Lei Jun fought against Dong Mingzhu, and Xiaomi dug old Gree employees to make air conditioners, which were ridiculed by Dong Mingzhu as sticker goods

A few days ago, the old photo of Dong Mingzhu and Lei Jun attending the meeting together became popular again. Dong Mingzhu in the picture "asked" Lei Jun: Just you? Can you also make air conditioners? Can you turn on air conditioners? Lei Jun silently responded to the Xiao Ai speaker: Xiao Ai, turn on the Mijia Internet air conditioner and turn off the Gree air conditioner!

It has to be said that Lei Jun and Xiaomi, who did not let go of any explosive points, launched the marketing copy of air conditioners to cater to the hearts of the people who love to watch the fun.

As expected, the next day, Xiaomi officially released the Mijia Internet air conditioner. This air conditioner labeled Mijia adopts Xiaomi’s commonly used pricing method: 1.5 horsepower, three-level energy efficiency standard, retail price of 1999 yuan, which is about 1,000 yuan cheaper than the big brands Gree and Midea congeneric products on the market, and the public test price is only 999 yuan.

It was still Lei Jun’s familiar formula and Xiaomi’s familiar taste.

01

A mysterious air conditioning company

"For this Mijia air conditioner, Xiaomi has started to form a team in the first half of last year, looking for OEM foundries, designing product prototypes, and also buying our air conditioner data reports," Dong Min, vice-president of Aowei Cloud Network, which provides information services, told AI Finance Agency.

Xiaomi’s air-conditioning business has always been in charge of Xiaomi’s ecological chain enterprise Zhimi Technology. The company responsible for the research and development and production of Xiaomi air-conditioners is a company called Zhuhai Sanyou.

From the industrial and commercial registration information, the legal representative of Zhuhai Sanyou is Liu De, the co-founder of Xiaomi and the head of Xiaomi’s ecological chain. The shareholder of Zhuhai Sanyou is Beijing Xiaomi Mobile Software Co., Ltd., with a 100% shareholding ratio. In short, Zhuhai Sanyou is a wholly-owned subsidiary of Xiaomi.

A point person in Zhuhai Sanyou’s business is Xiao Youyuan. He was originally a senior executive of Gree, worked in Gree for 10 years, and was also a trusted person of Dong Mingzhu, who was in charge of Gree’s overseas business. In 2015, Xiao Youyuan was poached by Skyworth with his team and participated in the establishment of Skyworth Air Conditioning. Hundreds of Skyworth Air Conditioning people came from Gree that year.

Xiao Youyuan, who participated in the founding of Skyworth Air Conditioning

From the industrial and commercial registration information of Zhuhai Sanyou, Xiao Youyuan and the team worked in Skyworth for two years, and soon took the team to the wholly-owned subsidiary of Xiaomi, "because Skyworth and Gree have very different corporate cultures."

"As a private enterprise, Skyworth is used to’small input and big output ‘, while the Xiao Youyuan team from Gree has a style of’big work and fast work’." A person familiar with the matter told AI Finance Agency. In addition, Skyworth air conditioners encountered the "Little New Year" of air conditioners at the beginning, and their performance was not good. Gree and his group were gradually emptied of Skyworth air conditioners.

Xiao Youyuan’s team, who joined Xiaomi’s subsidiary, brought "Gree Feng" to Xiaomi. Wu Wei, who has visited the Sanyou production line and is also a supplier of air-conditioning components, told AI Finance Agency that Sanyou is a mysterious company, but "the solution is almost the same as Gree". For example, the MCU (microcontroller) is made by Texas Instruments, a large American manufacturer, the module is made by Fuji or Mitsubishi, and the IPM (intelligent power module, responsible for frequency conversion) is made by Ruineng.

"Everyone in their company seemed to be holding their breath. After Gree came out to Skyworth, Gree issued a ban order, and all Gree suppliers were not allowed to supply Skyworth. The team gambled so much and was finally washed out by Skyworth," Wu Wei said.

The team was eventually recruited to Lei Jun.

However, Wu Wei revealed that Sanyou currently has only two production lines of its own, and its annual production capacity is "only a few hundred thousand units". Therefore, in May 2017, Zhuhai Sanyou and Zhongshan Changhong jointly funded the establishment of Zhongshan Hongyou Electric Appliance Co., Ltd., with Zhongshan Changhong holding 60% and Zhuhai Sanyou holding 40%. It should be noted that Changhong is the foundry of Zhimi air conditioners this time.

According to people familiar with the matter, Xiaomi’s foundry is not in Mianyang, Changhong’s headquarters, but in Nantou Town, Zhongshan, not far from TCL’s headquarters.

02

Lei Jun’s obsession

This is the third time Lei Jun has tried to make air conditioners.

The first dates back to three years ago. When Lei Jun first entered the air-conditioning industry, he chose to cooperate with Dong Mingzhu’s old rival, Midea. This immediately annoyed Dong Mingzhu and directly accused the cooperation between the two sides as "two scammers together, a group of thieves". At that time, Midea had just been ordered by the court to compensate Gree 2 million yuan for stealing Gree’s patents.

But this Youth series air conditioner, priced at 3,099 yuan, did not cause much splash. The selling point at that time was that it was used in conjunction with the Xiaomi Mi Band, which could be set to automatically turn on when you go home, and automatically enter sleep mode when you feel you fall asleep.

Youth series air conditioner

Perhaps deliberately to highlight Xiaomi’s "Internet thinking" in the limelight, there is no display panel on the surface of the air conditioner. This means that if users want to know the temperature of the air conditioner in the room, they need to open their mobile phone, check the app or pick up the Xiaomi bracelet. This incredible design appeared in the first generation of products. Fortunately, this is the only cooperation between Xiaomi and Midea in the field of air conditioning.

"It’s impossible for Midea to raise competitors," says one air-conditioning supplier. In fact, Xiaomi decided to invest in Midea at the end of 2014, paying nearly 1.30 billion yuan for a 1.29% stake. But the shareholding relationship has not alleviated the conflict between the two sides in real business.

Millet’s tentacles have already extended to rice cookers, electric fans, water purifiers, electric kettles, cooking machines and many other small household appliances. This is Midea’s territory, which will inevitably lead to fierce collisions, and it is impossible to expect that Midea will be willing to help Xiaomi produce air conditioners. However, from an investment perspective, Midea’s share price has doubled in the past three years, and Xiaomi’s investment in Midea has been very successful, earning a lot of money.

The second time Xiaomi launched an air conditioner was in 2017, which was developed by Zhimi, a wholly-owned subsidiary of Xiaomi. The minimalist design of this air conditioner has also won international design awards, and this design style has been carried over to the current Mijia air conditioner.

However, the price of the Zhimi air conditioner at that time was as high as 4,399 yuan. Although Su Jun, CEO of Zhimi Technology, said that there was almost no profit, such a high price did not have the pricing style of Xiaomi at all. Now the air conditioner has been removed from the Xiaomi mall.

Interestingly, in order to explain that his 4,399 yuan air conditioner was a conscientious price, Su Jun reported at the time that the quality of the current air conditioner was worse than that of more than ten years ago. "The original material was very solid, but now it is loose, and there are recycled materials in it. You don’t even need to open it, and you can feel the huge decline in quality just by the shell itself."

He said that Zhimi can also make its products cheaper than some 999 yuan air conditioners on the market, by using some inferior materials or even recycled materials to cut costs. "But that’s not something we can guide the quality of life of ordinary people, it doesn’t make sense."

But coincidentally, this time, the price of Mijia’s Internet air conditioner was exactly 999 yuan. However, it was embarrassing that the first user to get the goods couldn’t wait to hang the Xiaomi air conditioner on a second-hand trading platform on the same day.

03

Mi Ge Gree’s life?

What makes Lei Jun envious is that Dong Mingzhu’s Gree air conditioner profits are astonishingly high.

Chen Hang, chief analyst at Southwest Securities, told AI Finance Agency that Gree’s gross profit margin for air-conditioning products is above 35%, which is unusual in the home appliance industry known for price wars. Midea’s gross profit margin is slightly worse. But it is much higher than Xiaomi’s 10% gross profit for mobile phones.

High profits mean there is room to be compressed. This is also the direction of Xiaomi’s revolution, improving efficiency and reducing circulation costs.

This time, the air conditioner of Mijia brand, whether it is the price strategy or the product itself, looks much more reliable than the previous two times. But Dong Mingzhu has never been easy to bully. When Lei Jun entered the mobile phone market, it coincided with the market being on the eve of the transformation to smartphones, and the timing was excellent. But the air conditioner industry is relatively stable, the technology has existed for hundreds of years, and the market structure and corporate rhythm are quite stable.

Mijia air conditioner

"Gree will not be killed." Chen Hang analyzed that unlike other household appliances, air conditioners need to be installed, and one of Gree’s moats is a team of highly efficient ground installers. "Xiaomi will not have much impact on the giants in the short term."

"The competition of air conditioners is nothing more than the competition of brands and after-sales services." Lu Jianguo, deputy chief engineer of the Home Appliances Research Institute, also believes that now Xiaomi air conditioners are all new machines and have not yet reached the after-sales link. Users can take their mobile phones to the store for repair, but the air conditioner needs to be repaired at home, which will test the after-sales team of Xiaomi air conditioners.

Dong Min, vice president of Aowei Cloud Network, also expressed his concerns. Air conditioners are financial products. They are produced in winter and sold in summer, and they need to pay a lot of money in advance to stock up. To a certain extent, stocking up is also a gamble on the weather, and sales immediately rise in hot weather.

Dong Min was deeply impressed that when the weather was hot a few years ago, whoever had installers sold their air conditioners well. And this requires a huge ground force, which is not what Xiaomi is good at.

The bigger challenge comes from the supply chain. Back then, Xiaomi suffered a loss in the mobile phone supply chain and had been in short supply. Lei Jun went to South Korea to meet the boss of Samsung Electronics, hoping that the other party could guarantee the supply of mobile phone screens.

The risk of the supply chain is increasing in the air-conditioning market. The routine of these traditional large manufacturers is to build a huge capacity scale advantage first, and then firmly control the supply chain, especially the core components such as compressors, and finally achieve a stable market structure and profit margins.

"Compressors are a seller’s market," said Zhang Jie, a supplier of air-conditioning components. Gree and Midea produce their own compressors.

Zhang Jie revealed that there is a shortage of inverter compressors this year, and many air conditioner manufacturers have reduced production as a result. "Key components have been out of stock from this year to next year, so compressor companies must protect big factories, not millet."

AI Finance Agency learned from people familiar with the Xiaomi ecological chain that in order to get the upstream supply chain of air conditioners, Xiaomi paid a lot of money to obtain air conditioner compressors and IPM module parts. "They need to take out 30-4 billion to the compressor company to book the production capacity, which is equivalent to the table fee."

Dong Min believes that the air-conditioning business is designed and defined by Xiaomi in the short term, and Changhong conducts OEM OEM, because Changhong has a large volume and has the voice over, but according to the laws of TV and mobile phones, Xiaomi will definitely purchase and customize some important components in the future.

Zhang Jie was also a little surprised that Xiaomi chose Changhong OEM. "Changhong’s production line is relatively old, and it can’t be compared to the big factories." Changhong bought Meiling and Huayi in 2005 and 2007 respectively. Meiling is mainly responsible for the production of air conditioners and refrigerators in Changhong, while Huayi specializes in the production of compressors.

But in Zhang Jie’s opinion, Changhong’s Meiling air conditioners are not mainstream in the industry. The first echelon is Gree and Midea, the second echelon is Oaks, and the third echelon is Chigo, Haier, and Hisense. Meiling is outside these echelons.

Compared with the melee in the color TV market, the competition landscape of the air conditioner market is very clear. Gree and Midea firmly control the first camp of the market, and the two together occupy more than 50% of the market share. The remaining Oaks, Haier, Hisense, etc. have only a small market share.

"Xiaomi must have harvested the second and third camps first," Dong Min said. "Consumers have brand loyalty to the top few, but they have no impression of a lot of brands behind."

Asked in an interview with Mr. Dong in July what she thought of Xiaomi’s entry into the air-conditioning market, Mr. Dong understated: "We make it ourselves, they produce it under brand names. We are hardly on the same track, and we are not an industry type."

In fact, Dong Mingzhu had already reached for the mobile phone, while Lei Jun reached for the air conditioner. This was the lifeblood of the two families. When entering the other’s area of expertise, whether it was Lei Jun or Dong Mingzhu, their performance was difficult to satisfy.

04

Broken halberd "empty ice wash"?

Lei Jun "rose to the challenge", not just the bet with Dong Mingzhu, but the performance pressure may be a more important consideration for him to build air conditioners.

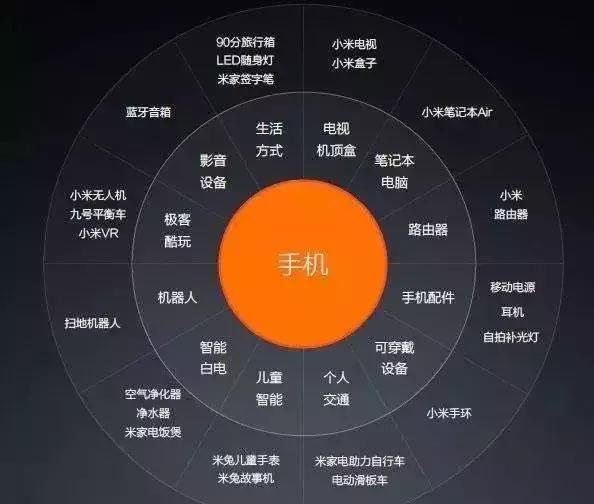

The Xiaomi Ecological Chain is a grand vision that Xiaomi has painted for the capital markets. In 2017, the Xiaomi Ecological Chain achieved 20 billion sales performance. Xiaomi has also set an ambitious goal for the ecological chain: 40 billion in 2018 and 80 billion in 2019. This means that the Xiaomi Ecological Chain needs to nearly double every year.

Xiaomi has proved its success in power banks, bracelets, sweeping robots, and air purifiers. But these products priced at tens of yuan or a few hundred yuan are a drop in the bucket for doubling the revenue of the ecological chain. According to the exclusive information of AI Finance Agency, Xiaomi made an organizational adjustment to the ecological chain team on July 27, and established a precious metals business department, an exploration product department, and an investment department under the ecological chain.

So far, Xiaomi has invested in more than 100 eco-chain companies and produced more than 1,600 SKUs of hardware products. But it is undeniable that Xiaomi specializes in industries where the original market is relatively chaotic and inefficient, typically color TVs, rice cookers, plug-in boards, and sweeping robots.

Take Xiaomi TV as an example. In the TV market that Xiaomi has entered, the share of leading brands such as Hisense and Skyworth is around 15%, and the share of other major brands is around 10%. The gap is not large. The melee pattern is conducive to Xiaomi’s competition for the market.

Because TV involves video content, for companies like Xiaomi and LeTV with operating experience, it is very familiar. And Xiaomi has also invested in video platforms such as iQIYI very early, and LeTV is known for video copyright. However, with the collapse of LeTV, the similarity of the two companies has also caused most of the share of LeTV super TVs to flow to Xiaomi. According to the data of Aowei Cloud Network, in April 2018, the total online and offline shipments of Xiaomi TVs exceeded all brands, ranking first in China.

"The categories that can contribute more than 2 billion can be exhausted, probably within 50. And among these 50, there may be only 10 fields that are relatively easy to enter." The person in charge of a Xiaomi ecological chain enterprise broke his fingers to the AI financial club. The bracelet can exceed 2 billion yuan, the sweeping robot can exceed 2 billion yuan, and the notebook can exceed 3 billion yuan.

If the Xiaomi ecological chain wants to double its growth, it has to enter the major home appliance market. In this market, Xiaomi has successfully won the TV market, and now there are only empty ice washers (air conditioners, refrigerators, washing machines) left.

However, Xiaomi’s playing style is not universal, especially in the air ice washing market, where Xiaomi has encountered unprecedented resistance.

In early 2017, Xiaomi ecological chain enterprise Yunmi released the first Internet smart refrigerator with a crowdfunding price of 999 yuan. The following year, it launched an Internet smart refrigerator iLive priced at 1999 yuan, which supports Wi-Fi connection and can be remotely adjusted by mobile phone app. In addition to the refrigerator, Xiaomi ecological chain enterprise Xiaoji intelligent mini drum washing machine (Xiaomi version) launched a crowdfunding on the Xiaomi platform, priced at 1499 yuan.

However, none of these products were as successful as expected, and young people’s first ice wash didn’t really make young people buy it. Xiaomi, which is good at marketing, even lost money in terms of market volume.

Xiaomi has also entered the drone market, built by Xiaomi ecological chain enterprise Feimi, after two and a half years of research and development, the cost of the mold alone cost more than 4 million yuan. Lei Jun personally demonstrated in front of 1 million netizens through Xiaomi live broadcast. However, surprisingly, in the live broadcast of Xiaomi employees, the drone actually lost control, and finally "blew up", and died before he could beat him.

In fact, even if it doesn’t "blow up", Xiaomi will have a hard time making a difference in the drone market. In the drone market, DJI is an absolute giant. Under the Iron Curtain of DJI, almost no players can survive in the consumer drone market.

Five years ago, Dong Mingzhu and Lei Jun made 1 billion bet, which was judged by the revenue of the two companies.

Now, Lei Jun and Dong Mingzhu’s gamble is only 5 months away. Xiaomi’s revenue in 2017 is 114.60 billion yuan, while Gree’s revenue is 148.20 billion, and it is expected to break through 170 billion this year. Lei Jun has almost no chance of winning. It has to be said that in the face of Gree, which still maintains strong growth, Lei Jun should carry out a large-scale "encirclement and suppression" of Dong Mingzhu earlier. To make amends, Lei Jun should not care about temporary gains and losses, and it is not impossible for Xiaomi to surpass Gree. Even if Xiaomi air conditioner is not done, it can still drive the industry to change like a catfish, which is what Xiaomi has always been best at doing.

(Wu Wei and Zhang Jie are pseudonyms in the article)