it has coincided with the peak of supply at the end of the year, and the performance of enterprises has stabilized and rebounded under the promotion of both pushing and marketing efforts.

But on the whole, the real market situation is not as optimistic as the growth rate of corporate performance. At present, the market pressure of chemical industry still exists, and the overall chemical industry rate is still relatively low. Judging from the push and de-transformation of real estate enterprises throughout the year, the average single-plate production capacity of large-scale real estate enterprises in 2019 decreased compared with that in 2018, and the performance growth mainly depended on the increase in the number of projects on sale.

02

Concentration: echelon differentiation pattern intensifies

TOP30 scale development watershed

By the end of 2019, the concentration of equity sales amount of TOP3, TOP10, TOP30, TOP50 and TOP100 housing enterprises had reached nearly 9.5%, 21.4%, 35.7%, 43.5% and 53% respectively. In terms of echelons, while the overall growth rate of the industry has slowed down, the differentiation pattern of housing enterprises in the top 100 echelons has intensified.

Among them, the scale growth of leading real estate enterprises slowed down and the concentration decreased slightly under the strategy of improving quality control speed. TOP4-10, TOP11-20 echelon scale enterprises have increased in concentration, and echelon competition has intensified, while the concentration of TOP21-30 echelon housing enterprises is basically the same. On the whole, TOP30 echelon housing enterprises benefit from the scale effect, national layout and relatively mature internal control mechanism, and have more industry competitiveness and room for further improvement in the future. With the rapid accumulation of resources in the real estate market to advantageous enterprises, TOP30 housing enterprises have become a watershed in the scale development of housing enterprises.

It is worth noting that after TOP30 in 2019, the concentration of housing enterprises in each echelon showed a downward trend compared with that in 2018. The concentration of the TOP31-50, TOP51-100 and TOP101-200 echelons has declined, and the internal rankings of the echelons will change more frequently as the competition pattern further intensifies.

03

Threshold for listing: amount of equity of TOP100 housing enterprises

The threshold has dropped, and the expansion of 100 billion housing enterprises has slowed down.

In 2019, the threshold of equity sales amount of real estate enterprises in each echelon of TOP50 increased slightly compared with the same period of last year. Among them, the threshold of the equity amount of TOP10 housing enterprises reached 170.35 billion yuan, a year-on-year increase of 5.8%. The threshold of equity amount of TOP20 and TOP30 real estate enterprises is 111 billion yuan and 82.52 billion yuan respectively, and the threshold increase is 12% and 3.6% respectively. The competition pattern of TOP50 housing enterprises has intensified, and the threshold of equity amount has increased by 7.6% compared with the same period of last year to 51.71 billion yuan. By the end of December, the threshold of the equity amount of TOP100 enterprises in each echelon was reduced from 20.4 billion yuan last year to 18.78 billion yuan, while the threshold of TOP200 enterprises remained at around 6 billion yuan.

In addition, by the end of 2019, the number of full-caliber 100 billion housing enterprises increased by only 4 to 34 compared with the same period of last year, and the number of housing enterprises with a scale of 50-100 billion reached 33. Compared with the high increase in the previous two years, in 2019, under the background of slowing down the growth rate of the industry scale, the number of newly added 100 billion housing enterprises dropped significantly, and the expansion of large-scale housing enterprises slowed down.

04

Corporate performance: the leading housing enterprises grew steadily.

Evergrande ranked first in the equity list.

By the end of 2019, the full-caliber sales of the four leading real estate enterprises had exceeded 550 billion yuan, but the growth rate slowed down significantly compared with the same period in 2018. Among TOP4 housing enterprises, Evergrande achieved remarkable results through price reduction promotion in September and October, especially in October, when it achieved a monthly performance of 90.3 billion yuan. By the end of the year, the accumulated sales amount of full caliber was 608 billion yuan, exceeding the annual target of 600 billion yuan for the whole year, and the scale of equity sales ranked first in the industry.

Sunac, on the other hand, broke through 500 billion yuan for the first time by virtue of its merger and acquisition advantages, abundant sales volume and high-quality product quality, and its monthly sales for three consecutive months from September to November remained above 60 billion yuan. In 2019, the total sales amount of full caliber was 555.63 billion yuan, a year-on-year increase of over 20%, which exceeded the annual sales target of 550 billion yuan. It is worth noting that, in addition to TOP4 housing enterprises, Poly is also close behind, and its full-scale performance this year exceeds 470 billion yuan.

05

Target completion rate: the vast majority of housing enterprises

Achieve the annual target as scheduled

Judging from the completion of corporate goals in 2019, most housing enterprises that set performance targets during the year have achieved their annual performance targets. Among them, 9 housing enterprises such as Shimao, Longhu, Sunshine City, Jinke, Zhongliang, Yuzhou and Baolong performed well, and completed the annual target ahead of schedule as early as November. By the end of December, the target completion rates of eight real estate enterprises, including Shimao, Sunshine City, Jinke, Zhongliang, Zhongjun and Jianye, were all above 115%.

On the whole, however, in recent years, regulation and control have continued, the overall market turnover rate is less than expected, and the target completion rate of housing enterprises has been decreasing year by year. Compared with 2016 and 2017, the target completion rate of nearly 80% of housing enterprises exceeded 110%, and the number of housing enterprises in this area decreased significantly in 2019. This year, the target completion rate of only half of housing enterprises is concentrated between 100% and 110%. We believe that under the background that the overall target growth rate of housing enterprises has slowed down and the average target growth rate has dropped from 41% in 2018 to 20%, although most housing enterprises have achieved their annual performance targets in 2019, their overall performance is not as good as that in 2016 and 2017.

06

Quality of growth: increased cooperation and decreased rights and interests.

The high-quality growth of enterprises should be paid more attention.

As can be seen from the data of the equity list, the overall project cooperation in the industry has increased in recent years, and the equity ratio of the sales amount of TOP100 housing enterprises has dropped from 85% in 2016 to about 75% at present. On the one hand, under the current industry background of high land price, tight funds for housing enterprises, increasing difficulty in land acquisition and development risks, cooperative development between housing enterprises has become the norm. On the other hand, under the current market background, more small-scale enterprises choose to expand the full-scale performance scale through cooperative development, and the overall equity ratio is correspondingly reduced.

However, we believe that in recent years, under the industry development trend of continuous policy regulation, slow growth of enterprise scale, leading real estate enterprises improving quality control speed and pursuing high-quality growth, the era of real estate enterprises blindly pursuing full-caliber sales scale has passed. Based on the increase of current project cooperation, the caliber of sales manipulation and equity can better reflect the marketing, operation and investment capabilities of enterprises, and should be paid more attention. For example, Country Garden, China Resources, Sunshine City, R&F, Kaisa and other enterprises all choose to disclose their equity performance, which also shows that their management has paid more attention to the high-quality growth of their performance while developing their scale.

07

Outlook: Enterprise Development Outlook in 2020

Looking forward to 2020, the main tone of the central government’s policy of "housing without speculation and keeping the word steady" will not change, and the central government will also strictly control financial risks. Stability will remain the top priority of real estate policy regulation in the next stage. At the enterprise level, although the overall market is under pressure, the environment for the industry to maintain long-term stable development has become clear. It is expected that the overall scale growth of large-scale housing enterprises will enter a stable period in the future. In the market adjustment period, the financing environment of housing enterprises will continue to operate at a low level, and corporate investment will remain cautious. In addition, with the return of residential products to the essence of living, more housing enterprises will exert their efforts from the product side in the future to enhance the competitiveness of their products through standardized product systems, refined products and intelligent construction.

Market: financial control, risk prevention and stability are the main tone.

Judging from the trend of industrial policies, the main tone of the central government’s "staying in the house without speculation, keeping the word steady" will not change in 2020, and stability will remain the top priority of real estate regulation and control policies in the next stage. On the one hand, the real estate industry is the most important area of deleveraging at this stage, and the central government will control financial risks to ensure that systematic financial risks do not occur. Monetary policy will be moderately tight to avoid flooding, but structural easing is expected. At the same time, with the downward movement of LPR interest rate center, the mortgage interest rate will also decrease steadily. On the other hand, local regulation will remain "loose outside and tight inside", the new talent policy will continue to exert its strength, and the "four limits" regulation will be partially relaxed, but the overall policy environment will continue to be tight.

Based on this, the overall transaction scale in 2020 is expected to be the same as this year or slightly increase, and the market of cities with different energy levels will be relatively independent. The property market in first-tier cities is expected to heat up slightly, while the overall stability of second-tier cities will continue, and the callback pressure will mainly focus on most third-and fourth-tier cities with serious overdraft demand in the early stage and lack of fundamental support. On the other hand, the investment in real estate development will keep a steady and slightly declining trend, and the acceleration of construction and completion will provide solid support for it. The cumulative growth rate of newly started area will gradually decline. Due to the tight capital and low base, the growth rate of land acquisition area will continue to rise, but the growth rate is relatively limited.

Performance: the scale growth tends to be stable, and the high-quality development of enterprises is the key.

Although the overall market pressure will be reduced in 2019, the market environment for the industry to maintain long-term stable development has become clear. It is expected that the overall scale growth of enterprises will enter a stable period in 2020, and the overall growth will remain stable. At the same time, the competition among echelon housing enterprises in the top 100 will intensify, and the differentiation pattern will also continue. Under such an industry background and competitive pattern, the strategy of housing enterprises should be based on prudence and stability. For housing enterprises, preventing risks and better adapting to market adjustment are the top priority.

At present, the era of housing enterprises blindly pursuing full-caliber sales scale has passed, and the development focus of enterprises has gradually shifted from "increment" to "quality improvement". While the overall target growth rate of housing enterprises is slowing down, the industry will also pay more attention to the high-quality growth of performance. In the context of market pressure, the growth of enterprise sales scale can not simply depend on the increase of supply, and the fierce industry competition in the future will put forward higher requirements for the organization, control and operation of housing enterprises themselves. Urban layout, brand effect, project quality and product strength will all be important components of the future core competitiveness of housing enterprises.

Investment: cash is king, and new investment continues to be cautious.

In 2020, the investment of housing enterprises will remain cautious, and differentiation, focus and prudence are the main themes. First of all, under the background of loose policies and tight financing, the cash pressure of most enterprises has increased sharply. It is expected that the investment attitude of enterprises will continue the conservative trend in the past two years, and land acquisition will return to rationality. Secondly, as the land market cools down and the comparable land price tends to fall, the land market in different cities may be divided, and some cities with "the bottom line has not fallen and is expected to decline" may make concessions under local financial pressure. On the whole, the overall investment rhythm in 2020 will show a situation of "loose before and tight after". If the land acquired before the year can be listed within the year, it will still be attractive to enterprises with high turnover.

In the choice of cities, contraction, focus and regional deep cultivation will be the main strategic directions for the future layout of housing enterprises. In 2020, we should focus on first-and second-tier cities and provincial capital cities with rebounding market. In the choice of third-and fourth-tier cities, we should avoid full coverage and excessive sinking, be alert to the irrational rise of land prices and serious population loss in the early stage, and focus on the third-and fourth-tier cities with industrial support under the dividend of the city circle, such as the integration of the Yangtze River Delta and the satellite cities in Guangdong-Hong Kong-Macao Greater Bay Area. From the perspective of rotation, after a wave of adjustment in the third-and fourth-tier cities around the core of these rings, the future development prospects are still huge under the impetus of urban agglomeration and urban agglomeration dividends.

Financing: The financing environment is low, and the hematopoietic capacity of the enterprise itself is the key.

After the first quarter of 2019, the financing environment of housing enterprises is basically at the bottom, and the financing difficulty of housing enterprises has increased significantly after the window period. It is expected that the financing of housing enterprises will remain at a low level in the short term. From the perspective of financing costs, the financing costs of most enterprises are rising in 2019, mainly because the financing costs at home and abroad, especially the cost of issuing bonds abroad, continue to rise. And affected by the continuous increase of domestic financing restrictions, the proportion of overseas financing of enterprises has also continued to increase. It is expected that the financing cost of housing enterprises will continue to remain at a high level in the future.

In terms of financing channels, traditional financing channels such as trust loans, bank loans, corporate bonds and overseas debts are subject to more and more restrictions. Although the financing scale of asset securitization products has increased, it is still limited for the overall financing relief of housing enterprises. On the other hand, although the listing fever continued in 2019, the number of newly listed real estate enterprises continued to remain at a high level. But for housing enterprises, listing does not mean that it is a matter of course. From the perspective of long-term development, how to improve the repayment ability of enterprises, optimize their own financial structure, achieve high-quality development, and gain recognition from the capital market determines the ultimate benefit of housing enterprises’ listing.

Products: The housing returns to the essence of living, and the era of product bonus is coming.

At present, most large-scale housing enterprises have begun to cultivate deeply after completing the national layout, and the product war of housing enterprises has begun. As residential products begin to return to the essence of living, more housing enterprises will exert their strength from the product side and seek profit increase by creating product premiums. We believe that the product development of real estate enterprises in the future will have the following major trends:

First of all, more and more housing enterprises will focus on the standardization of product systems and promote the digital application of real estate. While strengthening the collaborative mechanism, we will further improve work efficiency and empower data-driven decision-making and production integration. Secondly, the change of customer demand accelerates the spatial innovation of residential units, and the customization and refinement of residential products will become a trend in the future. In the future, the continuous release of demand for diversification and improvement will force housing enterprises to accelerate the spatial innovation and refined development of product units. Third, in the pursuit of a better life, buyers’ measurement of living experience will gradually extend from the apartment type itself to the construction and operation of residential community space. The construction and operation of residential community space will also become one of the main selling points of future housing projects. Finally, with the increasing number of young buyers, the acceptance and recognition of intelligence will also be significantly improved. With the help of science and technology, smart homes and smart communities will be more used in projects, and the wave of product intelligence will continue.

Diversification: strategic convergence and focus, with real estate business as the axis extension.

In recent years, many large-scale housing enterprises have contracted diversified businesses and focused on the development of their main businesses through strategic adjustment. In the future, the overall diversification strategy of enterprises will become more cautious. On the one hand, it is difficult for some housing enterprises to find a suitable profit model for their diversified businesses, and the input-output efficiency is less than expected, thus dragging down the overall development of enterprises. Timely divestiture is a reasonable choice under the strategic contraction of housing enterprises. On the other hand, in the process of continuous exploration and trial and error of diversified business development, housing enterprises will pay more attention to tapping the potential of strong business, realize the effective allocation of resources, strengthen the focus and give play to their strong advantages. The diversified business of enterprises will still focus on the ecological business of real estate, with a clearer development direction and closer synergy with the main business of real estate.

Reporting/feedback