Tencent was pressured by NetEase

Author | Huang Qingchun

In the past month (December 15, 2023 to January 15, 2024), user acquisition through ads market, social platforms, game live streaming host/game media almost all fell under the "Yuan Dream Star" marketing offensive:

On the input side, the fixed-file press conference said "the first phase of ecological incentive investment is 1.40 billion yuan, and the long-term investment is not capped". On the first day of the launch, the user acquisition through ads material was placed in more than 27,000 groups, which was 50 times that before the launch, and more than 600 stars were invited to promote;

Linkage end, WeChat Channels, QQ, Tencent News and other traffic entrances work together to promote, 6 "Honor of Kings" joint fashion free, and joint B station, Douyin, Douyu, Huya, Kuaishou, Weibo, Xiaohongshu and other platforms to carry out "Star Dream Partner" incentive plan.

Data Source: Diandian Data

Tianmei, Tencent’s major IP push, the outside world can clearly feel the importance of the entire Tencent in this game;Even some media have called "Yuan Mengzhixing" "Tencent’s next extremely important battle", or it will become its next "trump card".

However, the anomaly is that the "Yuan Dream Star" that Tencent has put on the stage so much is not a long-dormant heavy self-research masterpiece, but a party casual game that runs into the venue – after two rounds of confidential testing, the first exposure (September 20), the first test (September 28), the second test (November 17), and the open test (December 15) were quickly completed in more than three months.Such efficiency is still rare among domestic game makers, let alone as large as Tencent.

This makes one wonder why a party game makes Tencent so concerned and anxious.

Tiger Sniff believes that the pattern of Tencent is no longer limited to the vision of a game company. The reason why "Yuan Dream Star" was raised to the group strategy is to a greater extent that a certain trend and potential energy are loosening the entire Tencent’s future development channel – "Egg Party" covers the skin of the game and leverages the young market through the UGC (User Generated Content, that is, user-generated content) ecology, which truly touches the foundation of Tencent:Social relationship chain.

Following this logic, Tencent’s above actions are reasonable:The stability established by Tencent in the past is being loosened in the process of content and channel gaming. "Yuan Dream Star" is no longer limited to a single game category, and Tencent is betting not just on a party game, but on the next generation of social scenes.

Why did Tencent smash the "party"?

Since NetEase’s "Egg Party" detonated the party track, the entire gaming industry knew that the dormant Tencent would take action sooner or later.

On the one hand, CITIC Securities analysis, the essence of the party game is a mild multiplayer competitive game, due to the low threshold, fission propagation characteristics, easy to birth phenomenon-level large DAU (Daily Active User, the number of active users) game; while the domestic casual game has reached more than 800 million users, but the supply of party games is still small, so it is the blue ocean track in the mobile game segment.

Moreover, Tencent has been coveting party games for a long time – previously, Tencent has laid out the party track through a number of external collaborations and investments, such as investing in Synopsys, the developer of "Beast Party", cooperating with Nintendo to introduce Switch National Bank and Nintendo party games (such as "Mario Kart 8" and "Super Mario Party"), Tencent-backed Epic Games also acquired "Jelly Bean Man" developer Mediatonic’s parent company Tonic Games Group in 2021.

June 2023 QuestMobile data, growth contribution rate = APP year-on-year increment/secondary market year-on-year increment

On the other hand, "Egg Party" pushes up the DAU step by step through the player’s UGC ecology – Tiger Sniff learned that in September 2023, NetEase "Egg Party" completed the "Double Billion Achievement", that is, MAU (Monthly Active User, monthly active user) broke through 100 million + the total number of maps accumulated 100 million; as of December 2023, "Egg Party" has over 500 million registered users and 30 million DAUs.

In view of this, "Yuan Dream Star" is intentionally or unintentionally targeting "Egg Party" from the game category, launch time, and targeting the crowd, which can be called a precise sniper by Tencent for NetEase – on the day of the launch of "Yuan Dream Star" born with a golden spoon, not only WeChat and QQ spared no effort to set up a platform, but also platforms such as B Station, Douyin, Douyu, Huya, Kuaishou, Weibo, and Xiaohongshu came to join the audience, and won the first place in the App Store free list in two hours.

Generally speaking, new games are launched in two ways: "hot start" and "cold start". The survival of the cold start project depends entirely on the market data. "At the beginning, the cold start’Honor of Kings’ almost died, and it was originally called’Hero’s Trail ‘. When it was changed and re-launched halfway through, the expectations were not so high, and the result was a steep upward curve." A person close to the "Honor of Kings" project said to Tiger Sniff.

As for the hot start, it is mostly accompanied by a grand press conference + traditional hardcore alliance channels (Huawei, Lenovo, OPPO, vivo and other app stores) + new live broadcast platforms (Douyin, Kuaishou) + old live broadcast platforms (Douyu, Huya) + community (B station, TapTap) release momentum –Such a big battle is mainly due to the particularity of the "Yuan Dream Star" category: the party track is already a fully competitive field, and the new product iteration speed is fast, and the hot start is conducive to occupying the minds of vertical users.

"There is another important reason for the launch of" Yuan Dream Star "carpet shop, which involves the issue of sniping and counter-sniping between companies – the launch of" Yuan Dream Star "is not small, and the momentum will only be even worse in the first week of its launch, but NetEase, Lilith, Heart, Eagle Horn and other game manufacturers are also pushing new party games, and they are bound to grab the launch time and media schedule. In order to ensure the spread of high expectations, Tencent must’sweep goods’." A practitioner explained to Tiger Sniff that the logic of "Yuan Dream Star" carpet launch is to ensure that it will not be exposed by competing cards such as "Egg Party".

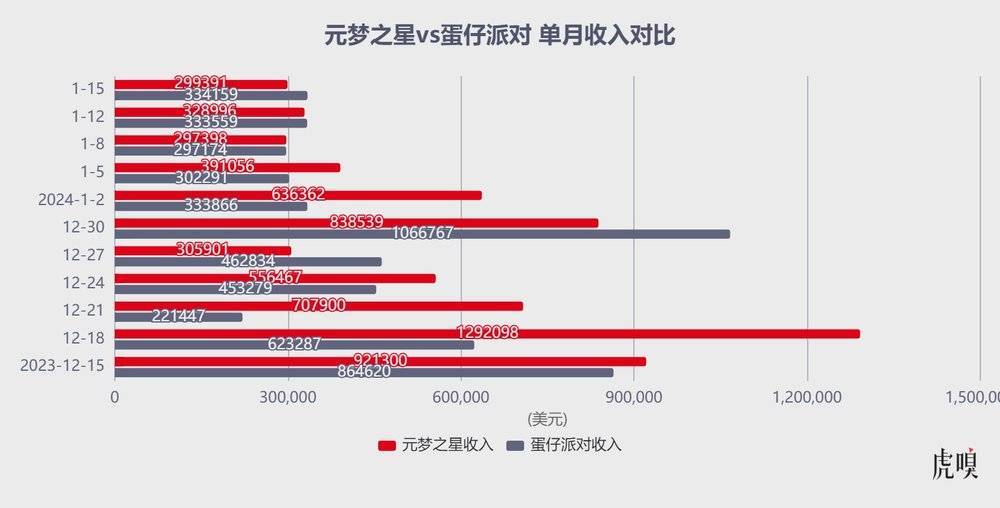

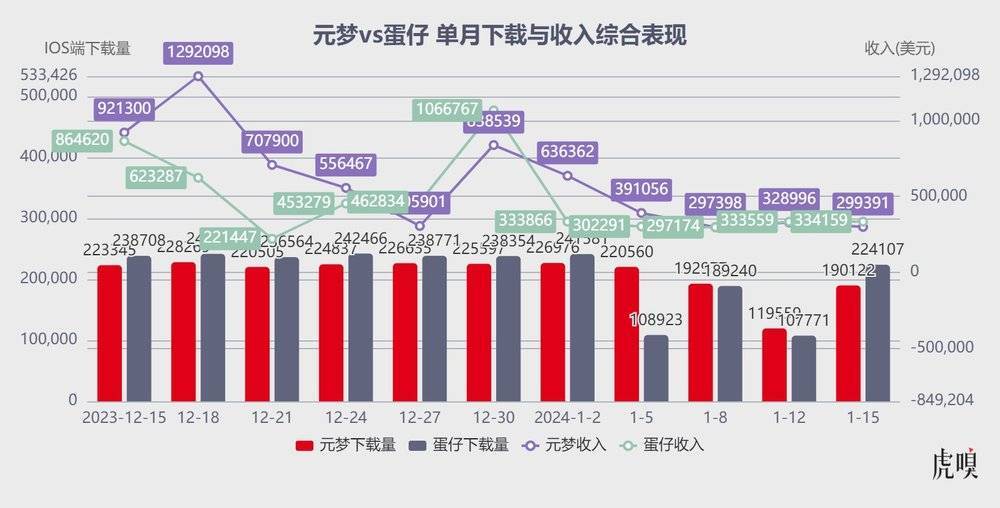

Now, from the "Yuan Dream Star" has been on the line for a month, at least from the market performance point of view is still competitive – data points show that the iOS end of the flow, December 15 to January 15 during the "Yuan Dream Star" total revenue of 138 million yuan (Tiger sniff to Tencent related people to verify, the other side said that the actual data is not limited to this), more than the "Egg Party" over the same period of 110 million yuan total revenue, in many new tours of a ride out of the steep climbing curve.

Data Source: Diandian Data

However, "Yuan Dream Star" has only been launched for more than a month, but "Egg Party" has been running for 20 months (launched on May 27, 2022) – the latter has not only completed the staging of the market structure, but also some users’ minds have been formed.Even "Egg Party" has become a phenomenal IP for party games.

In the face of such a situation, "Yuan Dream Star" chose to confront "Egg Party" head-on, hand-to-hand combat, even if Tencent used the power of the group to invest resources and link all channels and platforms that could be mobilized, but the game was not a pile of resources that could explode, otherwise Tencent would not be seven or eight years later. "Honor of Kings" is still a revenue trump card.

Moreover, "Jelly Bean Man", "Goose and Duck Kill", "Egg Party", and "Beast Party", these representative party games each have their own advantages, and have already divided up a lot of party players in the market. How can Tencent catch up and run a differentiated upward curve?

In this regard, people close to Tencent IEG (Tencent Interactive Entertainment Group) analyzed the strategy of "Yuan Dream Star" to Tiger Sniff:

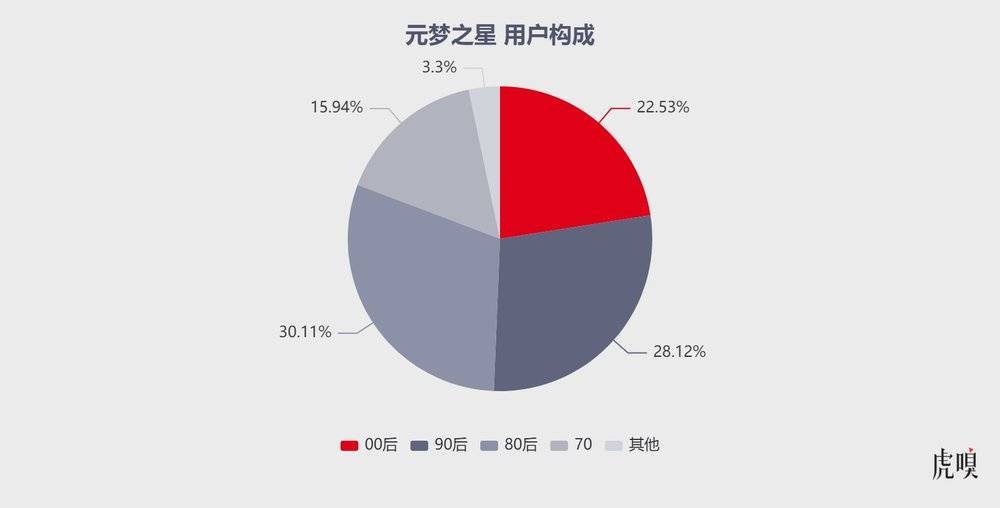

First, "Dream Star" has targeted the promotion direction to a "family fun game" –This is not a product that only targets the young market. "Yuan Dream Star" has established a more universal goal to target the full client base and full circle coverage;Taking a step back, even if "Dream Star" can’t hit the core user base of "Egg Party", this game still has a differentiated audience.

"Tianmei has chosen to incorporate strong social networking and mainstream gameplay, including the cooperation between" Star of the Dream "and" Honor of Kings "," Crayon Shin "," Kung Fu Panda "and other leading IPs, in order to bind the brand’s mind to more pan-users and pan-circles, and quickly absorb the fan groups behind different IPs into potential party game players." An industry insider analyzed to Tiger Sniff.

In other words, in terms of strategy, "Yuan Dream Star" reserves a back hand, and also wants to break down some player groups that "Egg Party" has not shaken, targeting users of all ages, to penetrate them and become a new addition.

DataEye, a third-party research institution, calculates the user composition of "Yuan Dream Star" in the first month

Secondly, the sewing ability of "Yuan Dream Star" is very "Tencent": the core gameplay of the game is the pass mode, but it integrates the strengths of each family, and the shadow of the shadow makes players feel the shadow of eating chicken + QQ speed car + CF + Werewolf + King + Jelly Bean Man + Egg Boy party, and in the recent "Mountain and Sea Adventure" new season preview shows that "Yuan Dream Star" plans to add ball bumper cars, bubble wars, go-kart mode, and tower defense gameplay to the game – you know,The series of gameplay integrated by "Yuan Dream Star" has led the trend. After all these gameplay are integrated into one game, "Yuan Dream Star" is no longer just a party game, but more like a game square.

"Party games is just a concept, or a container, and there is no standard for what gameplay should be in it. From its definition, it can be included in the game that is suitable for everyone to play together. The extension of the party is very large, and it must be constantly dug." A game producer said to Tiger Sniff.

The above producers further pointed out that in recent years, there has been almost no new single gameplay in the game market (unless there is a change brought about by technology), and new games are all stitching together various gameplays – following this logic, the underlying logic of new games is a mathematical problem: what gameplay to capture a group of users, and what IP to capture a group of users.The difference is that some people have made subtraction, some people have made addition, and some people have even made multiplication.

"There is no one-size-fits-all formula to get this math problem right (that is, to ensure the success of the game). Whether it should be subtracted, added or multiplied depends only on the product and the market." He stressed that the domestic game industry has been changing drastically in recent years, especially the obvious reshuffle of some large DAU products. To succeed, we must keep pace with the times.

A battle that Tencent cannot lose

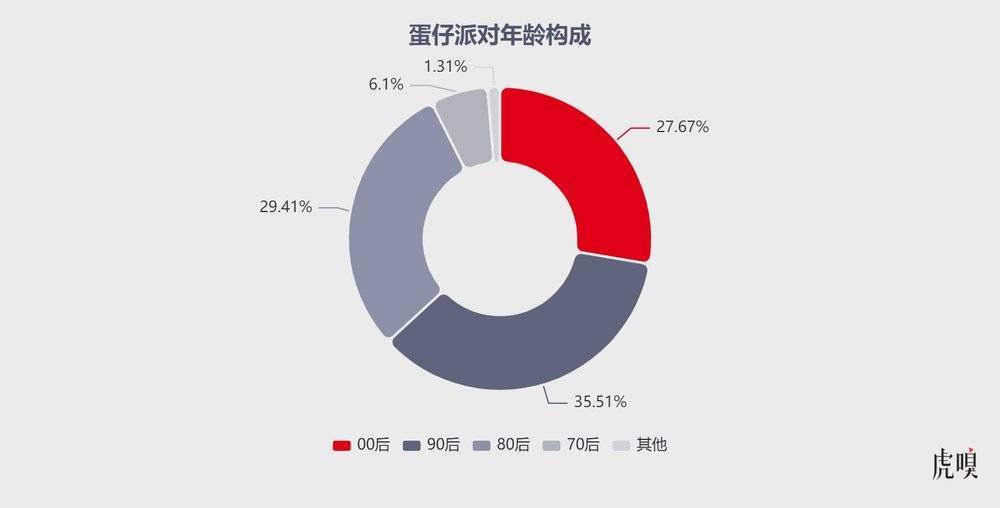

Tiger Sniff has previously written that party games such as "Jelly Bean Man: The Ultimate Knockout Tournament", "Among Us" and "Goose and Duck Kill" have successfully verified the huge potential of social communication. The reasons why "Egg Party" came from behind and successfully "penetrated" the post-00 group are divided into two levels:

On the one hand, "Egg Party" has come up with high-quality art design, superimposed its relaxed and casual game rhythm, strong interactive game social gameplay (can challenge racing, survival, individual points, team theme levels, while combining two-player cooperation, 2v2 confrontation, asymmetric competition and other gameplay), captured the hearts of many young gamers –These game scenes are undoubtedly a new "social currency" for the post-00s who value self-expression and have a stronger sense of group identity.

QuestMobile calculates the age distribution of egg users in June 2023

On the other hand, the UGC system derived from "Egg Workshop" in "Egg Party" has greatly broadened the boundaries of game exploration, not only providing players with the convenience of freely creating levels and self-made maps, but also fully mobilizing players’ creative collisions and sharing more secondary content.

The reason behind this is that there is an obvious change in party games. Before, the entire industry was casual and light games such as chess and cards to complete user education, and then heavy games to complete the harvest. Now the whole logic is different –Light games can also be made to complete the harvest, just like casual party games were originally low-stickiness games, but the gameplay richness of "Egg Party" and the entire game are becoming more and more complex, and casual parties can also be like heavy games.

Another change is that the difference between the RMB players of "Egg Party" and ordinary players and the difference in game experience is not so big. Strictly speaking, "Egg Party" is not a pure NetEase style game – NetEase specializes in big payment design, while "Egg Party" is a big DAU + low payment threshold in terms of business model. It follows the path of "Honor of Kings", and the logic has changed.

Take NetEase’s "Against the Cold" and "Naraka: Bladepoint" as an example, the character’s weapons and skin have circulation attributes, and there are tens of thousands of three-way transactions. It mainly promotes the scarcity of external equipment, but "Egg Party" mainly promotes fun, weakening the competitiveness –To a certain extent, the success of "Egg Party" has given NetEase the opportunity to break through and reflect on its own capabilities.

Based on the above analysis, if the success of "Egg Party" is UGC first, and the game is just a shell, then how "Yuan Dream Star" surpasses "Egg Party" has become a proposition that Tencent games must face – difficult, but crucial.

Looking at the review, after products such as "Crossing the Wire", "League of Legends", "Dungeon and Warrior" established the status of Tencent’s PC era, it rode the social (WeChat & QQ) and entertainment territory potential in the mobile game wave – Tencent games identified several promising game categories, a large number of horse racing projects squeezed into these tracks "gambling explosion", good at grafting the group’s resources into its own business system, through investment, joint research, and self-research to promote the rapid growth of gameplay, technology, and user ecology in different periods.

Data Source: Game Committee, Gamma Data

Even with the expansion of Tencent’s game industry-wide investment territory, the channel is likely to follow the mobile game era and quickly establish track control capabilities in the MOBA (Multiplayer Online Battle Arena) and shooting (including FPS/TPS/tactical competition, etc.) categories.

At present, Tencent games are facing a situation of internal and external troubles:

In terms of Tencent, the two cash cows in hand, "Honor of Kings", have been in operation for more than 8 years, "Game for Peace" has been online for nearly 5 years, and it has been more than 7 years since the explosion of chicken gameplay in 2017. However, the entire IEG has been unable to come up with a new explosion, and the two-dimensional trend led by "Yuan Shen" in 2020 and the party trend led by "Egg Party" in early 2023 are all passive followers. Tencent has long been anxious.

In terms of external competition, rising stars such as miHoYo ("The Original God"), Lilith ("The Awakening of Nations"), Moonton Technology ("Mobile Legends: Bang Bang"), IGG ("Kingdom Era"), Habby ("The Legend of Bow and Arrow") have occupied the top of the sub-category through a product with hundreds of millions of flowing water, and even gained good water in the global market.However, Tencent has become increasingly passive in leading new categories.

Moreover, the old rival NetEase is further strengthening its deterrence through new games, taking the 2023 summer as an example, GameLook statistics show that NetEase ("against the water cold mobile game", "egg boy party", "peak speed", "all-star streetball party") 4 new games have eaten more than 40% of the new game market, while Tencent ("Adventure Island: Legend of Maple"), Byte ("Crystal Core"), miHoYo ("Star Iron") The three giants’ new game flow only accounts for more than 30% of the new game market.

The situation is like this, Tencent naturally sees it in the eyes and is anxious in the heart – so, with the power of the group to launch "Yuan Dream Star" positive "hard" "Egg Party", if this "shot" is misfired, Tencent’s morale will inevitably be severely dampened –Therefore, "Yuan Dream Star" has become a battle that Tencent games cannot lose.

Of course, there are many game practitioners who are optimistic about the next market performance of "Yuan Mengxing", after all, leisure competition + big DAU is Tencent’s strength; but people close to Tencent IEG said that there is no DAU goal for "Yuan Mengxing" now:

On the one hand, the growth and accumulation of party games is a long-term cyclical work, and short-term results after going online are difficult to "determine life and death". At least this Spring Festival can see more possibilities;

On the other hand, Tencent’s various gaming businesses operate in a diverse manner and have different expected goals, making it difficult to determine the evaluation criteria.

The above-mentioned person further reiterated that Tencent IEG (including Tianmei Studio Group, Photon Studio Group, Rubik’s Cube Studio Group, and Northern Lights Studio Group) has its own layout and business promotion rhythm when it cuts into new products, and is not intentional to benchmark "Egg Party" as the outside world said. "Tencent’s style will not catch a wave of popularity in a certain category and gameplay in the market immediately; when a certain gameplay is popular, it will pay close attention to market changes in the early stage and invest in some start-up teams. Later, there will be projects based on market judgment, business needs, and meeting players."