NIO Quarterly Report: Revenue 17.10 billion Operating Loss 6.60 billion Delivered 5,045 Vehicles

Source, Lei Di

Lei Di.com, Lei Jianping, March 5

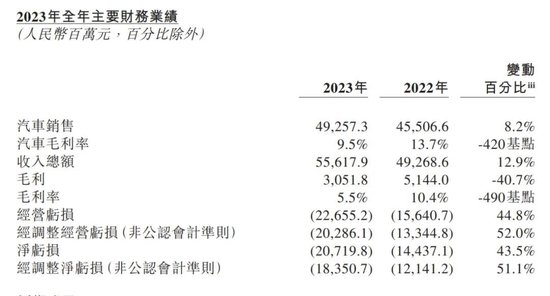

NIO Group (NYSE: NIO; HKEx: 9866; SGX: NIO) today released financial results. The financial report shows that NIO’s full-year revenue in 2023 is 55.6179 billion yuan (7.8336 billion US dollars), an increase of 12.9% from 49.269 billion yuan in the previous year.

NIO delivered 160,038 vehicles in 2023, an increase of 30.7% over 2022.

NIO’s gross profit in 2023 was 3.0518 billion yuan (429.80 million USD), down 40.7% from the previous year; gross margin was 5.5%, compared to 10.4% in the previous year.

NIO’s 2023 operating loss was 22.6552 billion yuan (US $3.1909 billion), up 44.8% from the previous year. Excluding equity incentive expenses, the adjusted operating loss (non-GAAP) in 2023 was 20.2861 billion yuan (US $2.8572 billion), up 52% from the previous year.

NIO’s net loss for 2023 was 20.7198 billion yuan (US $2.9183 billion), up 43.5% from the previous year. Excluding equity incentive expenses, the adjusted net loss (non-GAAP) for the full year 2023 was 18.3507 billion yuan (US $2.5846 billion), up 51.1% from the previous year.

Li Bin, founder, chairperson and CEO of NIO, said that in 2023, NIO set a new record for the delivery of 160,038 vehicles. On 2023 NIO Day, we launched the intelligent electric executive flagship ET9, showcasing a series of latest technologies such as self-developed AD chips, global 900V architecture, intelligent chassis system and other industries. "

"We are about to start delivering the NIO 2024 model, which is equipped with the most powerful computing power in the production car, and continue to improve the user’s driving and digital experience. At the same time, we plan to introduce the NOP + urban pilot auxiliary feature to all NT2.0 users in the second quarter. Continued investment in technology, power exchange network and user community will enhance our advantage in future competition," said Li Bin.

"Our automotive gross margin continues to grow, reaching 11.9% in the fourth quarter of 2023," said Beng Wei, NIO’s chief financial officer. "In December 2023, we completed a $2.20 billion strategic equity investment from CYVN, underscoring our unique positioning and competitiveness in the global smart electric vehicle industry. Looking to 2024, we will focus on high-priority business objectives, improve system capabilities, and further optimize cost management efficiency."

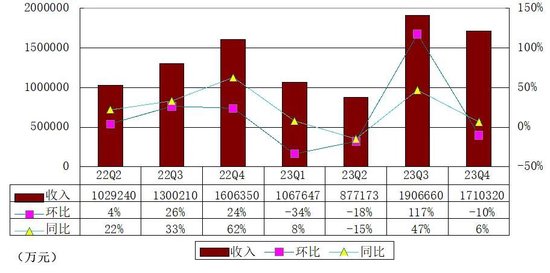

NIO Q4 revenue 17.10 billion up 6.5%

NIO’s fourth quarter 2023 revenue 17.1032 billion ($2.4089 billion), up 6.5% from $16.06 billion in the fourth quarter of 2022 and down 10.3% from $19.10 billion in the third quarter of 2023.

NIO’s vehicle sales for the fourth quarter of 2023 were 15.4387 billion yuan ($2.1745 billion), up 4.6% from the fourth quarter of 2022 and down 11.3% from the third quarter of 2023.

NIO delivered 50,045 vehicles in the fourth quarter of 2023, including 33,679 high-end smart electric SUVs and 16,366 high-end smart electric sedans, an increase of 25.0% from the fourth quarter of 2022 and a decrease of 9.7% from the third quarter of 2023.

NIO delivered 10,055 vehicles in January 2024 and 8,132 vehicles in February 2024. As of February 29, 2024, NIO’s cumulative deliveries reached 467,781 vehicles.

Just completed $2.20 billion equity financing

NIO has applied to the competent authorities in Anhui Province to complete the filing of investment projects for pure electric passenger vehicles, and has been included in the directory of automobile manufacturers of the Ministry of Industry and Information Technology.

On 27 December 2023, NIO completed a US $2.20 billion strategic equity investment from Abu Dhabi-based investor CYVN Investments RSC Ltd (‘CYVN’). Together with the transaction previously completed in July 2023, CYVN beneficially holds approximately 20.1% of the total issued and outstanding shares of the Company.

On February 7, 2024, NIO appointed Eddy Georges Skaf and Nicholas Paul Collins as new directors to the company’s board of directors. In addition, on the same day, James Gordon Mitchell resigned as a director of the company.

On February 1, 2024, NIO completed the Offer of Repurchase Rights relating to its 0.00% Convertible Senior Notes due 2026 (the’Notes’). The aggregate principal amount of the Notes validly filed and unwithdrawn prior to the closing of the Offer of Repurchase Rights is $300 million. After the Repurchase Settlement, the aggregate principal amount of the Notes remains outstanding at $910,000 and continues to be subject to the existing terms of the Deed and the Notes.

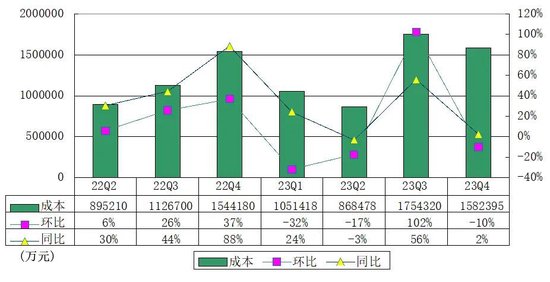

NIO Q4 cost 15.80 billion increased by 2%

NIO cost $15.80 billion in the fourth quarter of 2023, up 2% from $15.40 billion in the same period last year.

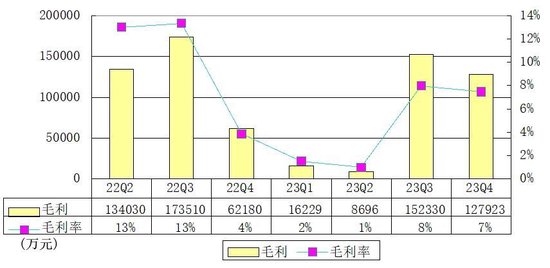

NIO Q4 Gross 1.279 billion Gross Margin 7.5%

NIO’s gross profit for the fourth quarter of 2023 was 1.2792 billion yuan (180.20 million USD), an increase of 105.7% from the fourth quarter of 2022 and a decrease of 16% from the third quarter of 2023.

NIO’s gross margin was 7.5% in the fourth quarter of 2023, compared to 3.9% in the fourth quarter of 2022 and 8% in the third quarter of 2023.

NIO’s automotive gross margin was 11.9% in the fourth quarter of 2023, compared to 6.8% in the fourth quarter of 2022 and 11% in the third quarter of 2023.

NIO Q4 expenses 7.90 billion increased by 7%

NIO’s expenses for the fourth quarter of 2023 were $7.90 billion, up 7% from $7.36 billion in the same period last year and up 24% from $6.37 billion in the previous quarter.

NIO’s research and development expenses for the fourth quarter of 2023 were 3.9721 billion yuan (US $559.50 million), a decrease of 0.2% from the fourth quarter of 2022 and an increase of 30.7% from the third quarter of 2023. Excluding equity incentive expenses, research and development expenses (non-GAAP) were 3.6164 billion yuan (US $509.40 million), an increase of 1.8% from the fourth quarter of 2022 and 36.8% from the third quarter of 2023.

R & D expenses remained relatively stable compared to the fourth quarter of 2022. R & D expenses increased compared to the third quarter of 2023, mainly due to higher design and development costs for new products and technologies and higher personnel costs in the R & D department.

NIO’s R & D expenses for the full year 2023 were 13.4314 billion yuan (US $1.8918 billion), up 23.9% from the previous year. Excluding equity incentive expenses, R & D expenses (non-GAAP) were 11.9142 billion yuan (US $1.6781 billion), up 25.2% from the previous year.

NIO’s selling, general and administrative expenses for the fourth quarter of 2023 were $3.9727 billion ($559.50 million), up 12.6% from the fourth quarter of 2022 and 10.1% from the third quarter of 2023. Excluding equity incentive expenses, selling, general and administrative expenses (non-GAAP) were $3.7815 billion ($532.60 million), up 16.1% from the fourth quarter of 2022 and 10.4% from the third quarter of 2023.

NIO’s selling, general and administrative expenses in 2023 were $12.8846 billion ($1.8148 billion), up 22.3% from the previous year. Excluding equity incentive expenses, selling, general and administrative expenses (non-GAAP) were 12.1167 billion ($1.7066 billion), up 25.8% from the previous year.

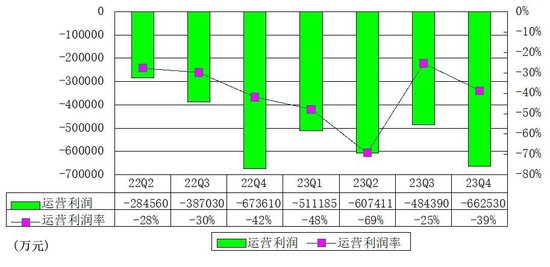

NIO Q4 operating loss 6.6253 billion operating margin -39%

NIO’s fourth quarter 2023 operating loss 6.6253 billion ($933.20 million), down 1.6% from the fourth quarter of 2022 and up 36.8% from the third quarter of 2023.

Excluding equity incentive expenses, the adjusted operating loss (non-GAAP) for the fourth quarter of 2023 was 6.0593 billion ($853.40 million), an increase of 0.7% from the fourth quarter of 2022 and 42.9% from the third quarter of 2023.

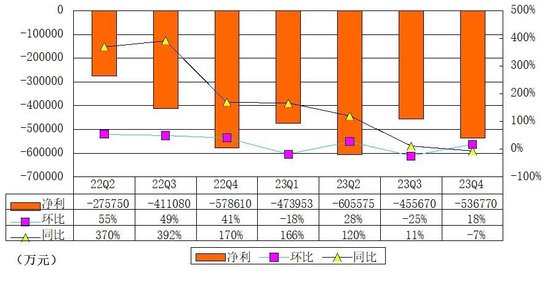

NIO Q4 net loss 5.3677 billion narrowed year-on-year

NIO’s fourth quarter 2023 net loss was 5.3677 billion ($756 million), down 7.2% from the fourth quarter of 2022 and up 17.8% from the third quarter of 2023. Excluding equity incentive charges, the adjusted net loss (non-GAAP) for the fourth quarter of 2023 was 4.8017 billion($676.30 million), down 5.2% from the fourth quarter of 2022 and up 21.5% from the third quarter of 2023.

As of December 31, 2023, NIO held cash and cash equivalents, restricted cash, short-term investments and long-term time deposits of $57.30 billion (USD 8.10 billion).

NIO expects Quarter 1 vehicle deliveries in 2024 to be between 31,000 and 33,000, a decrease of about 0.1% from the same quarter in 2023 to an increase of about 6.3%.

NIO expects Quarter 1 revenue in 2024 to be between 10.499 billion yuan ($1.479 billion) and 11.087 billion yuan ($1.562 billion), a decrease of about 1.7% from the same quarter in 2023 to an increase of about 3.8%.